You remembered to list your house, your bank accounts, even that plot of land in your hometown. But what about the company you built from scratch?

It started with an idea over chai. Then came the long nights, the first client, the government registration, and slowly, it became something real. Maybe it’s a growing startup. Maybe it’s your family’s bread and butter. But there it stands today: a company with your name on it.

Your work. Your legacy.

Now, imagine something happens to you suddenly.

Would your family know what to do with the company? Who’s supposed to take over? Would your business partner be left waiting for clarity? Would the business stall… or simply disappear?

It’s not a fun thought, but it’s a necessary one.

Because your company isn’t just a business. It’s an asset. One that deserves to be protected, just like everything else you leave behind.

Understanding Business Ownership Structures in India

Let us first understand the different ways people can own a business in India, and how those types affect who gets to run the business when the owner is no longer around.

1. Sole Proprietorship

This is the simplest kind of business. One person owns everything, and there’s no legal difference between the person and the business. If the owner passes away, the business usually stops, or the family may take over informally. But since it’s not a separate legal identity, there’s no formal process of passing it on.

2. Partnership Firm (Governed by the Indian Partnership Act, 1932)

This is when two or more people run a business together. It works based on a written agreement between the partners. If one partner dies, what happens next depends on the agreement. But because there’s no limited liability (meaning the partners are personally responsible for the business’s debts), it can be a bit tricky to transfer ownership smoothly.

3. Limited Liability Partnership (LLP) [Governed by the LLP Act, 2008]

An LLP is like a mix between a company and a partnership. The partners are not personally responsible for the business’s debts; that’s what “limited liability” means. It’s a separate legal identity, so the business doesn’t stop if a partner dies. But transferring a partner’s share still needs proper paperwork and legal steps.

4. One Person Company (OPC) [Introduced under the Companies Act, 2013]

This is a special type of company meant for solo entrepreneurs. You can run it alone, but you have to name a nominee, someone who can take over if anything happens to you. That makes planning easier and clearer.

5. Private Limited Company (Pvt Ltd) [Governed under the Companies Act, 2013]

This is where things get more complex. A Private Limited Company is completely separate from its owners (called shareholders) and the people who manage it (called directors). That’s great for business protection, but it also means your heirs won’t automatically get your share of the company if something happens to you.

This becomes even messier when non-family members, such as co-founders or investors, are involved. According to the Ministry of Corporate Affairs and various judicial pronouncements, succession of shares in a Private Limited company demands clear documentation, consent of the board, and often, probate of a will if shares are bequeathed.

Private Limited Companies: Common but Complex

Out of the five types of business ownership, Private Limited Companies are the most common choice for growing businesses, but they also come with the most rules and paperwork. From registration to annual filings and compliance, there’s a lot to take care of. That’s why many first-time founders find them a bit confusing.

Why are Private Limited Companies Complicated?

