Death.

The only certainty in life.

One, we often do not prepare for.

Losing someone you love is hard. But what if, on top of the heartbreak, you suddenly couldn’t access money they left behind? What if you couldn’t pay the mortgage, afford a hospital bill, or cover funeral expenses-even though the funds were right there in the bank?

This happens far more often than people think.

In the middle of grief, families around the world are being dragged into complicated, expensive, and exhausting legal battles-all because one critical step was skipped: bank account details were never listed in the will.

A joint account doesn’t guarantee access. Naming a nominee doesn’t ensure a smooth transfer. Not mentioning financial accounts in your Will can leave loved ones stranded.

Look at these real stories that show what can go wrong and how easily it can be prevented.

Read Also: Why should you include Post Office Saving Schemes in your Will

Case 1: Locked Out of a Joint Account (Texas, USA)

A woman in Texas lost her husband. As she tried to access their joint checking account to cover funeral costs and ongoing bills, she discovered it had been frozen. Even though her name was on the account, the bank wouldn’t budge.

Why?

Because the account had been opened under “tenancy in common“-not with “right of survivorship.” That meant the husband’s half of the funds legally became part of his estate, which required probate court approval to access.

Eight months. $15,000 in legal fees.

All while bills were piling up and grief was still fresh.

If they had clearly stated the ownership structure in the will-or used proper beneficiary designations-this crisis could’ve been avoided.

Read Also: 5 Unique Wills That Turned Death Into a Statement of Life

Case 2: The Lost ₹14 Lakh in Mumbai

In India, a family stumbled upon a savings account with ₹14 lakh that belonged to their late father. It was a blessing.

Until it became a nightmare.

There was no nominee listed. No mention of the account in his will. The bank demanded a long list of documents:

- A Succession certificate,

- Affidavits from every legal heir,

- Indemnity bonds.

The family had to travel repeatedly to rural Maharashtra, where the account had originally been opened in 1992. The process took two years and cost ₹2.3 lakh -about 20% of what they were trying to claim.

And this isn’t an isolated case. India has an estimated ₹82,000 crore in unclaimed bank balances.

Mostly because families don’t know about the accounts or don’t have legal authority to access them.

Case 3: The Spain–UK Inheritance Puzzle

A British woman who retired in Spain passed away with €420,000 across three Spanish banks. But her UK will didn’t mention these foreign accounts.

Her executors spent 14 months and €37,000 unraveling the mess. They had to:

- Hire forensic accountants to identify the accounts

- Navigate Spain’s complex inheritance system (“herencia yacente”)

- Translate all UK probate documents

- Obtain a Madrid-issued death certificate-something they didn’t know they needed

The banks wouldn’t release a cent without everything in order. All of this could have been avoided with one section in the will noting foreign holdings.

Case 4: A Two-Digit Typo That Cost Thousands

Peter Teich, a pensioner in the UK, expected to receive a £193,000 inheritance. But a sort code error in his will-just two wrong digits-sent the money to a complete stranger.

And that stranger refused to return it.

Peter had to spend £12,000 identifying the recipient through legal discovery, and another £34,000 to get a court injunction. Barclays, the bank responsible for the transfer, initially offered a £25 “token” apology.

All of this from a simple clerical error, one that clearer, double-checked will documentation could’ve prevented.

Case 5: When Nominees and Legal Heirs Collide

In a 2023 case heard by the Mumbai High Court, a deceased man’s brother-named as the nominee on a bank account-refused to hand over ₹92 lakh to the man’s widow and children.

According to India’s Reserve Bank guidelines, a nominee is merely a trustee, not the legal owner. But the brother insisted otherwise. The family was dragged into a two-year court battle, which required:

- A forensic review of 12 years of bank statements

- DNA testing to verify the children’s legitimacy

- Banking Ombudsman mediation

The will lacked clear instruction on how to handle the account. Without it, legal heirs were forced to fight for what was rightfully theirs.

Case 6: Digital Wallet, Real-World Disaster

A man in California had $28,000 in his PayPal account when he passed away. But no one in his family knew about it, and it wasn’t listed in his will.

Eighteen months later, PayPal marked the account as inactive and sent the funds to California’s unclaimed property division.

By the time the family found out, they had missed the submission deadlines. It took six months of petitions just to get 85% of the funds back.

