Introduction

Did you know that over ₹1,000 crore worth of investor money goes unclaimed in India every year because families have no idea where their investments are or how to perform a Demat Account Transfer? Are you one of them?

Why bother about a Will, nomination, or legacy planning when everything seems perfect? But life is unpredictable. An emergency or sudden event can leave your family searching for answers at the worst possible time.

Without a will, nomination, or legacy plan, your family may be left confused, stressed, and unsure where to begin. They don’t know where your investments are, how to claim them, or what steps to follow.

This is why legacy planning is important for every investor. It protects your family during the hardest moments and makes sure your money safely reaches the people you love. Understanding basic tools like Wills, nominations, and documents such as NSDL’s e-CAS can help ensure your family never stays in the dark.

What is NDSL e-CAS, and why do you need it?

NSDL’s e-CAS (electronic Consolidated Account Statement) is a simple digital PDF that shows all your investments in one place. It collects your shares, mutual funds, bonds, and other securities from your NSDL and CDSL demat accounts and puts them together in a single, password-protected file. This statement is emailed to you every month (if you had a transaction) or at regular intervals.

For families, e-CAS becomes very helpful during emergencies because it quickly shows what investments exist and where they are held, making the post-death claiming process much easier. In times of tragedy, this simple PDF can bring peace of mind and ensure your family isn’t left with nothing. Another important aspect of legacy planning is adding the demat account nominations to your will to avoid any legal disputes or confusion in your family.

Why Having a Will and Demat Account Nomination is Important

A Will explains who should finally receive your assets after you pass away, and it is an essential part of legacy planning. But when it comes to demat accounts, the Depository Participant (DP) will first transfer the securities to the registered nominee.

A nominee is an individual(s) you appoint who will inherit and manage all the assets in the demat account after the account holder’s passing. If the Will mentions someone different, legal heirs can still claim their rights later, but the process may take extra time, legal steps, and paperwork.

This is why keeping your Will and demat nomination aligned matters. If both documents match the same people, the same share of assets, your family will not face delays or conflicts during transmission. Regularly reviewing them after major life events (marriage, childbirth, divorce, or new investments) is a smart part of legacy planning.

Step-by-Step Guide to Demat Account Transfer

When an investor passes away, the family must follow certain steps to get the investments transferred. This process is called transmission.

Through transmission, the investments of a person who has passed away can be given to their nominee or legal heirs. These investments can be shares, mutual funds, bonds, or anything held in a demat account.

When an investor passes away, their family cannot use the demat account directly. They must follow a few steps to get the funds and investments shifted to the right person through a Demat Account Transfer.

Follow These Steps For Transmission Process :

1. Get the Death Certificate

This is the first and most important step. No bank account, mutual fund transfer, or demat account transfer will be processed without it.

2. Check the NSDL e-CAS Portal

The e-CAS helps the family understand what investments the person had. It shows all shares, bonds, and mutual funds in one place. This saves time and avoids confusion.

3. Contact the Depository Participant (DP)

The DP is the broker who opened the demat account. The family must submit:

- Transmission Form

- Death Certificate copy

- Their own KYC documents

If there is a nominee, the process is quick and simple.

4. If There Is No Nomination

The family may need extra documents like a succession certificate, a legal heir certificate, or a Will. This can take months or even years.

5. Verification and Transfer

After checking everything, the DP transfers the investments to the nominee or the legal heir’s demat account.

Adding a Nominee to Your Demat Account

You can add a nominee in two simple ways …depending on what is easier for you.

1. Online (NSDL e-Nomination)

- Visit the NSDL nomination portal.

- Enter DP ID + Client ID + PAN.

- Verify using OTP.

- Choose Nominate or Opt-out.

- e-Sign using Aadhaar OTP.

2. Offline (Through Your DP / Broker)

- Fill NSDL Form 10.

- Add nominee details and percentage allocation.

- If the nominee is a minor, add guardian details.

- Submit the form with KYC and one witness signature.

- The DP will update the nomination in your demat records.

Rules You Must Know

- You can add up to three nominees.

