I still remember the day my friend Ananya shared how her family spent almost two years sorting out her late father’s finances. He was an organised man, owned a house, had investments, and always believed in “planning ahead.” Yet ironically, he never made a will. When he passed away, the family discovered mutual funds, bank deposits, and shares no one even knew existed. Without a will, they had to go through endless paperwork, legal formalities, and emotional strain just to claim what was already theirs.

Sadly, this isn’t unusual.

Stats show that less than 10% Indians have written a will.

That means most families face confusion, delay, and even legal battles after a loved one passes away. A will is not just for the wealthy, it’s for anyone who wishes to protect their loved ones and ensure that their hard-earned legacy is passed on smoothly.

But what is a Will?

A will is a legal declaration that ensures your property and wishes are carried out exactly as you intend after your lifetime. It allows you to plan how your assets and belongings will be distributed among your loved ones, offering clarity and peace of mind. It plays an important role in maintaining harmony within families, even in complex inheritance situations.

In India, wills are governed by the Indian Succession Act, 1925, and the best part is that there’s no strict format required. A will can even be handwritten and still hold legal validity, as long as it’s signed and witnessed properly.

Who can write a will?

The Indian Succession Act, 1925, guides the basic criteria for making a will in India. It only deals with wills made by Hindus, Buddhists, Sikhs, or Jains in India. Disposing of Muslim properties takes place by Muslim Law only.

You must meet a few basic legal requirements for writing a will:

- The person making the will must be at least 18 years old and of sound mind.

- The will should be written voluntarily, without any coercion or undue influence.

- It must clearly state how you want your assets distributed, leaving no room for ambiguity.

- The will should be signed in the presence of at least two witnesses as per Indian law.

| Pro Tip Always ensure you mention all your major assets, from real estate to securities and insurance policies to digital investments, in order to make your will complete and future-proof. To make sure you don’t miss out any asset, list everything down first, which can be easily done using the Mitt Arv app. |

Types of Wills in India

Did you know there are different types of wills, each designed for unique situations? Let’s walk through the five main types of wills recognized in India and understand when and why you might need each one.

- Privileged Will

Life in the armed forces comes with unpredictable risks and Indian law recognizes that. A Privileged Will is specially designed for members of the Indian Army, Navy, Air Force, and other forces serving in war or high-risk zones. It’s a simplified version of a will, created to allow soldiers to record their last wishes quickly, even in emergencies. Unlike a regular will, a privileged will:

- Doesn’t require registration or stamp duty.

- Can even be made without witnesses, making it ideal in urgent or combat situations.

This flexibility ensures that those who protect the nation can protect their families too, without getting entangled in legal formalities.

- Unprivileged Will

An Unprivileged Will is the most common and legally recognized will in India, governed by the Indian Succession Act, 1925. It can be made by anyone above 18 years of age and of sound mind.

To ensure its validity:

- The will must be written (oral wills aren’t accepted).

- It must be signed by the testator (the person making the will).

- It should be witnessed by at least two people.

This is the ideal choice for anyone who wants to make their legacy plan legally binding and transparent.

- Conditional Will: When ‘If’ Matters

A Conditional Will only takes effect if a specific condition is met. For instance, if someone writes, “If I die in a car accident, my house will go to my sister,” the will only becomes valid under that particular circumstance.

However, conditions must be clear and realistic. If they’re too vague or impossible (for example, “if I live forever”), the will could be declared invalid. Conditional wills are useful for those who want to plan for very specific life situations.

- Holographic Will

A Holographic Will is for those who prefer a more personal touch. It’s completely handwritten by the testator, no lawyer, no formal drafting. It is also called a D.I.Y. (do-it-yourself) will.

While simple and cost-effective, it must still meet certain legal requirements to hold validity:

- It should be fully handwritten by the testator.

- It must be dated and signed.

- It should be witnessed by two people.

- It must clearly state that it’s the person’s last will and testament.

In India, such wills are legally valid, provided they fulfill these conditions. They’re ideal for those who want privacy and a personal expression of their final wishes.

- Joint Will

A Joint Will is created by two or more people, most commonly, a married couple. It outlines how their assets will be handled after both of their lifetimes.

For instance, a couple might decide that after one spouse passes, all assets go to the other, and only after both are gone will the estate pass to their children.

In India, joint wills are valid as long as they’re:

- Registered,

- Signed, and

- Witnessed by two people.

This is a thoughtful choice for couples who wish to plan their legacies in harmony.

Why Should Everyone Have a Will?

- A will allows you to specify exactly who receives your assets, down to individual items and amounts. This clarity can prevent potential conflicts and ensure your wishes are honored.

- With a will, you can prevent certain individuals, like estranged relatives, from inheriting your assets, and keeping your wealth with those you trust and care about.