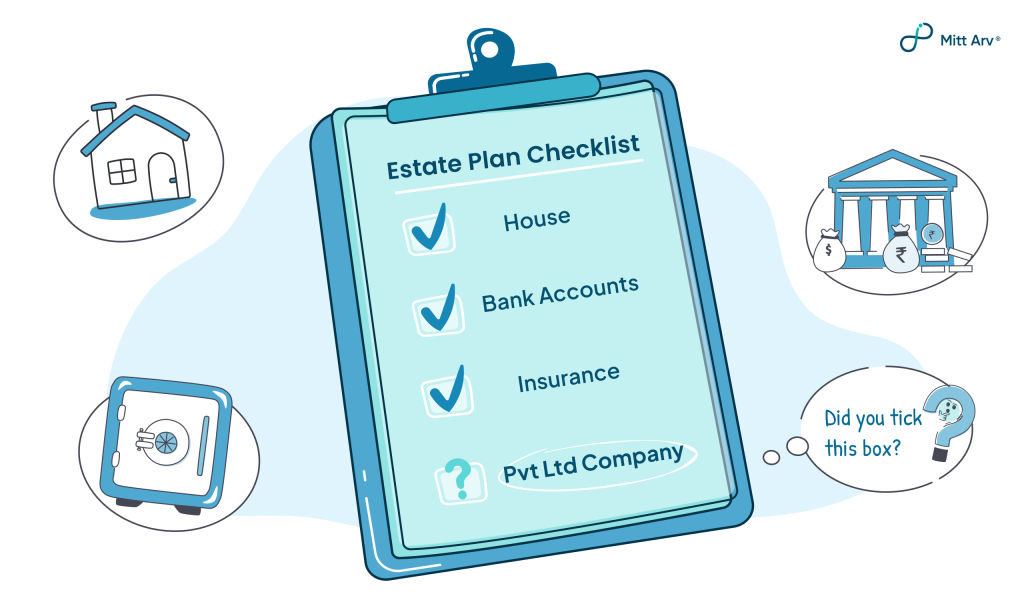

When most people create a will or estate plan, they check off the basics: house, bank accounts, life insurance. These are personal assets, and with the right documentation, they can pass to your heirs fairly smoothly.

But then there’s your Private Limited Company. It’s likely one of the most valuable things you’ve built, a business you’ve registered, nurtured, and think about every single day. And yet, it’s the one thing most often left out or misunderstood in estate planning.

Why? Because a Pvt Ltd Company doesn’t behave like a personal asset.

- It’s not just “yours”: Legally, you own shares in the company, not the company itself. Those shares don’t transfer automatically to your heirs.

- Shares in limbo: The Companies Act doesn’t allow for automatic transfer of shares to the next of kin without documentation.

- Power struggles: A co-founder assumes they’ll run the company. Your family believes they now control your share. Disputes arise.

- Director vs Shareholder confusion: Your heir may inherit your shares, but cannot run the company unless appointed as a director.

- Legal delays: Without clear estate documentation, your company’s operations may freeze for months, even years.

While your house or bank account is in your name and passes through your will, your company is a separate legal entity. Your personal will doesn’t automatically govern what happens to your business, especially your shares, voting rights, and directorships.

See Also: Step-by-Step Guide to Prepare a Will

Why Planning for a Private Limited Company is a Must?

Owning a Private Limited Company means managing several key documents and roles such as:

- Memorandum and Articles of Association (the company’s rulebook)

- Shareholder Agreements (agreements between the owners)

- Share Certificates (proof of who owns what)

- Board Resolutions and Director Appointments

These documents help the company run smoothly. But if your estate plan doesn’t match what’s written in these documents, it can create big problems.

Let’s say your will states that your daughter should inherit your shares, but your shareholder agreement stipulates otherwise or prohibits transfers to outsiders. In that case, your family could face a lengthy legal battle to obtain what you intended for them. Your business partners may also object, and the company might come to a standstill.

Things get even trickier when your co-founders aren’t family members. Without clear instructions, they may not know what you want, or worse, may not agree with it. This can lead to fights, confusion, or even harm the business you worked so hard to build.

Let’s face a tough question

What if something happened to you tomorrow?

