Post Office Saving Schemes are government-backed savings plans offered by India Post. They are known for their safety, steady returns, and affordability, making them popular among Indians for building savings. As of 2025, many of these schemes offer attractive interest rates, some above 8% per annum.

India Post offers a variety of saving schemes to cater to different needs, from basic savings accounts to long-term investment plans for retirement or children’s future. All these schemes carry the sovereign guarantee of the Government of India, which means your money is secure.

In this blog, we’ll walk you through the key post office saving schemes – their current interest rates, how they work, who can invest, limits, and tax benefits.

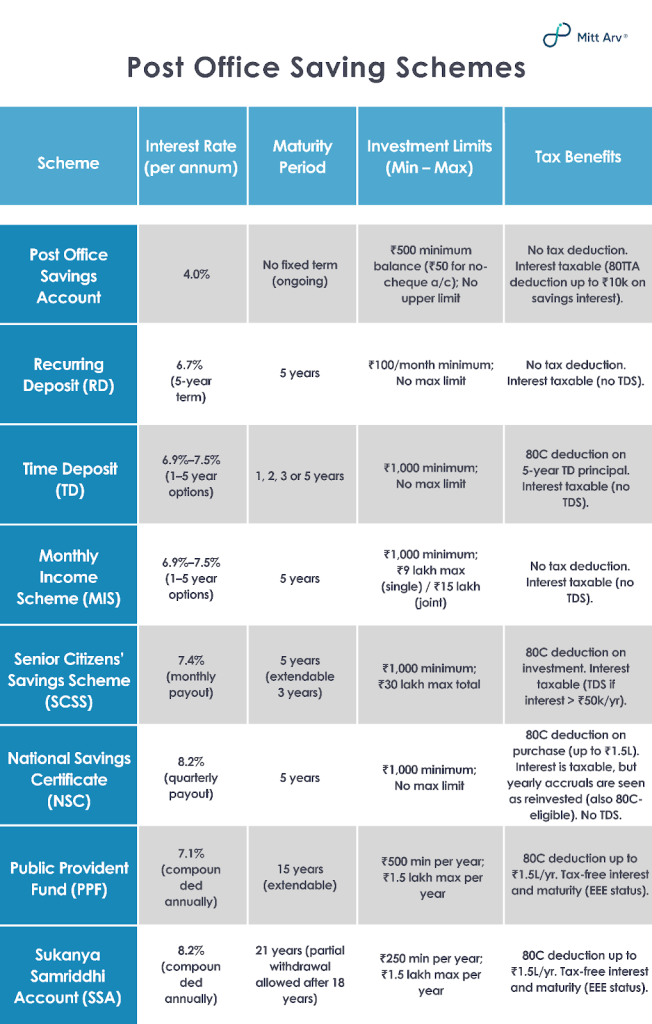

Major Post Office Saving Schemes

Below are some of the major Post Office saving schemes, along with their key features available in 2025.

- Post Office Savings Account (SB)

A Post Office Savings Account works like a regular bank savings account but is held with the post office. It’s simple to open, maintain, and ideal for everyday savings.

- Interest Rate: 4% p.a., credited annually; fully taxable.

- Section 80TTA: Interest up to ₹10,000 is tax-deductible (non-senior citizens).

- Accessibility: Available for individuals, joint holders, and minors (with guardian).

- Account Limits: One account per person per post office; transferable between post offices.

- Minimum Balance: ₹500 required; ₹50 penalty if not maintained; account closes if balance hits zero.

- Withdrawals: Minimum ₹50.

- National Savings Recurring Deposit Account (RD)

A 5-year savings scheme to build a lump sum through disciplined monthly deposits.

- Interest Rate: 6.7% p.a., compounded quarterly and fixed at account opening.

- Deposits: Start with ₹100/month (multiples of ₹10); no upper limit.

- Returns: ₹10,000/month for 5 years yields ~₹11.36 lakh at 6.7%.

- Account Types: Single, joint (up to 2 adults), or minor (10+ years or via guardian).

- Multiple Accounts: You can open more than one RD.

- Tax: No tax deduction on deposits; interest is taxable (no TDS—self-reporting required).

- National Savings Time Deposit Account(TD)

A government-backed fixed deposit scheme offering guaranteed returns for 1 to 5 years.

- Tenure Options: 1, 2, 3, or 5 years, you choose based on your needs.

- Interest Rates (2025):

- 1 year – 6.9%

- 2 years – 7.0%

- 3 years – 7.1%

- 5 years – 7.5%

(Interest is compounded annually; paid at maturity or yearly for 5-year TDs)

- Investment: Minimum ₹1,000; no upper limit (in multiples of ₹100).

- Multiple Accounts: Open more than one TD for different terms if needed.

- Tax Benefits:

- 5-year TD qualifies for Section 80C deduction (up to ₹1.5 lakh).

