Every home, every plot, every corner of land you own carries a part of your journey, your hard work, your dreams, and your family’s memories. It might represent your family’s largest asset.

Yet many owners assume it will “naturally” pass to their heirs without ever mentioning it in a will.

The result? Property disputes crowd India’s courts. Families fighting over property titles. Apartments sitting locked for decades, village homes crumble while cousins trade legal notices, and crores of rupees in land value lie frozen because the owner never wrote, “Who gets what?”

Read this blog to learn why clearly documenting real estate in the will is important.

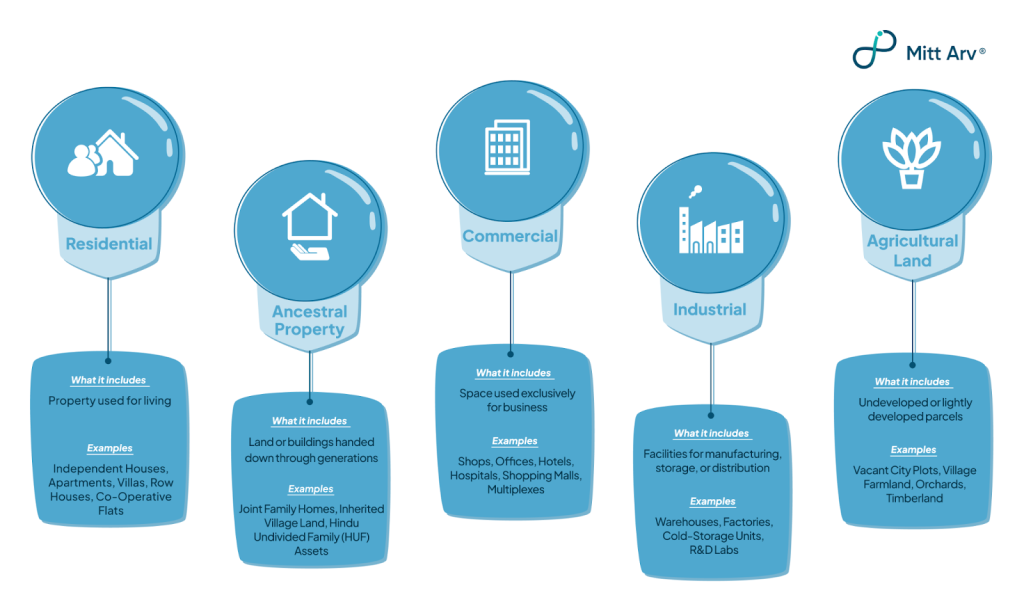

What is Real Estate?

Real estate refers to the land itself plus anything permanently attached to it, natural or man-made. That means the soil and minerals below, the airspace above, and all “improvements” such as houses, office blocks, roads, utilities, or even a simple boundary wall. Unlike cars or furniture (classified as personal property), these attachments are immovable and therefore part of what the law calls real property.

Common Types of Real Estate Assets in India

Most people hear “real estate” and immediately picture a house or an apartment, but it covers more than that. The common types of property that Indian families own and should account for in their estate plans:

Each of these property types has financial worth and often sentimental value too. Failing to clearly specify who should inherit them can create many issues. No matter the type, from a city flat to ancestral farmland, listing every property you own in your will is important. In the next part, you will find out why this matters so much and how you can protect your family from the confusion and chaos.

4 Reasons to Definitely Cover Real Estate in Your Will

This is why you must mention every piece of property you own in your will or estate plan:

