There’s a strange comfort in checking our bank balance or tracking an investment. Watching numbers grow gives us a sense of control, doesn’t it?

But when was the last time you tracked what you owe, with the same attention you give to what you own?

Most people see “assets” and “liabilities” as opposites; one builds wealth, the other burdens it.

But that’s an oversimplification.

The truth is, both are two sides of the same coin.

Your home loan enabled you to own that beautiful flat.

Your education loan helped you build your career.

Your business loan opened doors to opportunity.

Liabilities aren’t bad. They’re bridges to progress.

The problem begins when we stop keeping track of them.

Between home loans, education loans, car EMIs, and credit card dues, managing borrowed money can feel like trying to juggle with your eyes closed. According to RBI data, from 2019 to 2025, annual liabilities have grown 102% and one of the reasons for this is poor tracking and a lack of repayment planning. In such cases, a loan tracker can help simplify this process for you.

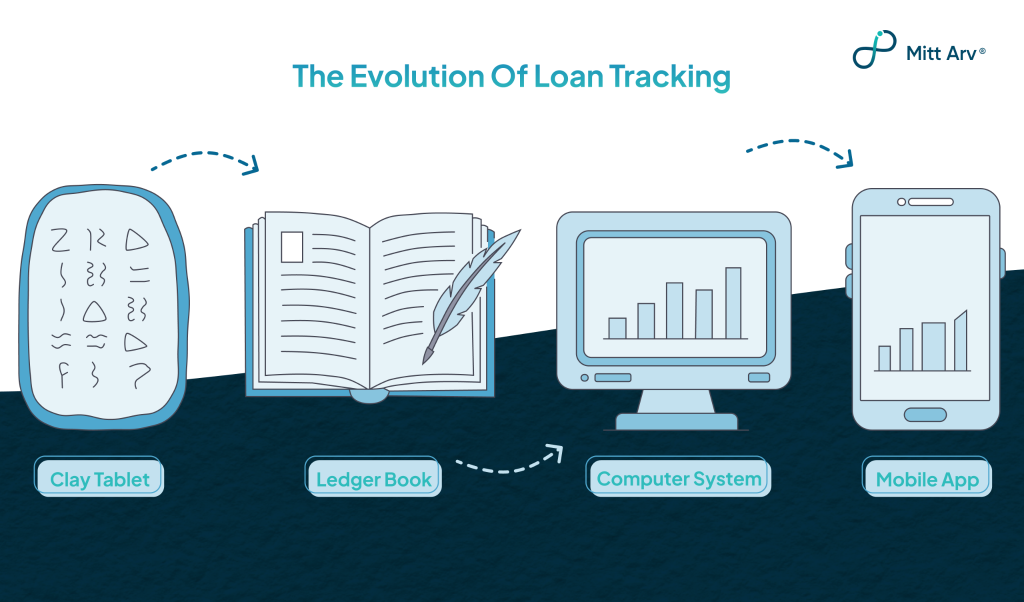

The Evolution of Loan Tracking

For as long as people have borrowed and lent money, they’ve needed a way to track it. The earliest loan records we are aware of were inscribed on clay tablets in ancient Mesopotamia around 3000 BCE. These tablets listed who owed what, by when, and under what conditions. Surprisingly, the core idea hasn’t changed much for thousands of years: record the loan, record the repayment, and hope nothing gets misplaced.

As the world modernised, so did the methods of tracking loans. Banks and credit unions in the 20th century replaced handwritten ledgers with early computer systems. But even then, most institutions kept parallel paper files because the technology wasn’t advanced or reliable enough on its own.

The Reserve Bank of India (RBI) reported that as of March 2024, total bank credit in India crossed ₹164 lakh crore, with retail loans alone growing at 18.8% year-on-year, driven largely by personal loans, housing loans, and credit card usage. According to RBI’s Financial Stability Report, India’s outstanding personal loan portfolio has expanded so rapidly that it nearly doubled in the last five years. But here’s the surprising part: even with such enormous lending volumes, many institutions still rely on loan tracking systems that feel stuck in the 1960s.

Banks handle trillions in transactions every year, yet their internal tracking tools often resemble old-school spreadsheets, disconnected databases, and processes dominated by manual work.

