Bank accounts are among the most common assets we possess. Starting at the age of 13 -15 years and continuing until retirement, we frequently open multiple bank accounts. Each move to a new city or country often necessitates the opening of another account, along with the challenge of managing them effectively.

You might have different bank accounts linked to various financial needs, such as insurance schemes, shareholdings, or savings. While you may remember the details of all your accounts now, it is not guaranteed that you will retain this information for life.

For example, in the event of memory loss, you could forget important details like account numbers, nominee names, beneficiaries etc. This oversight could result in your funds becoming unutilized or unclaimed. For example, insurance benefits intended to support you and your family in times of need might go unclaimed if you are unaware of the accounts that you hold.

To prevent such issues, consolidate all your bank account information in one place. This helps you track your finances and ensures your loved ones can access funds when needed.

Use a single platform to consolidate your financial information, eliminating the need for multiple tools. This ensures your data is always accessible, especially during emergencies.

You can try using our “Asset Vault”

It helps you to list and share your assets with your loved ones in real-time, offering awareness and guidance when it’s needed the most. Streamline the listing and storage of valuable assets, properties, and essential documents in a single, user-friendly platform.

Steps to Follow When Listing a Bank Account as an Asset:

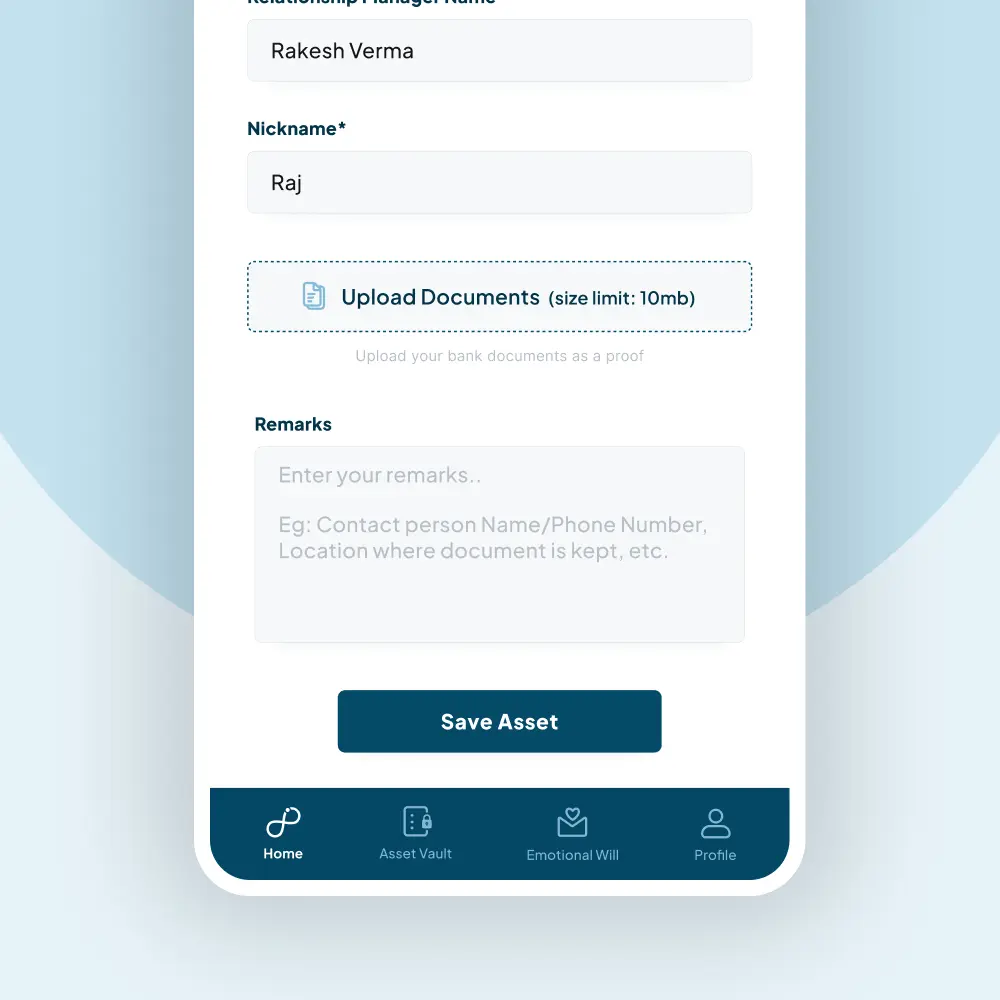

Below, you will find step-by-step instructions on how to list your bank account in Asset Vault.

