Did you know that a recent survey by SBNRI, a FinTech platform, revealed that at least 60% of NRIs in countries like the U.S., U.K., Canada, Australia, and Singapore are considering returning to India after retirement? India’s improving infrastructure, affordable healthcare, and cultural familiarity make it an attractive destination for many.

For NRIs, retirement planning is not just about savings. It involves unique challenges such as navigating cross-border regulations, currency fluctuations, tax planning, and diverse investment opportunities. Let’s explore how NRIs can secure their retirement while avoiding common pitfalls such as underestimating living costs, not considering healthcare expenses, or not planning for currency exchange fluctuations.

Understanding Retirement Goals

Before beginning with financial planning, individuals should define their retirement vision. They must consider where they plan to retire—whether in India or a foreign country. The envisioned lifestyle, whether city living, a countryside retreat, or frequent international travel, plays an important role in shaping financial decisions. Estimated living costs, including housing, healthcare, taxes, and travel expenses, should be carefully evaluated. Additionally, those with dependents must factor in family obligations and inheritance planning to ensure a well-structured retirement strategy.

| 💡Did You Know? According to a survey by HSBC, nearly 59% of NRIs plan to retire in India but underestimate taxation and healthcare costs, so make sure you check and account for everything while planning for retirement. |

See Also: Top 10 Common Mistakes to Avoid While Retirement Planning

Choosing the Right Retirement Destination

Retiring in India

India is a preferred retirement destination for many NRIs due to lower living costs, familiar culture, and family ties. However, key factors to consider include taxation, healthcare facilities, the cost of living, and foreign exchange risks. While metro cities like Mumbai and Delhi have higher costs, smaller towns like Goa and Kerala offer more affordable lifestyles. Private healthcare in India is improving, but that doesn’t mean you can skip having insurance.

Retiring Abroad

Some NRIs prefer to retire abroad due to stable economies and high-quality healthcare. Visa and residency rules vary by country, and some, like Portugal and Canada, offer retirement visas for NRIs. Social security benefits also differ, and understanding taxation treaties between your resident country and India can help minimize tax liabilities.

Investment Strategies for NRIs

NRIs must build a diversified investment portfolio balancing safety, liquidity, and returns.

- Retirement Accounts

NRIs can utilize various retirement accounts based on their country of residence. In the US, 401(k) and Roth IRA (Roth Individual Retirement Account) options exist, whereas the UK offers a Self-Invested Personal Pension (SIPP). In Canada, the Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA) have their own tax implications. India also allows NRIs to invest in the National Pension Scheme (NPS) for long-term savings.

- Real Estate

Owning property in India provides a rental income stream but involves taxation. Renting instead of buying may be a more flexible option if you plan to retire abroad.

- Fixed Deposits

Fixed deposits like Foreign Currency Non-Resident (FCNR), Non-resident External (NRE), and Non-Resident Ordinary (NRO) accounts offer different tax benefits. FCNR deposits remain tax-free in India. Government bonds also provide secure investment opportunities.

- Equities & Mutual Funds

NRIs can invest in Indian stock markets through the Portfolio Investment Scheme (PIS). Mutual funds and Exchange-Traded Funds (ETFs) offer diversification, while systematic investment plans (SIPs) ensure long-term wealth accumulation.

Tax Planning for NRIs

Taxes play a very important role in retirement planning, and NRIs should be mindful of various tax regulations.

- Taxation on Global Income

India taxes NRIs only on income earned in India unless they become residents. However, NRIs may face the risk of double taxation, where the same income is taxed in both their resident country and India. Double Taxation Avoidance Agreements (DTAA) are international treaties that India has signed with many countries to prevent this. These agreements help prevent NRIs from being taxed twice on the same income, providing relief and ensuring fair taxation.

- Capital Gains Tax

NRIs selling property in India pay capital gains tax but can claim exemptions under Sections 54 and 54F. Equities also have long-term capital gains (LTCG) tax implications after ₹1 lakh exemption.

