You work hard. You save for decades. But what if one missing paper or one forgotten detail wipes that all away?

That’s exactly what happened in 2023–24. More than ₹8,500 crore was reported as unclaimed pension funds in India.

Not because people didn’t save. But because no one knew where the papers were. Or that the money even existed.

A solid plan doesn’t end with saving. It ends with your family having access, clarity, and support when they need it most. Otherwise, your family will be left behind with a void of confusion.

So how do you avoid this?

It starts with knowing your options. Clearly, confidently, and ahead of time.

Let’s break it down.

Which Pension Plan in India is Right for You?

Understanding your options isn’t just smart, it’s essential. Whether it’s NPS, PPF, or annuities, they can make your financial and retirement planning simple. It can help you retire comfortably and live stress-free in your golden years.

- National Pension Scheme (NPS): Flexible investment for retirement with partial withdrawals at 60 and lifetime pension through annuity.

- Public Provident Fund (PPF): A 15-year government savings plan with tax benefits and guaranteed interest for safe long-term wealth building.

- Atal Pension Yojana (APY): For unorganised sector workers; offers ₹1,000–₹5,000 monthly pension based on contribution and entry age.

- Employee Pension Scheme (EPS): Linked with EPF; provides pension benefits to employees post-retirement after 10+ years of service.

- Deferred Annuity Plan: Pay gradually or as a lump sum, and receive a pension after a specific period (ideal for retirement planning).

- Immediate Annuity Plan: One-time payment, with a monthly pension starting immediately. Great for retirees needing instant income.

Choosing your retirement plan is just the first step. But what truly matters is how well it is organised.

The Risk Isn’t Just Losing Money. It’s Leaving Loved Ones Lost.

We all plan for our future, investing in retirement schemes, contributing to EPF, and setting aside savings. However, if these documents aren’t organised properly, it can cause problems later in life.

Let’s be honest.

If something were to happen to you, could your family easily find these important documents?

Saving alone isn’t enough; your family should have access to the details when needed.

Some of the retirement planning mistakes to avoid are :

- Keeping documents scattered across files and inboxes.

- Family being unaware of what exists.

- Not having Retirement Plans in your will.

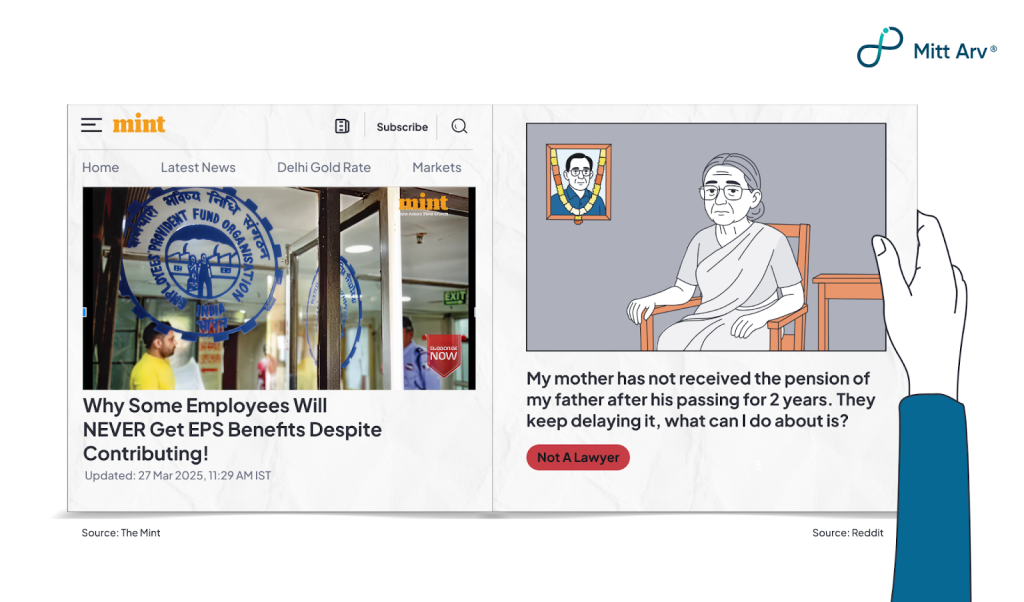

That’s how hard-earned savings turn into unclaimed funds. Just look at Mr. Rajnikant Behera’s life.

He was a retired pensioner who went from city to city for over 10 years just to claim the money he had already earned.

And the reason? One missing document.

“I’m diabetic and can’t even afford medicines,” he said, exhausted and frustrated.

This problem goes far beyond one person. There are lakhs who silently suffer, still trying to claim what is rightfully theirs. But the importance of retirement planning in India is a growing concern. Especially, in cases where the pensioner passed away or when the funds can’t be accessed.

Now, the real question is: Why did that happen?

Mr. Rajnikant couldn’t claim his pension due to unorganized financial details. Don’t make the same mistake.