- Interest earned is taxable; no TDS deducted.

- Report in ITR

- National Savings Monthly Income Account(MIS)

A popular choice for those seeking fixed monthly income with capital safety.

- Interest Rate: 7.4% p.a., paid monthly

- Tenure: 5 years

(e.g., ₹2,00,000 investment gives ~₹1,233/month for 5 years; principal returned at maturity) - Investment Limits:

- Minimum: ₹1,000 (in multiples of ₹1,000)

- Maximum (Single Account): ₹9 lakh

- Maximum (Joint Account): ₹15 lakh (shared among joint holders)

(Limits are per individual across all MIS accounts)

- Who Can Invest:

- Individuals (single or joint—up to 3 adults)

- Minors (10+ years or via guardian)

- Premature Withdrawal:

- Allowed after 1 year with penalties:

- 2% deduction (if closed between 1–3 years)

- 1% deduction (if closed after 3 years)

- Allowed after 1 year with penalties:

- Tax Treatment:

- No tax deduction on investment

- Monthly interest is fully taxable (no TDS; self-report in ITR)

- Senior Citizens Savings Scheme Account(SCSS)

A secure investment option offering high interest and regular income for seniors.

- Eligibility:

- Individuals aged 60+

- Retirees aged 55+ (or 50+ for defence) within 1 month of receiving retirement benefits

- Interest Rate:

- 8.2% per annum, paid quarterly

- Tenure: 5 years, extendable by 3 more years

- Investment Limits:

- Minimum: ₹1,000 (multiples of ₹1,000)

- Maximum: ₹30 lakh across all SCSS accounts

- Can be held individually or jointly with spouse

- Tax Benefits:

- Deposits eligible for Section 80C deduction (up to ₹1.5 lakh/year)

- Interest is taxable

- TDS applies if annual interest exceeds ₹50,000 (under Section 194A)

- Nomination:

- Nominee can be added at opening or anytime for smooth fund transfer upon death

- Public Provident Fund Account(PPF )

A long-term, government-backed savings scheme offering tax-free returns and compound growth over 15 years.

- Interest Rate:

- 7.1% p.a., compounded annually (subject to quarterly revision by the government)

- Tenure:

- 15-year lock-in, extendable in 5-year blocks

- Partial withdrawals allowed from year 7

- Loan facility available from year 3 to year 6

- Contributions:

- Min: ₹500/year Max: ₹1.5 lakh/year

- Up to 12 deposits allowed per financial year

- Tax Benefits (EEE Status):

- Exempt-Exempt-Exempt

- Contributions eligible for Section 80C deduction (up to ₹1.5 lakh/year)

- Interest earned and maturity proceeds are fully tax-free

- Exempt-Exempt-Exempt

- Who Can Invest:

- Indian residents (one account per person)

- Minors (via guardian) – combined ₹1.5 lakh annual limit for parent + child

- NRIs cannot open new accounts, but existing ones can continue till maturity

- Safety:

- Fully backed by the Government of India – safe and ideal for retirement planning

- Sukanya Samriddhi Account(SSA)

A high-interest, tax-free savings scheme designed to secure your girl child’s education and marriage expenses.

- Who Can Open:

- Parents or legal guardians for a girl child below 10 years

- One account per girl, max two accounts per family (exceptions for twins/triplets)

- Interest Rate:

- 8.2% p.a., compounded annually (reviewed quarterly by the government)

- Contributions:

- Min: ₹250/year Max: ₹1.5 lakh/year

- Deposits allowed for 15 years from account opening

- After that, it continues to earn interest till maturity

- Tenure & Withdrawal:

- Matures 21 years from opening

- Partial withdrawal (up to 50%) allowed at 18 years for education/marriage

- Account closes earlier if the girl marries after 18

- Tax Benefits (EEE Status):

- Contributions up to ₹1.5 lakh eligible under Section 80C

- Interest and maturity amount are fully tax-free

- National Savings Certificates (VIIIth Issue) (NSC)

A government-backed, tax-saving instrument that offers guaranteed returns with compounding benefits.

- Interest Rate:

- 7.7% p.a., compounded annually

- No interim payouts—principal + interest paid at maturity (5 years)

- Investment Limits:

- Minimum: ₹1,000

- No maximum limit (but only up to ₹1.5 lakh/year qualifies for tax deduction under Section 80C)

- Tax Benefits:

- Section 80C deduction on initial investment (up to ₹1.5 lakh/year)

- Accrued interest for the first 4 years is treated as reinvested—also eligible under 80C

- Final year’s interest is taxable (no further deduction applicable)

- No TDS on maturity; interest must be self-declared in ITR

- Who Can Invest:

- Any Indian resident (individual or minor via guardian)

- Joint holding allowed (up to 3 adults)

- Maturity & Liquidity:

- Lock-in period: 5 years

- Premature withdrawal only in exceptional cases (e.g., death of holder, court order)

Summing up

Why It’s Important to Record This Asset

Investing your money is only half the job; the other half is keeping track of those investments. Post office schemes often involve physical documents like passbooks, certificates, or account statements. It’s extremely important to record these assets in your personal financial records.