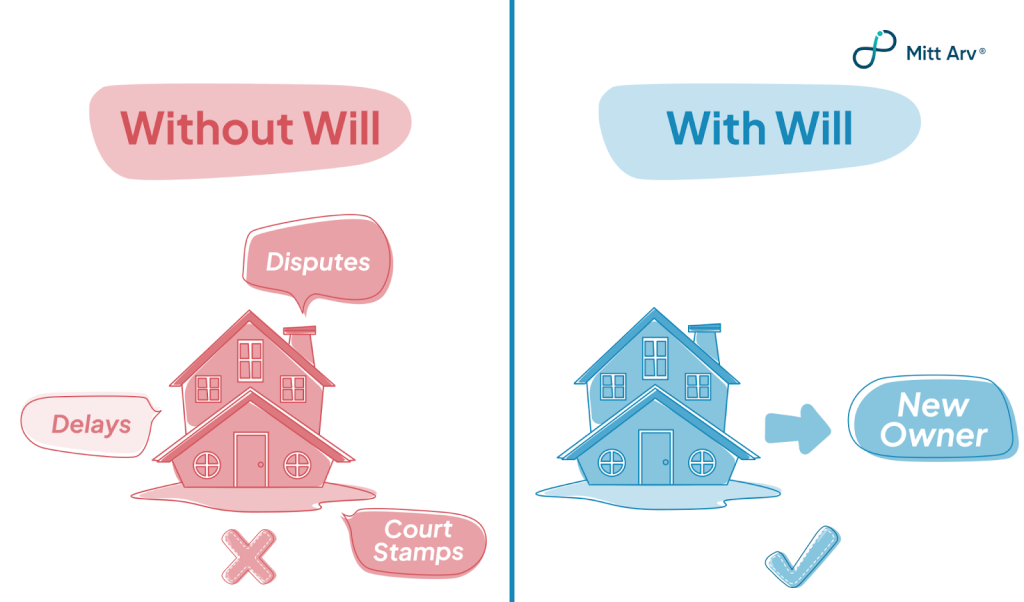

- To Prevent Family Disputes and Maintain Harmony: Property can, unfortunately, become a source of bitter family fights. Clearly stating who gets which property (or what share) in your will helps avoid confusion.

A properly drafted will helps prevent family disputes and ensures a smooth transfer of your property to the rightful heirs. When everyone knows your wishes, there’s less room for quarrels.

Did you know?

In India, half of wealthy families say inheritance is a burden, and a surprising 61 % have already fought over family wealth the highest conflict rate in the world.

- To Ensure Legal Clarity and Easy Transfer: Without a will, the distribution defaults to India’s succession laws, which may split your property among relatives in a way you never intended. Your family may face months or years of delays to get legal ownership. A will provides clarity, allowing ownership to be transferred quickly and according to your wishes.

- To Avoid Lengthy Court Battles: Property disputes are one of the biggest burdens on Indian courts, making up about 66% of civil cases. If you properly specify your real estate wishes in your will, you save your family from becoming part of this statistic. They won’t have to spend time, money, and peace of mind fighting legal battles.

- To Protect Your Legacy: Real estate is often the most valuable asset in an estate. It could also be tied to your legacy (an ancestral home, for example). Including it in your will ensures that your legacy is preserved as you want. You can ensure an ancestral home stays in the family or land remains intact for future generations, instead of being sold or misused against your wishes.

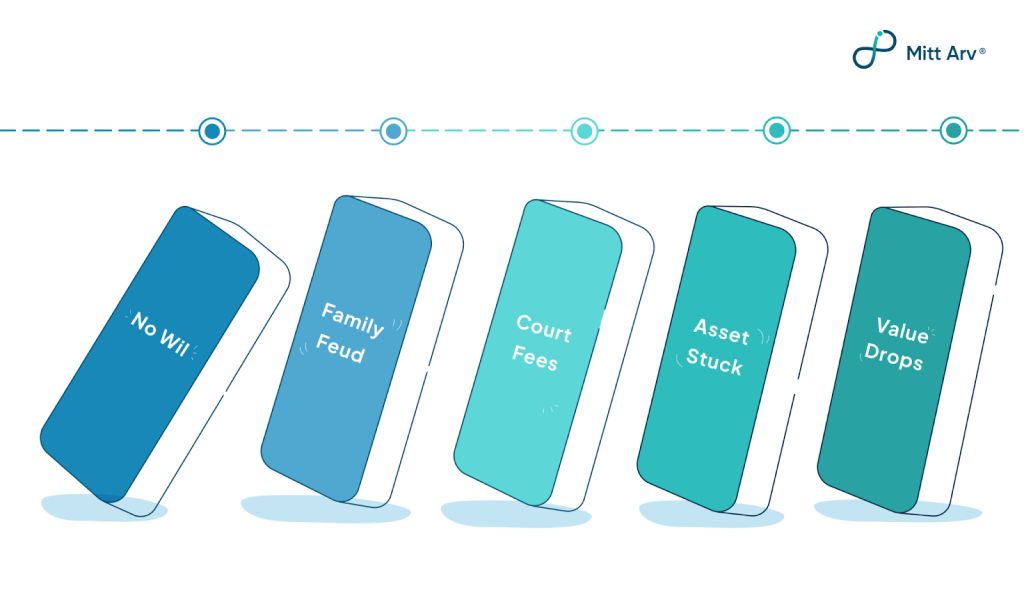

What happens if you forget (or choose not) to include your house, land, or other property in your will? Unfortunately, there can be serious consequences.