This creates a strange paradox: we live in the age of AI, blockchain, and instant global payments, yet many financial institutions, both globally and in India, still operate with systems designed for a slower, simpler world.

This gap is exactly why loan trackers are becoming essential today.

What Exactly Is a Loan Tracker?

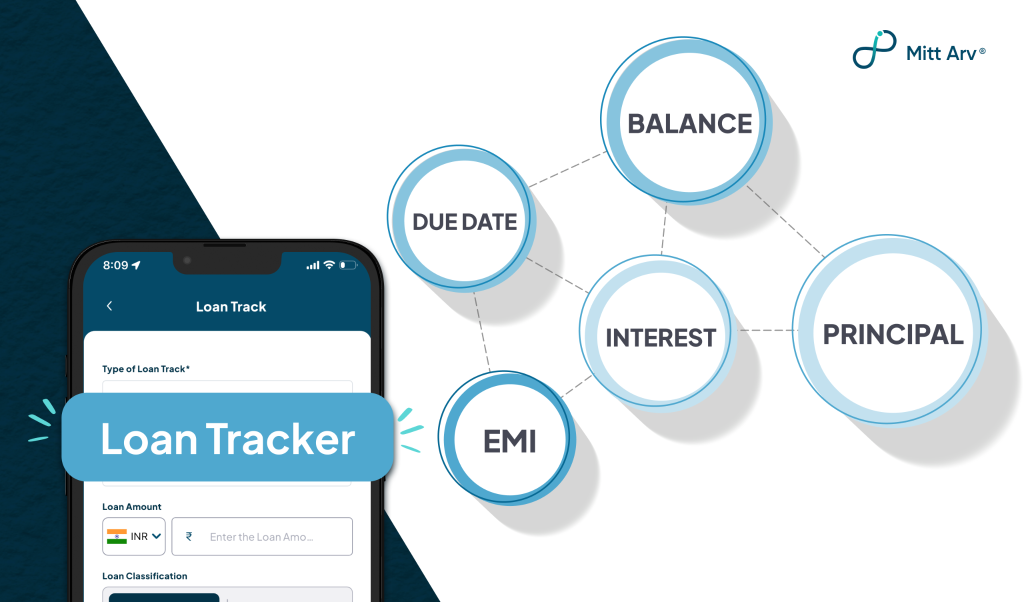

To overcome the limitations of old tracking systems, a loan tracker offers a modern and digital way to monitor loans, whether you’re borrowing or lending.

In the simplest terms, a loan tracker is a tool that helps you monitor and manage your loans, all in one place.

It gathers details like:

- Loan amount

- EMI amount

- Interest rate

- Repayment schedule

- Outstanding balance

- Payment history

and displays them in a clear, organised dashboard.

A loan tracker is equally useful for both borrowers and lenders.

If you’re a borrower, a loan tracker shows your total loan amount, upcoming EMIs, interest paid, and how much you still owe. It also reminds you before payments are due and stores all your loan documents safely in one place.

If you’re a lender, it helps you monitor the loans you’ve given, showing repayment timelines, interest earned, and any pending dues. You can easily track who has paid, who hasn’t, and how your overall lending is performing.

Benefits of Using a Loan Tracker

- One Place for Everything

A loan tracker brings all your borrowing and lending details into one clean dashboard. You no longer need to search through your emails, bank apps, WhatsApp messages, or diaries to remember who owes what; instead, you can just open the tracker and see everything instantly.

- Smarter Financial Planning

A loan tracker shows you your outstanding balance, how much interest you’ve paid, how much someone still owes you, upcoming payments, and closed loans. It removes uncertainty and gives you financial clarity at a glance.

- Reduced Financial Anxiety

Financial stress usually comes from not knowing where your money stands. A loan tracker removes guesswork and gives you control. The moment things are organized, your mind becomes calmer.

- Secure Storage of Documents

Sanction letters, loan agreements, and repayment receipts are all safely stored in one place. Thus, no fear of losing papers or scrambling for documents during emergencies.

- Helps Improve Your Credit Health

Timely reminders + better planning = fewer delays.

Fewer delays = stronger credit score.

A loan tracker indirectly helps you maintain a better credit profile, which results in lower interest rates in the future, higher loan eligibility and better financial credibility.

