As Sandra Day O’Connor famously said, “I need to retire from retirement. ” This highlights the importance of having a strong Retirement Planning Checklist in place. Proper planning ensures that you can enjoy your retirement without the stress of financial uncertainty.

Retirement planning isn’t just about saving money; it’s about creating a plan for a secure and comfortable future. It’s your guide to achieving financial independence and enjoying a stress-free retirement!

Whether in India or elsewhere, rising living costs and healthcare make it necessary to secure your financial future well ahead of time. In this blog, we will provide a detailed Retirement Planning Checklist to ensure your golden years are truly golden, filled with financial security, peace of mind, and the freedom to enjoy the life you’ve always dreamt of.

The Retirement Planning Checklist:

1. Set Your Retirement Goals

When are you planning to retire?

First, start with deciding on your ideal age to retire. Having a clear goal helps set expectations, and your planning will revolve around that.

In India, the retirement age for government employees is typically between 58 and 60, while private-sector employees may choose to work longer. Decide whether you want to retire early or extend your working years based on your financial needs and lifestyle preferences.

What does your life post-retirement look like?

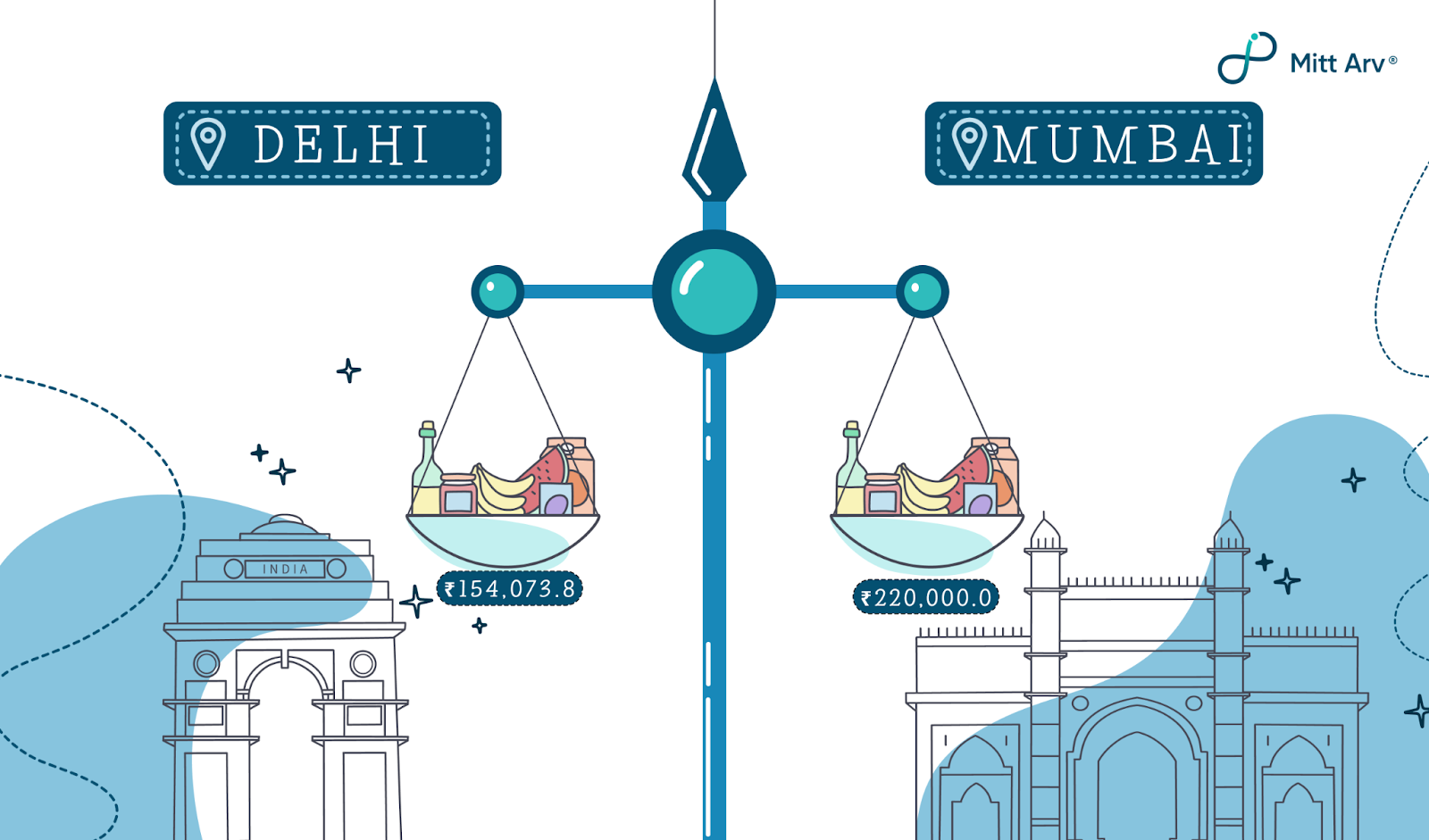

It is important to define how you want your post-retirement life to look. You might have to adjust your plan if you want a more luxurious lifestyle. Another component is where you plan on living. Will it be a tier 1, tier 2, or tier 3 city? The cost of living in these cities will be different in different cities, and this will directly impact your retirement plan.