Consequences of Forgetting to Include Real Estate in Your Will

Take the Ambani brothers, for instance. When Dhirubhai Ambani died without a will in 2002, it caused a bitter legal battle between his sons over the family empire, a feud that could’ve been avoided with clear instructions.

Another example is that of Mary Roy, who had to fight her brother in court for nearly 39 years to claim her share of her father’s property. He died without a will, and the legal battle only ended after decades of stress and a landmark judgment for women’s inheritance rights.

Most families don’t have the resources or patience for such long battles. Even loving siblings can fall apart when inheritance isn’t clearly spelled out.

Here’s something many don’t know!

If someone dies without a will or legal heirs, their property can be taken over by the government under the doctrine of escheat. In Goa, nearly 60 such properties are already on record and may soon become state-owned.

Why risk everything you’ve built over the years being lost or fought over? Writing a will is the simplest way to avoid all this.

Planning Your Real Estate Legacy

Even with a will in place, people often forget to include certain assets, like a small plot, a jointly held flat, or ancestral land. These gaps can still lead to confusion and family disagreements. That’s where a solution like Mitt Arv helps, making it easier to list everything you own and ensure nothing is left out.

Mitt Arv is a platform that makes the whole process of end-of-life planning simple and convenient. It offers two key features that can be incredibly helpful:

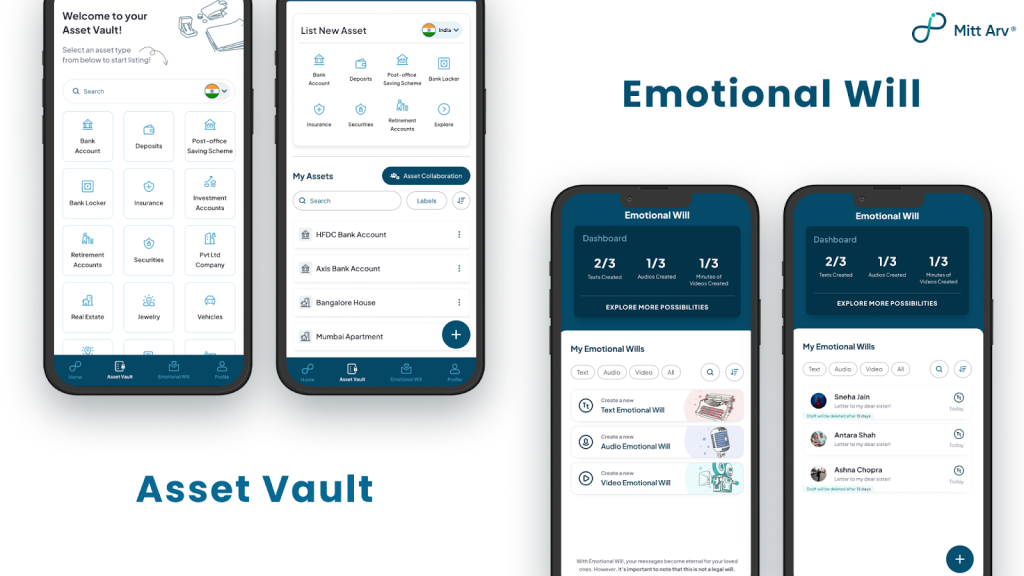

- Asset Vault: This is a secure digital vault for all your asset information, including your real estate. You can list all the properties you own, along with relevant details (like documents, locations, etc.), in one organized place.

This means if something happens to you, your loved ones won’t be scrambling to figure out “what you owned” or “where the papers are.” Mitt Arv’s Asset Vault keeps everything documented and accessible at the right time, ensuring nothing is forgotten or left unclaimed.

- Emotional Will: Mitt Arv’s Emotional Will feature lets you leave heartfelt messages for your loved ones in text, audio, or video form. You can record a video message for your family, write a loving letter, or even leave instructions – all to be delivered after you’re gone or when you are terminally ill.

It’s a beautiful complement to the legal will, as it takes care of the emotional legacy while your written will takes care of the financial and real estate legacy.

In the End

Put every property you own in your will. When you state clearly who gets the house, the flat, or the family land, your loved ones avoid fights and costly delays. The easiest way is to list each place, decide who should inherit it, and write that into a will. Start by listing every asset on the Mitt Arv app, then outline who inherits what with a lawyer and ensure nothing is left unaccounted for.

Don’t wait for a “better time” to plan; life is uncertain, and early action brings lasting peace of mind. Make real estate part of your will today, and turn your property into a source of security, not stress.

Ready to protect your family’s future?

Begin your end-of-life plan with Mitt Arv and secure your legacy now.