- Tax Efficiency Strategies

To optimize tax planning, NRIs should invest in tax-efficient retirement accounts in India and abroad and take advantage of DTAA benefits.

| 💡Did You Know? The DTAA between India and the US allows NRIs to claim tax credits, reducing their overall tax burden. |

Healthcare Planning for Retirement

Medical expenses are one of the biggest retirement concerns. NRIs should buy comprehensive health insurance in both their country of residence and India. Long-term care insurance is also essential for age-related illnesses. Government healthcare schemes like Ayushman Bharat provide coverage for eligible Indian residents. Make sure you plan for your healthcare while retirement planning.

| 💡Did You Know? Private health insurance in India costs significantly less than in Western countries, making it an attractive option for NRIs. |

Estate & Succession Planning

Proper estate planning ensures a smooth transfer of wealth and avoids legal hurdles.

- Writing a Will

NRIs with assets in multiple countries should draft separate wills complying with local laws. Clarity in property division and nomination details is crucial.

- Setting Up a Trust

Trusts help in wealth protection and tax efficiency for high-net-worth NRIs, avoiding probate delays and legal complexities.

- Power of Attorney (POA)

Assigning a trusted individual to manage Indian assets while residing abroad can be beneficial.

| 💡Did You Know? NRIs can register their wills in India to avoid disputes and legal challenges later. |

See Also: Will Update 101

Your Turn

Retirement is not the end of the road but the beginning of a new journey. By planning wisely, NRIs can ensure that their golden years are stress-free and financially secure.

The best time to start planning was yesterday; the next best time is now. Whether you dream of sipping chai by the Ganges or enjoying a seaside sunset in Portugal, your financial choices today will shape the retirement of your dreams. Take control of your future and embark on the path to a fulfilling retirement!

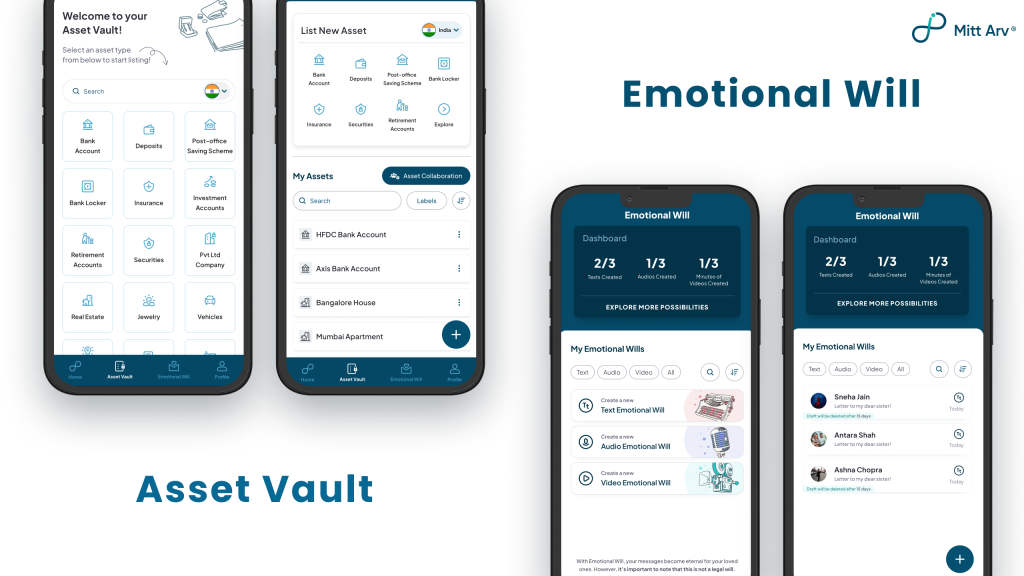

Planning for retirement can feel overwhelming, especially when you have numerous assets to manage. Our easy-to-use Asset Vault is designed to bring you peace of mind, helping you organize all your assets in one place and making retirement planning effortless.

Here’s how listing your assets with Mitt Arv makes life easier:

Comprehensive Asset Organization: From real estate to investments, insurance policies, and valuables—store every detail in one secure, easy-to-access digital vault.

- Time-Saving: No more scrambling to locate documents or critical details when needed. Your entire financial portfolio is just a few clicks away.

- Clarity & Control: Understand the full scope of your wealth and make informed decisions for a stress-free retirement.

- Family Peace of Mind: Ensure your loved ones can effortlessly access essential information, avoiding confusion during times of need.

With Mitt Arv, you’re not just organizing your assets but creating a clear path to a secure and worry-free retirement. Start with the first step today, list your assets and take control of your future!