Case 7: The Paperless Nightmare

In another heartbreaking situation, adult children were left to piece together their parent’s banking life without a clue. The parent had gone fully digital-no printed statements, no physical records.

When they passed, the family had no passwords, no access to emails, and no idea where the accounts were.

They had to:

- Call dozens of banks and credit unions

- Submit death certificates repeatedly

- Face dead ends and rejection letters

- Spend months just identifying where money might exist

It must have been emotionally crushing and logistically overwhelming.

Read Also: DigiLocker and Mitt Arv: Different Roads to the Same Destination

The Pattern Is Clear

Across continents and cultures, the same problem keeps surfacing, people don’t include specific bank account details in their wills.

And the fallout is legal delays, emotional stress, and financial damage.

Here’s what many people don’t realize:

- Joint accounts can still get frozen

- Nominees are not always final owners

- Digital accounts get easily overlooked

- Foreign bank accounts create massive complications

- Missing or incorrect information (like sort codes) can derail the process entirely

It’s not enough to write a will. The will must be clear, complete, and current.

Why This Matters Now More Than Ever

Modern life is more complex than it was a generation ago.

We bank online.

We have investments across platforms. Many of us live or work internationally. Our finances are spread out. And that’s exactly why organizing them matters.

When we don’t leave behind a clear map, our loved ones are left to wander in a maze of legal and financial red tape. They may have to go to court. They may lose money to fraud, unclaimed funds, or legal fees. They may never recover what was meant for them.

But this can be prevented. With just a little preparation.

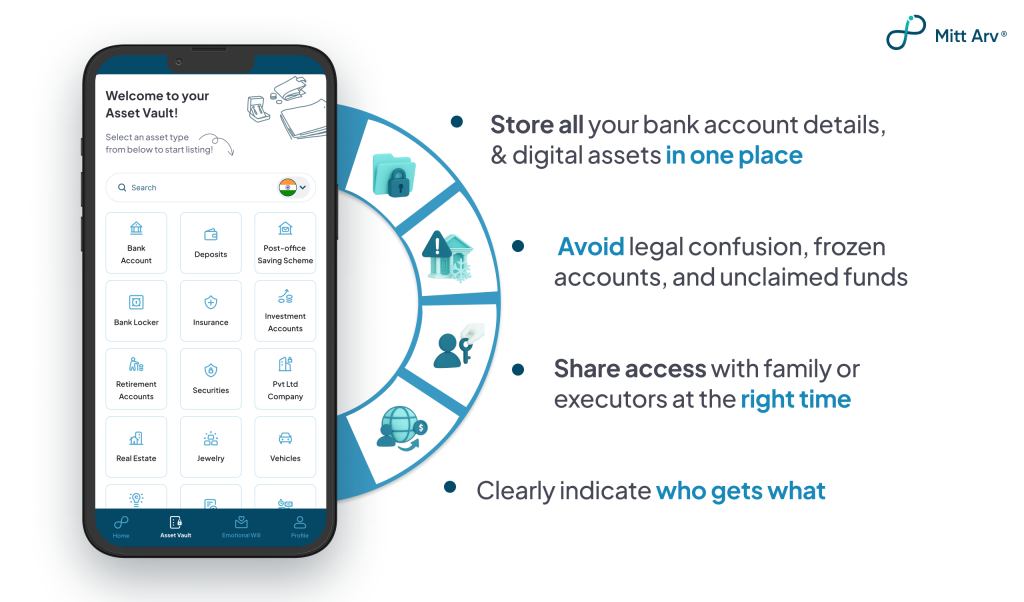

One Smart Solution: The Mitt Arv Asset Vault

This is where Mitt Arv comes in.

Mitt Arv offers an innovative, secure, and effective way to make sure your loved ones have the information they need-when they need it most.

With Asset Vault, you can:

No more piecing things together.

No more hunting for clues.

Just clarity, care, and a plan that actually works when it’s needed.

Grief Shouldn’t Come with a To-Do List

Losing someone is devastating. The last thing anyone should have to deal with is a mess of missing documents, locked accounts, or legal showdowns.

Take the time to make your will complete. Include your bank accounts. List your digital wallets. Document your financial life in a way that makes sense.

And let Mitt Arv help you make that possible-with the Asset Vault, your single, secure space to protect your legacy and ease the burden on those you love.

Start your Asset Vault today at Mitt Arv, and make sure your silence never becomes their struggle.