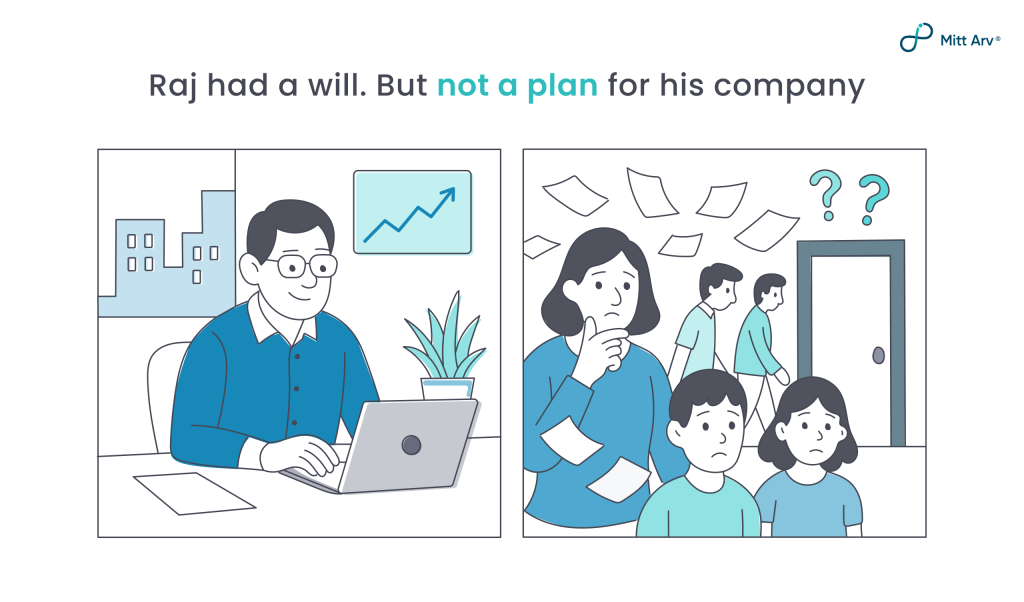

Think of a realistic scenario to see why planning is so important. For example, a founder of a small company, let’s call him Raj, who suddenly passes away. He had a will, but nowhere had he clearly recorded what should happen to his company. His wife doesn’t understand the shareholding rules. His son wasn’t even sure how much of the company his father owned. His co-founder assumed the family would take a backseat in the time of grief, but the family believed they had full rights. Within months, arguments began. The business suffered, and employees started leaving due to uncertainty.

In this kind of turmoil, the value of the business can drop quickly. Studies have found that a founder’s sudden death can seriously hurt a company’s performance – sales can drop, and the company’s survival is put at risk.

In the worst-case scenario, the company might have to shut down entirely because nobody has the legal authority or knowledge to keep it running. This is a nightmare situation for any business owner, your hard work could unravel simply because there was no clear plan. Even if you’ve done everything right in life, this one blind spot can undo it all.

- Your business can lose value.

- Your family can be pushed into legal battles.

- Your legacy can fade into uncertainty.

This fear is a wake-up call. It’s not meant to scare you without reason, but to show how important it is to plan ahead. It’s much better to address these “what-ifs” while you can, rather than leaving it to chance.

Leave No Loose Ends: Let Mitt Arv Handle It

Planning for these scenarios might sound overwhelming, especially if you’re not familiar with estate planning. That’s where Mitt Arv comes in.

Mitt Arv is a friendly, secure platform built to make end-of-life planning simple and stress-free. In fact, Mitt Arv literally means “My Legacy” in Swedish, and its mission is to ensure no family is left dealing with chaos when a loved one passes.

And as rightly said by Vishal Mehta, founder of Mitt Arv, “Building a company, even though it can be done as a proprietorship, is a sign of creating something lasting. Long lasting. And often, especially in the Indian businesses, long lasting means transferring the legacy to next of kin. And the best way to do that? Keep them informed. It takes less than 15 minutes”.

What can Mitt Arv do for you?

So, what can Mitt Arv do for you and your Pvt Ltd company?