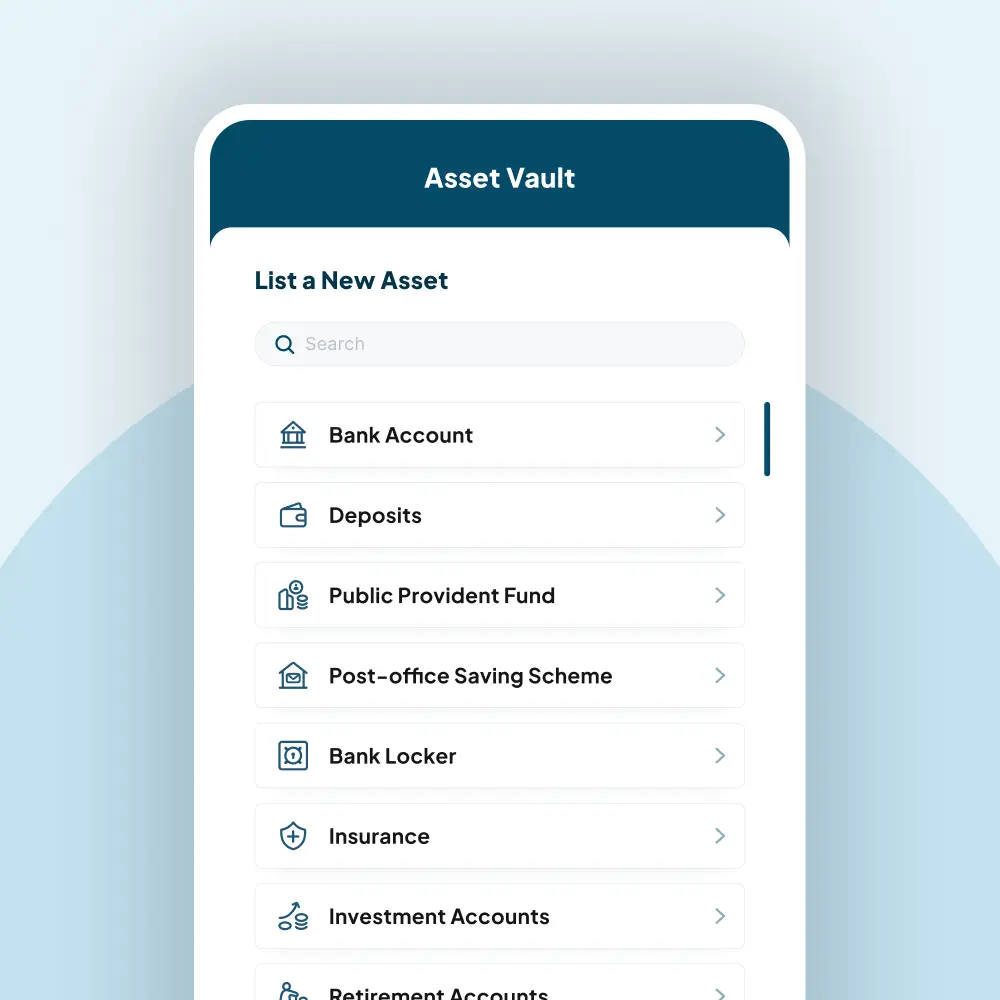

1. When you download the “Mitt Arv” app from Play Store or App Store and sign in, click on “List a new Asset”. Then, choose “Bank Account”. Alternatively, you can tap on the “Asset Vault” icon at the bottom and then select “Bank Account” to list a new asset.