- If you do not mention percentages, all nominees get an equal share.

- SEBI rules say you must either nominate or formally opt out.

- If you do neither, your demat account can be frozen for debits.

- All joint holders must sign; POA holders cannot nominate.

- Update Important Nominee Details.

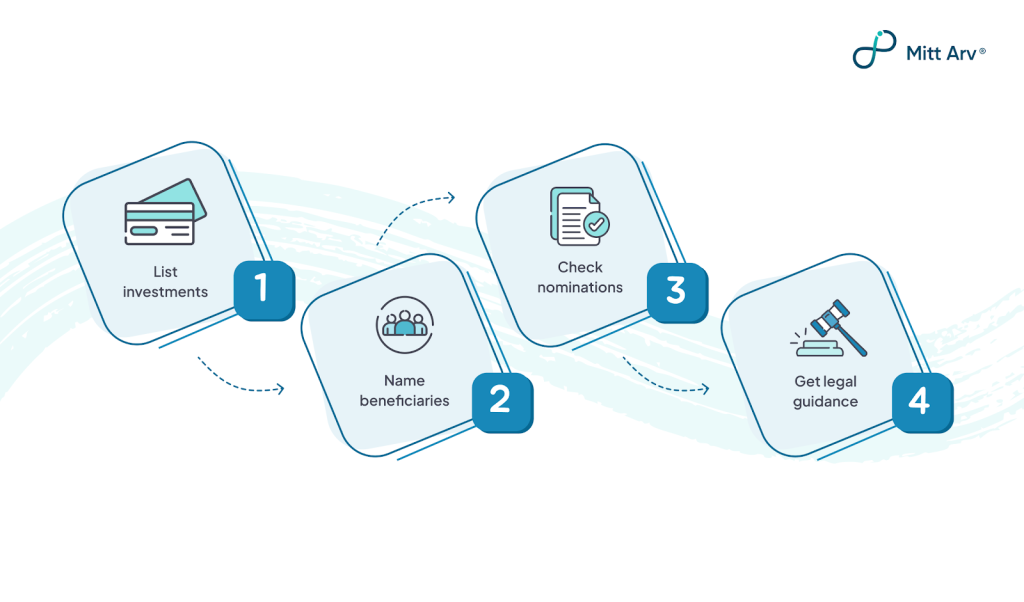

Legacy Planning Tips for Investors

- Check your nomination status on your broker/DP portal.

- If you don’t have one, add it online via NSDL or submit Form 10.

- Update your Will to match the nominee details.

- Mention your DP ID/Client ID and exact percentage division.

- Review after major life events like marriage, children, or buying new assets.

How to keep your Financial & Legacy planning organised?

Keeping your financial and legacy planning organised is one of the most important responsibilities you have as an investor. When your documents, nominations, and asset records are scattered or outdated, your family may struggle to understand your assets or access them when required. This can lead to delays, stress, and even loss of assets simply because no one knew where things were.

Death-Tech platforms like Mitt Arv make legacy planning much easier and safer. Mitt Arv offers an Asset Vault where you can securely add and manage all kinds of assets, real estate, bank accounts, crypto, insurance policies, and more. It is a tool to organise and list your asset details, so in times of unpreparedness, it helps you organise and list all your assets clearly, so you or your family never have to chase paperwork during emergencies.

With real-time asset management, you can update and share your records anytime and share important details with your loved ones whenever you feel it is the right time. This means your family will never be left confused or lost during a difficult time. They will know exactly what assets exist and where to find them.

You aren’t limited to one country. You can store asset details from India, the USA, Singapore, and other nations, so even if your life and investments are spread across the world, everything stays protected and organised in one place. This is especially useful for NRIs or global investors.

But that’s not all. Mitt Arv takes security extremely seriously. It is ISO 27001 and SOC 2 compliant, which are global standards for protecting sensitive information. This means your data is stored with strict security controls, and the platform is built to handle cybersecurity risks safely and efficiently.

With Mitt Arv, you can rest easy, knowing your global assets are protected, and your family will have clarity, guidance, and access when it matters most.