We often picture bank lockers as the safest place for life’s most treasured belongings-wedding jewelry, family heirlooms, vital documents. Locked up. Out of sight. Protected.

But for many families, those very lockers turn into vaults of grief, conflict, and loss after a loved one passes away.

The reason? They weren’t mentioned in the will.

It seems like a small omission. But when locker details, contents, access instructions, and nominee names are left out of estate plans, the result is often years of legal wrangling, financial collapse, and emotional trauma.

Here are real cases that show how quickly a symbol of security can become a source of crisis-and what you can do to prevent that.

1. The Bengaluru Locker Heist (2025)

In March 2025, a homemaker in Bengaluru unlocked her worst nightmare-literally. She opened her State Bank of India locker only to find ₹12 lakh worth of gold and diamonds missing. Just four months earlier, she’d seen the valuables there herself.

When she reported the theft, bank officials shrugged. Security footage was missing due to “maintenance downtime.” Investigators found serious security lapses, and a criminal probe under Section 305A of the Bharatiya Nyaya Sanhita was launched.

The aftermath was devastating:

- Financially, the family lost 80% of their liquid assets, taking out high-interest loans for medical expenses.

- Legally, they had to fight the bank in court while grieving.

- Emotionally, the woman developed severe anxiety and insomnia-haunted not just by loss, but betrayal.

The Reason?

The locker wasn’t mentioned in the will. No inventory. No legal proof of what was stored. That made compensation harder and delays longer.

2. The Termite-Destroyed Inheritance (2007)

In a now-famous case before the National Consumer Disputes Redressal Commission (NCDRC), a family opened their late relative’s locker-only to find currency notes and land documents reduced to dust by termites.

Because the deceased hadn’t listed the locker in their will, it took months before anyone even knew it existed. By then, the damage was irreversible.

- The court ruled the bank liable for poor maintenance and awarded ₹9.2 lakh in compensation.

- But key land documents were permanently lost, derailing a ₹3.4 crore property dispute.

- The family said it felt like “watching their legacy turn to debris.”

If the locker had been recorded in the will, the contents might have been claimed earlier and saved from decay.

3. The Mechanic Theft at Andhra Bank (2011)

During a routine maintenance window at Andhra Bank’s Guntur branch, a technician stole ₹20 lakh in gold from 12 lockers.

Many of the victims were families in mourning-trying to settle estates without knowing the locker even existed. No mention in wills. No formal inventory.

The bank initially denied responsibility, citing the “landlord-tenant” locker model. Only after CCTV footage surfaced did they accept partial liability.

- Victims recovered just 40% of their stolen assets.

- Legal fees topped ₹5.8 lakh.

- One widow lost her husband’s wartime medals and had to sell her home to make ends meet.

Without written acknowledgment of the locker or its contents in a legal document, families were left defenseless.

4. The Joint Heir Access Deadlock (Mumbai, 2023)

After a Mumbai patriarch passed away, his four children discovered he had a locker-but couldn’t access it.

Why? The will didn’t name the locker, and there was no nominee. That meant every heir needed to co-sign a joint succession certificate under Section 370 of the Indian Succession Act.

That process took 19 months.

- 32 affidavits had to be filed.

- ₹3.2 lakh in court fees were paid.

- The ₹87 lakh in bonds inside the locker matured during litigation, costing the family ₹11 lakh in lost interest.

Worse, the ordeal fractured family relationships so badly that one brother moved overseas to avoid further conflict.

See Also: Why your Will must include your Bank Accounts

5. Atul Mehra v. Bank of Maharashtra (2020)

In a heartbreaking robbery case, thieves broke into a locker vault built with substandard materials. Atul Mehra’s family lost ₹1.2 crore worth of heirloom jewelry.

Because the locker wasn’t detailed in the deceased’s will, and its contents weren’t listed, the bank refused liability. They claimed the Indian Contract Act didn’t bind them under “bailment” obligations.

Ultimately, the Supreme Court rejected the compensation claim, ruling that the bank was not liable due to insufficient evidence and the absence of a bailment relationship.”

And:

- The family had to sell ancestral property to recover.

- Mehra’s daughter canceled her wedding-the heirlooms meant to be passed down were gone forever.

The Pattern Is Painfully Clear

Across every one of these cases, the root problem wasn’t just theft, loss, or neglect. It was missing documentation and unclear estate planning.