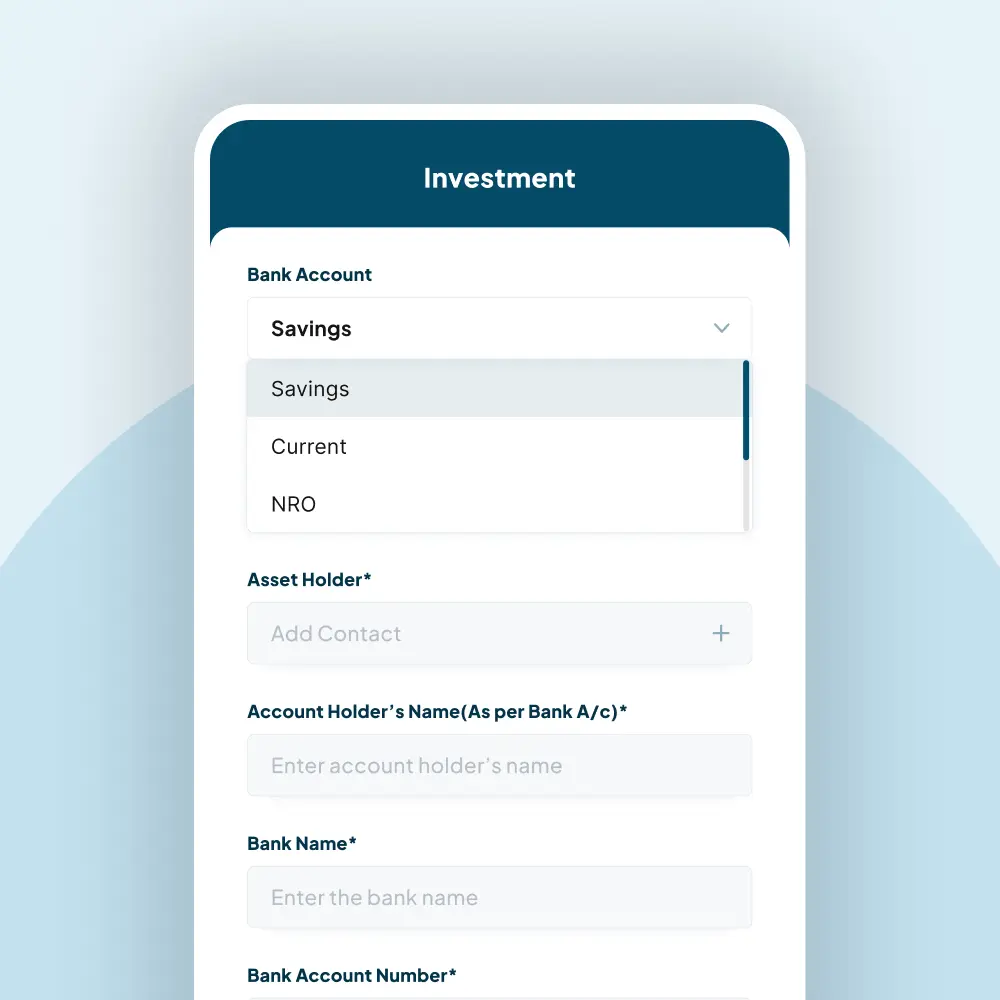

2. Select from the different types of bank accounts that are available.

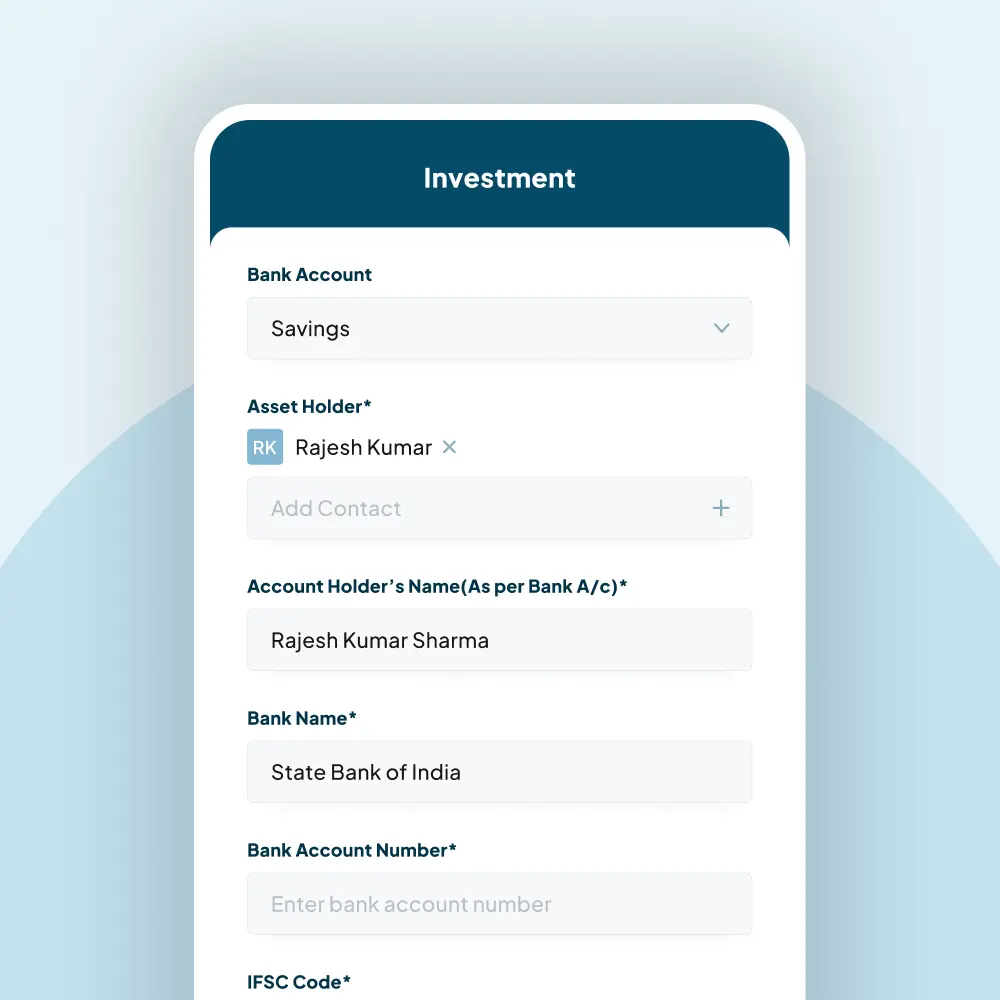

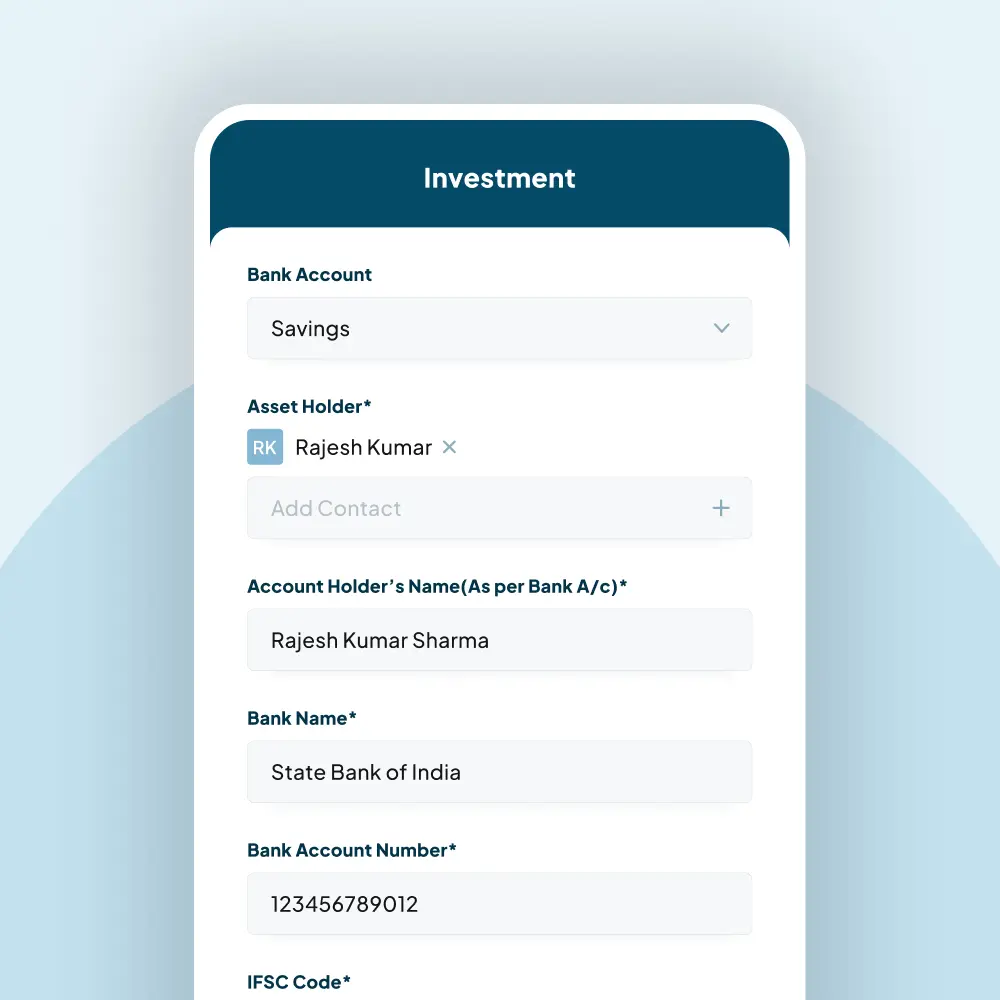

3 . Add all the essential details, like the Account Holder’s name, Bank Name, Bank Account Number, IFSC code, Nominee Name, etc.

4. Make sure to review all the information before saving it to make sure no incorrect information has been added.

5. And Voila, your asset is saved! Also, using the Asset Vault’s Collaboration feature, you can create a COLLABORATION GROUP, manage member permissions, and exchange detailed asset information within a centralized space accessible to all group members. So, if someone doesn’t have the time to do a listing of their assets, you can do that for them!

Ensure the financial security of your loved ones by keeping your finances organized and sharing important financial details with them so they can easily find important documents when needed most.