- Effective Financial Planning: Clearly tracking investments ensures awareness of maturity dates, earned interest, and alignment with financial goals (e.g., education fees, major purchases).

- Prevents Lost or Forgotten Savings: Regularly updating a simple record avoids investments slipping through the cracks or becoming unclaimed due to misplaced documents or forgotten details.

- Simplifies Legacy Management: Documenting investments helps family members easily locate and claim assets, reducing their stress during difficult times.

- Provides Peace of Mind: Maintaining an updated financial record eliminates guesswork, keeping details accessible and easing daily financial management.

Why You Must Appoint a Beneficiary

When you fill out the paperwork for any post office scheme, you’ll notice a section asking for a nominee or beneficiary. This person will receive the proceeds in case the account holder (you) is no more. Appointing a beneficiary (nomination) is very important.

- Smooth Transfer of Funds:

Having a nominee simplifies and speeds up the transfer of money to your loved ones after your passing, avoiding lengthy and costly legal procedures. - Prevents Family Disputes:

Clearly appointing a beneficiary helps prevent disagreements among family members over claims, reducing emotional stress and conflict. - Essential for Joint Accounts:

Even for joint accounts, having a nominee ensures clear handling if all account holders pass away, providing additional security. - Regularly Update Nominations:

Ensure your nominations reflect life changes (marriage, childbirth, etc.) to avoid confusion, outdated records, or difficulties during claim settlement.

Avoid the Fear of Unclaimed Wealth with Mitt Arv

Unclaimed assets in India exceed ₹2,00,000 crore, growing yearly by 15-20%, often due to lost paperwork, outdated nominations, or lack of family awareness. To ensure your hard-earned savings never become part of this statistic:

- Clearly record all your financial assets and regularly update nominees.

- Prevent family disputes and simplify transfers by maintaining accessible records.

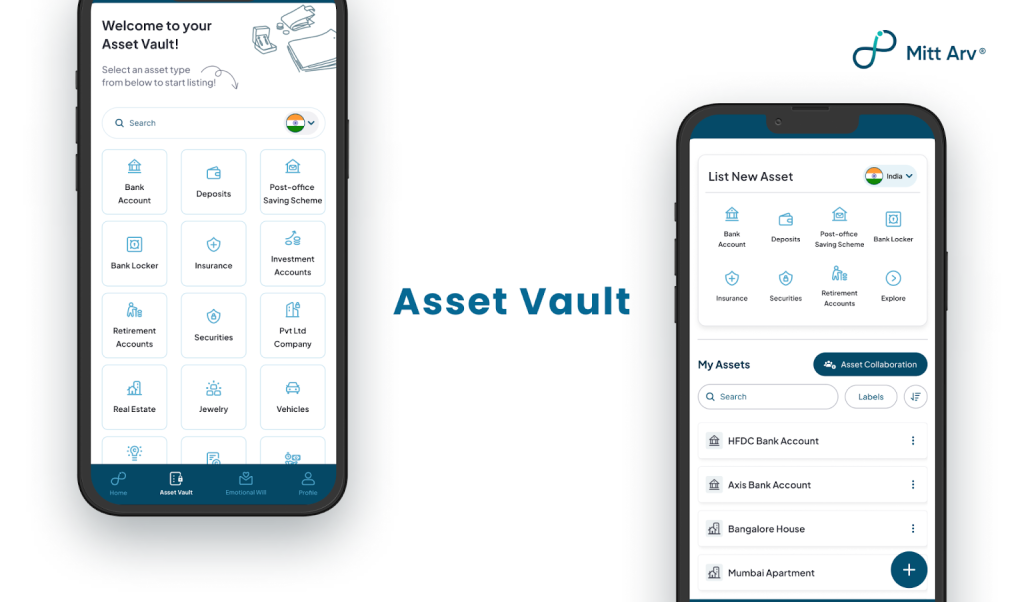

Mitt Arv offers a practical and intuitive solution to these challenges through its product Asset Vault, a secure digital platform that lets you easily store and manage details of all your financial assets, including bank accounts, insurance policies, and post office investments. This ensures your family can effortlessly locate essential financial information when required.

Read Also: 4 Challenges to Tackle for a Stress-Free Future with Asset Vault

Ready to secure your legacy?

We encourage you to take that next step. Whether you’re just starting with a small RD or have multiple accounts and investments, begin recording and organising them today.

Download Mitt Arv and try out the Asset Vault to safely note your post office scheme details (and all other assets). Planning ahead ensures that your love and legacy live on without chaos.

So start now, record your assets with Mitt Arv today, and gain the peace of mind that comes from truly securing your family’s future.