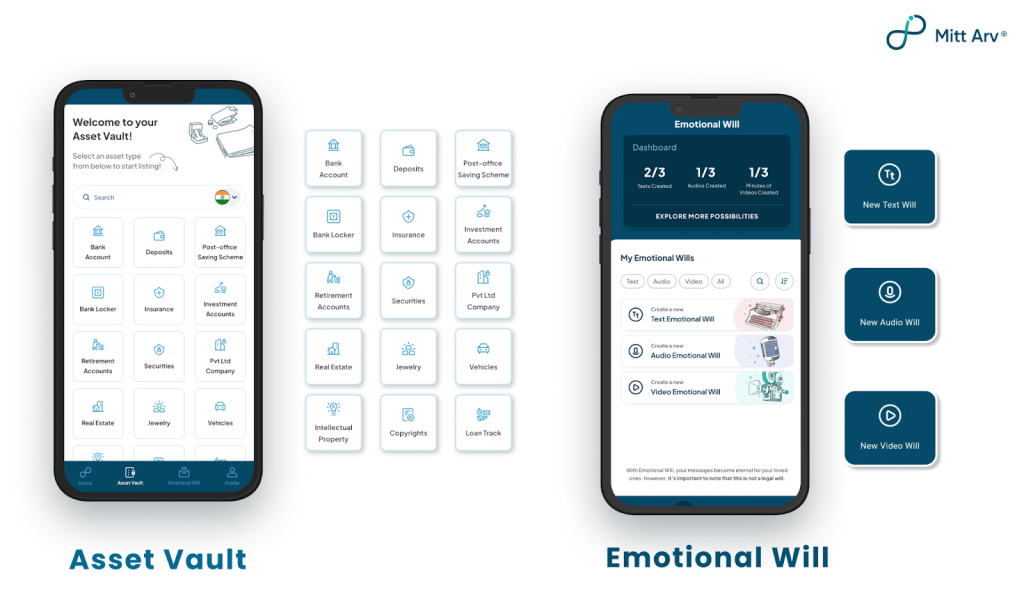

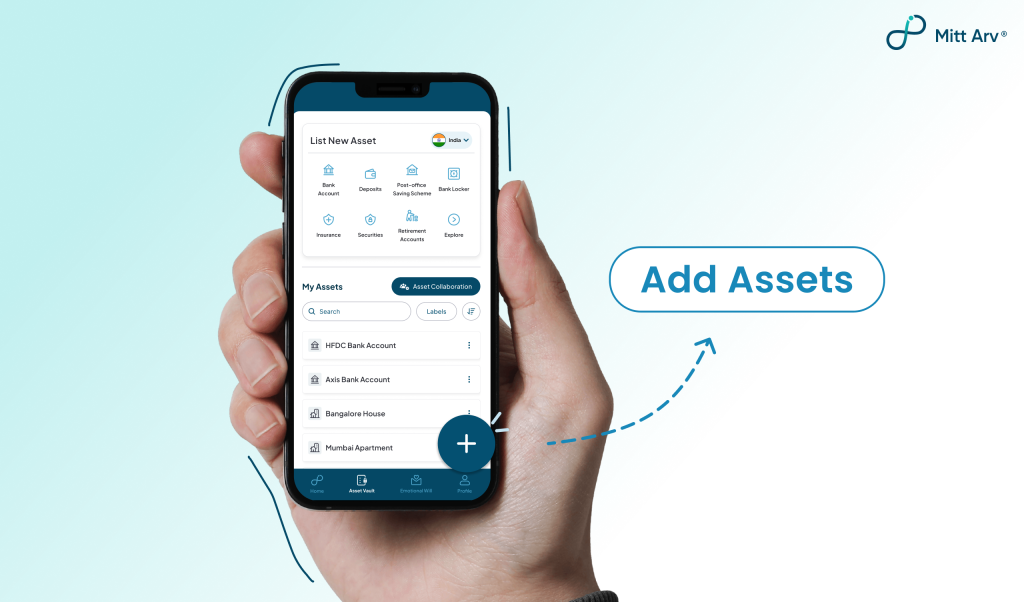

- Asset Vault: Mitt Arv’s major product, Asset Vault, is a secure digital vault where you can list all your asset details, from bank accounts to properties to your company shares, in one organized place.

Instead of keeping your share certificates in a file cabinet or an Excel sheet that only you know about, you can record the details in the app. This vault centralizes everything, so nothing gets forgotten.

- Add Trusted Contacts and Share Information: Mitt Arv lets you designate who should be notified about the assets you own at the delivery time you choose. These designated contacts are your trusted contacts. You can share this information in real-time with that person or keep it hidden until the appropriate time.

The app’s collaboration features even allow you to share asset info with trusted family members or advisors at different permission levels.

- Timely Handover, No Delays: Mitt Arv ensures your information reaches your loved ones when it matters most. With smart check-ins with your trusted contacts, the app can deliver your asset details posthumously or when you are terminally ill, so that your assets don’t go unnoticed and ensure they’re acted on exactly when needed.

For those who want to take their planning a step further, Mitt Arv Premium offers advanced features designed to give you even more control, clarity, and comfort.

With Mitt Arv Premium, you can:

- Store multiple country assets in one place, so nothing gets overlooked in your estate plan

- Upload unlimited documents per asset, making it perfect for storing certificates, agreements, or notes for your assets

- Create unlimited collaboration groups, so you can work with co-founders, advisors, and family members as needed

- Choose from 2 GB to 20 GB of secure storage, depending on your needs

Final Thoughts

You don’t need to do it all at once. Just start by recording one asset detail at a time in the Mitt Arv Asset Vault. Upload the relevant document. Add someone you trust.

It’s a small action, but it could make a world of difference someday.

Because your legacy shouldn’t be left to chance.

It should be passed on with clarity, compassion, and care.