Download Mitt Arv and leave a lasting legacy for your loved ones to cherish forever. That’s the best way to make them feel at ease, even after you.

Sign up for free and start legacy planning with Mitt Arv today.

Available on Android, iOS & Web.

FAQs

1. Why Should I Consolidate My Bank Account Information in One Place?

Consolidating your bank account information helps you keep track of all your financial assets in one central location. This simplifies financial planning, ensures you don’t lose track of accounts, and makes it easier for your loved ones to access important information during emergencies.

2. How Can I Ensure the Security of My Bank Account Details in Asset Vault?

Our app is fully secure.

Encryption at rest as well as in transit keeps your data safe from unauthorized access. Data at rest is stored on the Azure Cloud using RSA 2048-bit encryption. During transit, it is encrypted using the RSA-2048 bit and Transport layer encryption.

For strong security, we have an OTP-based login or a Single Sign-On.

At Mitt Arv, it’s all about your control. We don’t collect any data without your consent.

If you’d like to know more about trust & security, watch this video (Link).

3. Can I Update or Delete My Listed Assets in Asset Vault?

Yes, you can easily update, delete, or edit your listed assets in Asset Vault at any time. Simply log in to your account, choose the asset you wish to modify, and make the necessary changes. This flexibility ensures that your asset information remains accurate and up to date.

4. Is Asset Vault Available on Both Mobile and Desktop Platforms?

Yes, Asset Vault is accessible via mobile apps available on both Play Store and App Store, as well as through web browsers on desktop computers. This ensures you can manage your assets conveniently from any device.

5. How Often Should I Update My Bank Account Information in Asset Vault?

It’s recommended to update your bank account information when there is a change, such as opening a new account, closing an existing one, or updating nominee details. Regular updates ensure that your financial records are current and accurate.