Follow these steps while making your will :

- Include your pension and retirement accounts in your will (You have deleted the earlier part so nothing to add/change here)

- Name beneficiaries to avoid legal hassles

- Tell your family what you’ve planned

Now, to include all your retirement & pension accounts in your will, you need to list your documents in one place, which no doubt can be a tiring & time-consuming task.

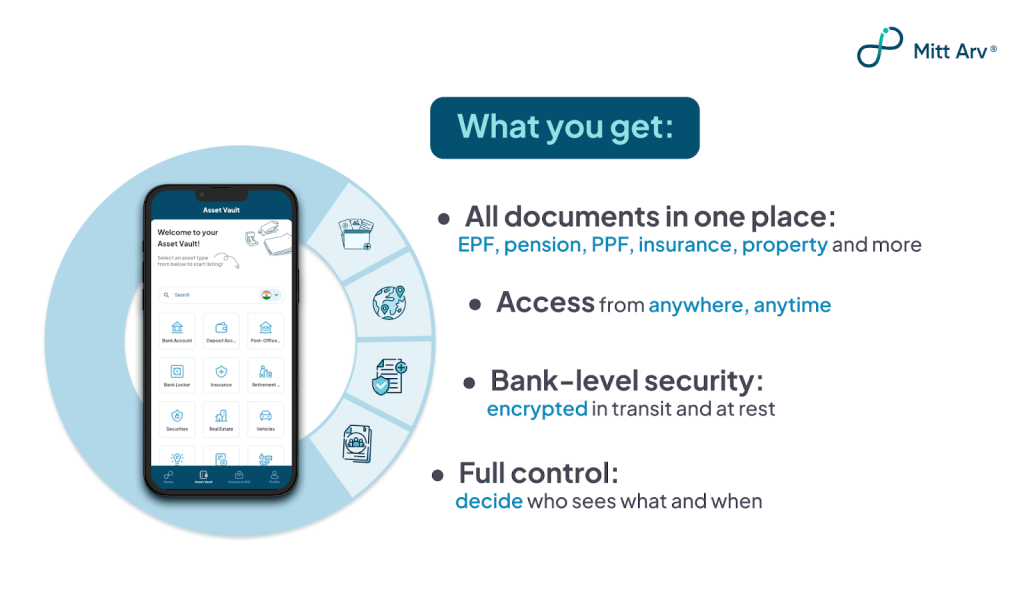

That’s where Mitt Arv comes in, a digital legacy app that helps you organise and manage all your asset details in one place.

With Mitt Arv’s Asset Vault, you store all your important financial & asset details (international or local), be it insurance or real estate or intellectual property, or digital assets, in one single dashboard.

Plus, you can also create collaboration groups to involve trusted family members or advisors and share access with them as you want.

Worried about security? Don’t worry. We’ve got you covered.

Mitt Arv is an ISO 27001-certified platform with end-to-end data encryption that keeps your information secure and protected. Your information stays private, protected, and only shared when you choose to.

Make a Plan Your Family Can Count On

We all know that emergencies don’t come with a warning.

In those moments, your family shouldn’t be searching through piles of paper or wondering where to find your pension details.

They need answers, not anxiety.

A few thoughtful steps, like mentioning all your assets in your will can make things easier for you and your family.

It is not easy to track your assets all the time, that is why Mitt Arv is here to help you. List your assets bank lockers, retirement schemes, insurance, digital assets and more.

Organise your pension & retirement plans today & make sure your legacy reaches the people it was meant for.

Download Mitt Arv today.

Frequently Asked Questions (FAQs)

1. How to store pension documents securely?

Store pension documents securely by uploading them to a trusted, encrypted platform like Mitt Arv. Keep scanned copies, nominee details, and statements organised and share access only with trusted individuals.

2. What’s the difference between a pension plan and a retirement plan?

A pension plan is often provided by an employer and gives a fixed monthly income after retirement. Retirement plans (like NPS or PPF) are individual savings options to build a retirement fund.

3. Can I access my retirement funds before retirement?

Some plans allow partial withdrawals for emergencies or specific purposes, but withdrawing early may reduce your retirement savings and could attract penalties.

4. Why should I mention retirement plans in my will?

If your family doesn’t know about your retirement plans, they may not be able to claim the benefits. Include pension in your will to avoid confusion and protect your loved ones.

5. How much money do I need to retire comfortably?

This depends on your lifestyle, health, and financial goals. Experts recommend saving enough to cover at least 70–80% of your current income per year in retirement.

6. What legacy planning tools are available for Indians?

Mitt Arv offers a platform of Asset Vault and Emotional Wills as legacy planning tools for Indians. This helps users manage and pass on their assets or memories securely.

7. How can I avoid EPF claim issues in the future?

EPF and pension claim processes can be difficult without the right documents. Keep your UAN active, update KYC regularly, add a nominee, and store all details in a secure place for digital legacy management.

8. When should I start planning for retirement ?

Many of us wonder whether to start retirement planning early or wait until later in life, but the truth is it’s not complicated. Since, it is never too early or too late to start, but you should ensure to start saving from your late twenties onwards to get the maximum benefit.