- If you have children, a will lets you name guardians to care for them. Without it, the decision falls to the courts, which may not align with your preferences.

- A will makes it easier and faster for your loved ones to access your assets, reducing the stress and legal hurdles they might otherwise face.

- Thoughtful estate planning can help reduce the taxes owed by your estate. You can also allocate gifts or charitable donations, which can further offset estate taxes and support causes meaningful to you.

According to The Week, awareness about will-writing is increasing in India, but there’s still a long way to go. Most disputes that reach civil courts could be avoided by clear documentation through a simple will.

Your Tomorrow Deserves a Plan

A well-thought-out will is a gift to your loved ones, sparing them unnecessary stress and uncertainty. It also gives you peace of mind knowing that everything you’ve worked for will go exactly where you intended.

But as lives get busier and assets more diversified, from real estate to mutual funds and even digital investments, keeping track of everything can feel overwhelming. That’s where technology steps in to make things simpler.

The good news? Times have changed.

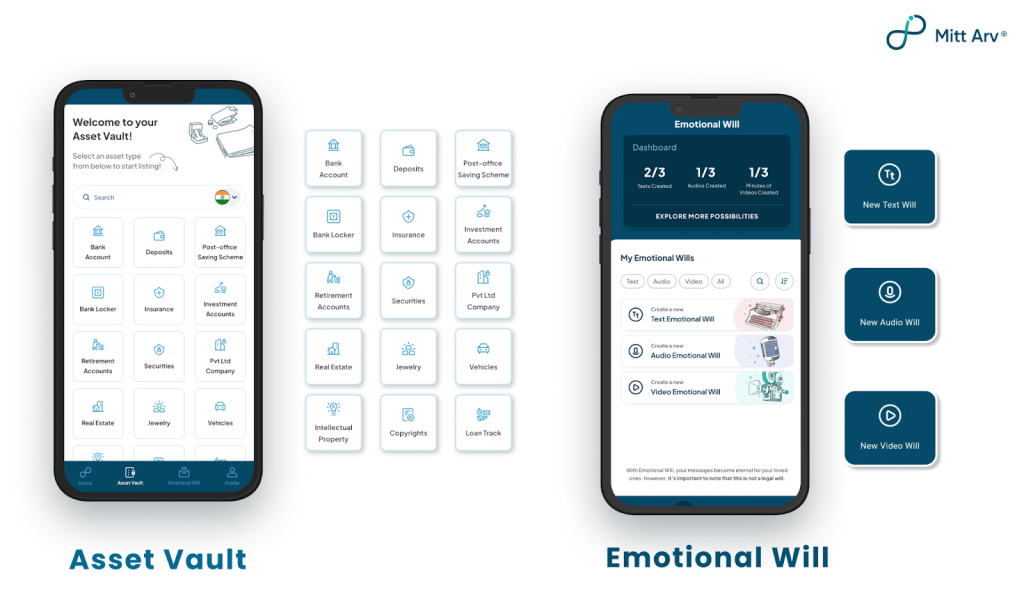

Mitt Arv helps you organize all your asset details in one dashboard securely through its Asset Vault, where you can store everything important from property papers and insurance details to investments and digital assets. So, when you decide to write your will, you have everything organised in one place.

But your legacy goes beyond material wealth, it’s also about memories, emotions, and personal connections.

That’s why Mitt Arv offers an Emotional Will feature, allowing you to leave behind heartfelt letters, audio notes, or video messages for your family and friends. These messages are stored safely and delivered at the right time, offering comfort, connection, and a little piece of you that stays behind to your loved ones.

FAQs

Q1. What is a will?

A will is a legal document that specifies how a person’s assets and property should be distributed after they pass away.

Q2. Who is eligible to write a will in India?

In India, anyone 18 years or older and of sound mind can make a will. To be legally valid, the will must be written voluntarily, clearly state how assets should be distributed, and be signed in the presence of at least two witnesses.

Q3. What are the main types of wills in India?

There are several types of wills, including:

- Privileged Wills: Meant for armed forces personnel engaged in war or similar high-risk duties.

- Unprivileged Wills: Commonly used by civilians and must be signed in the presence of witnesses.

- Conditional Wills: Activated only if specific conditions occur (e.g. if the testator dies in a particular way).

Q4. What is the difference between traditional wills and digital wills?

Traditional Wills are physical documents signed, witnessed, and securely stored, ensuring a straightforward legal process. Digital Wills are created online and are easier to update, though they may not be legally recognised in all areas and require secure storage to prevent unauthorised access.

Q5. Why might everyone benefit from having a will, regardless of wealth?

A will allows individuals to specify asset distribution, name guardians for children, and minimise potential conflicts among heirs. It also provides a chance to make charitable contributions and can reduce estate taxes, making it a valuable tool for anyone, not just the wealthy.