For example, You would need around 154,073.8₹ in Delhi to maintain the same sta ndard of life that you can have with 220,000.0₹ in Mumbai!

2. Estimate your Post Retirement Expenses

Daily Living Expenses

Calculate your expected daily living expenses after retirement, including housing, groceries, utilities, travel, and personal hygiene. Remember to account for inflation, which will most likely drive up living expenses.

Healthcare Planning

One of the most important costs to remember is healthcare planning. Schemes like Medi-claims and health insurance should be included for when in need.

Chad Harmer, Founder, CIO, Real Estate Broker, and Financial Planner of Harmer Wealth Management rightly said, “One critical but often overlooked aspect of retirement planning is the integration of healthcare costs into the broader financial plan. While many individuals focus on savings targets, investment growth, and income streams, they often underestimate the financial impact of medical expenses, long-term care, and inflation on healthcare services. Healthcare costs can be substantial, particularly in the later stages of retirement, and failing to plan for them can disrupt even the most carefully constructed financial strategies. Planning should start with an understanding of potential medical expenses, including insurance premiums, out-of-pocket costs, and the likelihood of needing long-term care.“

Family and Kids-Related Support

If you plan to support children or other family members financially, make sure to account for this in your retirement planning checklist. It helps to ensure that you set aside funds for these expenses, such as education support or financial aid so that you’re prepared to offer help without compromising your financial security.

According to Sebastian Wade, Real Estate Consultant, Eden Emerald Buyers Agent, “Many people focus on their income streams but don’t think about how their living situation might change as they age. Downsizing to a more manageable home or moving to an area with lower living costs can free up equity and reduce ongoing expenses. I worked with a couple who sold their large family home and bought a smaller property in a regional area. Not only did this cut their monthly costs, but they also put the remaining funds into investments, which gave them more financial security.“

Travel And Fun

Budget for expenses if you plan to travel or engage in various hobbies. Travel, hobbies, and social activities will all add to your retirement expenses, so they should be considered when planning.

Debt Planning

Retirement Planning includes taking a thoughtful approach to managing debt. Ideally, working towards reducing or clearing debts like home loans, personal loans, and credit card balances can ease financial pressure and help you enjoy a more relaxed retirement. Creating a plan to pay these obligations gradually will allow you to focus on building savings with less worry about future financial strain.

Charity and Giving Back

If you plan to be actively involved in helping others in the form of charity, it’s wise to allocate a part of your budget toward these goals. Setting aside funds for charitable donations or community projects can help you continue making a positive impact post-retirement.

3. Build a Strong Saving Plan

Maximize Contributions to Retirement Accounts

When planning for retirement, the earlier you start contributing to retirement accounts, the better positioned you’ll be for a secure financial future. For employees in India, different options are available depending on whether you’re in the private or public sector, and maximizing these contributions can lead to substantial benefits in the long term.

Private Sector Employees: EPF and NPS

Private sector employees can take advantage of two primary retirement planning and savings vehicles:

- Employee Provident Fund (EPF):

- This is a government-backed, long-term investment scheme where both the employee and employer contribute a percentage of the employee’s salary (currently 12% each in most cases) to the EPF account. The EPF offers guaranteed returns with a current interest rate of around 8-9% annually.

- By maximizing voluntary contributions beyond the mandatory 12%—known as the Voluntary Provident Fund (VPF)—you can increase your retirement corpus significantly. The VPF also enjoys tax-free returns, making it a low-risk, high-reward saving option.

- National Pension System (NPS):

- NPS is another powerful tool for retirement savings, especially for private-sector employees looking for flexibility and tax benefits. It is a government-sponsored pension scheme that allows individuals to invest in a mix of equities, government bonds, and corporate debt based on their risk preference.

- Contributions to the NPS are eligible for tax deductions under Section 80C (up to ₹1.5 lakh) and an additional deduction of ₹50,000 under Section 80CCD(1B). This makes NPS highly tax-efficient. Additionally, after retirement, a portion of the NPS corpus can be withdrawn tax-free. At the same time, the remaining amount is used to purchase an annuity that provides regular income.

Government Employees: Pension and Provident Funds

Government employees in India have traditionally enjoyed a pension system that guarantees regular income after retirement. However, with the shift towards the New Pension Scheme (NPS) for government employees hired after 2004, contributions to NPS have become increasingly relevant.

- Employee Provident Fund (EPF):

- Government employees, like private sector employees, contribute to the General Provident Fund (GPF) or EPF. These contributions are compulsory, but maximizing them by adding voluntary contributions, similar to the Voluntary Provident Fund (VPF), can significantly increase the retirement corpus.

- National Pension System (NPS):

- For post-2004 recruits in government jobs, the NPS replaces the traditional pension system. The government and employees contribute to the NPS, which balances equity and fixed-income returns.

- Like the private sector, maximizing your NPS contributions can be highly advantageous due to tax benefits and flexibility in allocating investments according to your risk profile.