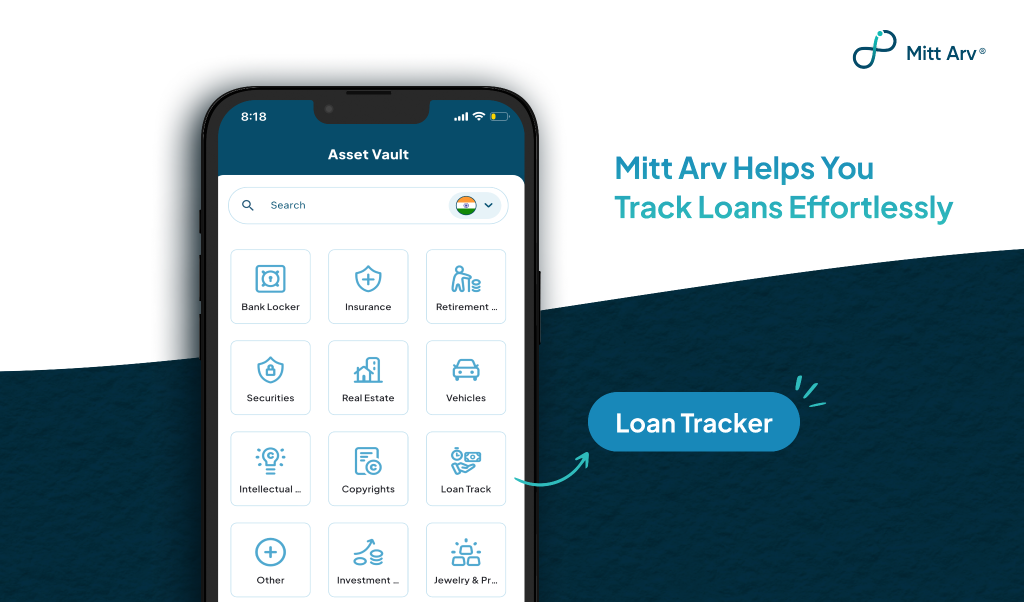

How Mitt Arv Helps You Track Loans Effortlessly

By now, it’s clear that loan tracking isn’t just about remembering EMIs, but it’s about gaining clarity, reducing stress, and staying financially prepared.

But the real question is: Where do you start?

Most people don’t have the time to build spreadsheets or manage multiple notes and reminders. And that’s exactly why Mitt Arv created a simple, smart, and secure Loan Tracker for everyday users in its Asset Vault feature.

Just like you store your properties, investments, insurance, and digital assets in the vault, loan tracking becomes an “asset class” of its own, a structured space where every borrowing and lending detail can be recorded, monitored, and accessed whenever you need it.

So…

At the end of the day, loans are a part of your life story. They tell the tale of bold decisions, important milestones, and dreams you invested in. And when you understand your liabilities as clearly as your assets, you unlock a new level of financial confidence.

Start organising your loans today with Mitt Arv!

FAQs

1. What is a loan tracker, and how does it work?

A loan tracker is a digital tool that helps you monitor all your loans in one place. It tracks your EMI due dates, outstanding balance, interest paid, and repayment schedule. A loan tracker also sends reminders and stores loan documents safely, making loan management simpler.

2. Why should I use a loan tracker to manage my EMIs?

Using a loan tracker helps you avoid missed EMIs, late fees, and repayment confusion. It keeps all your loan details organised, gives you reminders, and ensures you always know how much you owe and when payments are due.

3. Can a loan tracker help improve my credit score?

Yes. A loan tracker app sends timely reminders, helping you pay EMIs on time. Consistent repayments reduce delays and improve your credit score, which increases your future loan eligibility and lowers borrowing costs.

4. How is a loan tracker different from a manual spreadsheet?

A loan tracking system updates your loan progress automatically, sends reminders, stores documents securely, and reduces manual errors. A spreadsheet requires manual input and doesn’t notify you about upcoming payments.

5. How can Mitt Arv’s loan tracker help me?

Mitt Arv’s loan tracker, lets you add all your loans as an asset class. It helps you track EMIs, store documents, monitor lending and borrowing, and organise your financial life in one place.

6. Is my loan data secure with Mitt Arv?

Yes. Mitt Arv uses RSA-2048 encryption and secure servers to protect sensitive information like loan agreements, repayment history, and personal details.