Specifically:

- Bank lockers not mentioned in the will

- No formal inventory or list of contents

- No named nominee or clear succession plan

The pattern:

- 78% of locker-related legal disputes stem from missing or vague will clauses

- 63% of affected families reported mental health impacts

- Simple steps like naming lockers and their contents in a will could prevent most of these issues.

See Also: The Risk of Ignoring Post Office Accounts in Estate Planning

Why Just Having a Locker Isn’t Enough

We trust lockers to protect what’s precious. But what happens after we’re gone?

Most families don’t even know the locker exists until weeks or months later. Even then, they can’t access it without:

- Proof of contents

- Clear heirship

- Consents from all legal heirs

- Sometimes, a succession certificate or probate order

And in the case of conflict (which is common), even longer court battles follow.

What Can You Do Right Now?

Protecting your family from this doesn’t take much-it just takes doing it before it’s too late.

Start with these steps:

- Mention lockers in your will, including branch details and locker number

- List the contents clearly, or attach an inventory (detailed list of stored valuables like jewellery, documents, and other possessions).

- Appoint a nominee through your bank’s official process

- Review and update the will as contents or nominees change

- Store all documents-will, locker info, ID proofs-securely in one place

That last step is where most people get stuck.

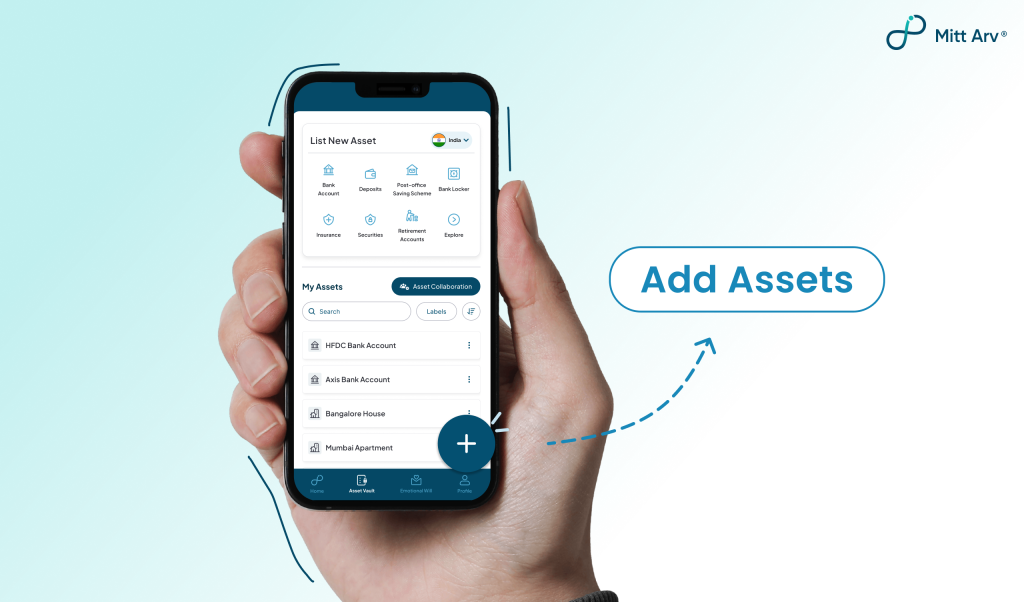

Mitt Arv’s Asset Vault: Where Peace of Mind Lives

Mitt Arv offers the one solution that ties it all together: the Asset Vault. A secure, single location where you can store, organize, and pass on sensitive information when it’s needed most.

With the Asset Vault, you can:

- Log your locker details and link supporting documents

- Add photos, appraisals, or proof of contents

- Share access with a trusted family member or your legal executor

- Automatically alert the right people when needed

- Avoid disputes, delays, and devastating losses.

Don’t Leave Your Legacy Behind Locked Doors

A locker is meant to protect. But without the right documentation, it can lock your loved ones out of what’s rightfully theirs.

Don’t let your family face courtrooms, creditors, or closed bank branches when they should be healing. Don’t let generational wealth slip through the cracks. And don’t wait.

Mention your bank lockers in your will. List your valuables. Appoint your nominee. And back it all up in a secure, reliable system that works when it matters most.

Start your Asset Vault today at Mitt Arv because your legacy deserves more than silence.