4. Start Early

It’s a common myth that people should only start retirement planning later in their lives. The truth is, the sooner, the better! Starting early not only allows your money to grow through compounding but also relieves the pressure of hurried retirement, making you feel more proactive and in control of your financial future.

let’s take an example: If you start investing ₹10,000 per month at the age of 30 with an annual return of 10% and plan to retire at 55 (in 25 years), here’s how your investment grows:

- Total Investment: ₹10,000 x 12 months x 25 years = ₹30,00,000

- Future Value (at 10% annual return): ₹1,31,01,811.85

This means your initial ₹30 lakh investment grows over four times through compounding alone! By starting early, you’re giving your money the maximum potential to grow. Similarly, if you start investing at the age of 25, 35,40, and 50, the following will be the returns:

This comparison highlights the powerful impact of starting early. By investing at age 25 rather than 40, your ending balance at age 55 is nearly ten times larger. You should also note that the compounding doesn’t stop there. Even after retirement, the money grows with you. Let us again take the example of our 30-year scenario (the previous amount is still compounding, plus he’s still investing). The only difference is that now you’re 70 years old, the math would look like:

1.Total Investment: ₹10,000 x 12 months x 40 years = ₹48,00,000

2. Future Value (at 10% annual return): ₹58,542,217.35

By the age of 70, your ₹48 lakh investment grows nearly twelve times! Starting early isn’t just about maximizing returns; it’s about creating lasting financial security that grows with you. If you want to calculate your retirement corpus, use the following calculator.

5. Investment Diversification

Systematic Investment Plan

Systematic investment plans, or SIPs, induce a systematic retirement savings plan. As SIPs and mutual funds involve setting aside small amounts of funds regularly, it doesn’t put a lot of strain on daily activities while saving up for retirement.

Balancing Risk and Returns

India offers many investment options, such as stocks, mutual funds, bonds, real estate, and gold. Diversifying your investments ensures that you don’t lose everything, even if you are at a loss, as it can deeply impact your retirement plan.

6. Tax Benefit

Tax-Efficient Withdrawals

To minimize your tax liability, carefully consider your withdrawal schedule. For example, PPF income is tax-free, but pensions and withdrawals from NPS or EPF can be subject to taxes. See a financial planner for effective withdrawal management.

Make Use of Tax-Free Investments

Continue investing in tax-free instruments like PPF and NPS, which offer tax deductions while building your retirement savings.

7. Emergency Planning

Emergency Fund

Life is unpredictable, One such very recent example of covid 19 lockdown. Jobs lost, health deteriorating, and hospital bills rising. Only the ones who had sufficient savings survived, and one should remember this when planning for retirement. Maintain an emergency fund equal to at least 6-12 months’ worth of expenses. This will help cover unforeseen expenses, such as medical emergencies or home repairs, without dipping into your retirement savings.

Keeping Inflation In Account

Make sure inflation is factored into your retirement plan. Your savings must increase to keep up with the steady decline of purchasing power caused by inflation. Consider inflation-indexed bonds or assets that often yield strong returns during inflation.

See Also: Retirement Planning with 4% Rule in India

8. Regularly Review and Update Your Plan

Maintaining your retirement plan in an up-to-date and reviewed manner is essential to meeting your objectives. Review your finances every year to account for changes in spending, income, inflation, and life-altering events like getting married or having a child. Significant life events like a job move, a death in the family, or health problems may also call for modifications. Ensure your healthcare directives, power of attorney, and other estate planning paperwork are updated regularly to reflect your current wishes and family situation. This keeps your plan current and in line with your changing requirements.

Emily Tran, Finance Analyst and Management Specialist, Maple Worthy says, ” An often overlooked aspect of retirement planning is the importance of updating estate planning documents to ensure they align with current laws, personal wishes, and financial situations. As individuals approach retirement, it’s crucial to have a comprehensive estate plan that clearly outlines their desires regarding asset distribution, health care decisions, and guardianship matters, if applicable.“

Final Thoughts

Retirement planning is often a sensitive topic of great importance. It requires careful thought and reflection, sound financial and legal decisions, and staying up to date with trends to make an effective retirement in India or elsewhere. Aviad Faruz, CEO of FARUZO advises:

“Beyond finances, consider how you’ll spend your time in retirement. Do you have hobbies, passions, or a purpose that will make early retirement fulfilling? If not, extending your career—perhaps on a reduced schedule or in a role that aligns with your interests—might provide both stability and personal satisfaction.“

“As in all successful ventures, the foundation of a good retirement is planning,” quotes Earl Nightingale. But do not worry; in fact, it’s never too early or too late to begin making plans for your retirement. Seek expert advice, review your investments regularly, and modify your plan according to trends and requirements. This way, you can enjoy your retirement life stress-free!

Ready to start your retirement planning journey? Check out Mitt Arv. Our Asset Vault helps you organize and safeguard your financial assets, ensuring nothing is overlooked. Our Emotional Will empowers you to leave behind meaningful messages and memories for your loved ones to cherish. Together, these tools provide a complete foundation to kickstart your retirement planning journey.