Have you ever thought about what you wish to leave behind? At Startup Mahakumbh 2025, Mitt Arv noticed that not many people stop to think about the legacy they’re building. But if there’s one person who shows us how it’s done with grace and vision, it’s Ratan Tata.

Ratan Tata’s Estate Plan demonstrates that planning one’s estate is about securing the future for loved ones, supporting causes close to your heart, and preserving your values for generations.

In this blog post, we explore how Ratan Tata, one of India’s most respected industrialists and philanthropists, planned his legacy. We’ll see how his vision and kindness, reflected in his will, offer valuable lessons for all of us.

Ratan Tata’s Will: An Inspiring Example of Estate Planning

When Ratan Tata passed away in October 2024, along with an immense fortune of ₹3,800 crore,he left a legacy defined by generosity, clarity, and care that makes us all think, “Hey, maybe estate planning isn’t so intimidating after all!”

Most of Tata’s fortune was allocated to two charitable trusts he founded, the Ratan Tata Endowment Foundation and the Ratan Tata Endowment Trust. This move reflects his lifelong commitment to philanthropy, ensuring that the causes he supported would thrive even after his death.

But Tata didn’t stop at charity. He thoughtfully considered family, close friends, employees, and even his pets:

- About ₹800 crore went to his half-sisters and a close friend, showing how he valued relationships beyond immediate family.

- His brother and other family members received shares of beloved properties, keeping sentimental family homes within the family.

- Tata’s close friend received a cherished seaside bungalow, highlighting his appreciation for long-standing friendships.

Care for Those Who Care for You

Ratan Tata’s generosity extended significantly to his staff. He allocated nearly ₹3.5 crore to ensure the well-being of his domestic helpers, drivers, and assistants, providing life-changing financial support based on their years of dedicated service.

He even forgave loans owed by employees, including substantial amounts such as a ₹51 lakh loan from his cook and a ₹1 crore education loan for a trusted aide. Tata’s estate plan also included funds for the lifelong care of his beloved dog, Tito.

These acts of kindness underscore a key lesson: estate planning is a profound way to express gratitude and ensure the well-being of those who have supported us throughout our lives.

What Is Estate and Legacy Planning and Why Does It Matter?

When you hear the words “estate planning,” you might picture complicated documents and endless paperwork. But it’s quite simple, it’s just about deciding in advance how your assets and affairs should be handled after you’re gone.

At its heart, estate planning is about protecting your loved ones from confusion and conflict. It usually starts with a will, a legal document that states who gets what from your assets. But it can also involve trusts, powers of attorney, and even your preferences for medical care. It’s about making sure there are no unanswered questions later, just clear instructions and peace of mind.

Now, legacy planning sounds a little fancier, like something only billionaires or celebrities do. But here’s the truth: legacy planning is for everyone. Legacy planning is about how you’ll be remembered. It’s about passing on your values, your life stories, your impact, and not just your possessions.

Ratan Tata’s estate plan is a prime example of legacy and estate planning at work:

- He outlined the beneficiaries clearly, appointed trusted executors, and included conditions such as a no-contest clause to ensure his plan is executed properly.

- He aligned wealth distribution with his values, demonstrating that legacy planning involves leaving a meaningful impact.

Without a plan, things can get messy. Without a will, your estate could end up tangled in legal red tape, possibly distributed in ways you never intended. Worse, it could lead to family disputes, delays, and unnecessary heartache.

Think of legacy planning as finalizing a gift for your future generations; you ensure that whatever you leave behind is a help, not a burden.

Legacy Planning Lessons from Ratan Tata’s Estate Plan

Ratan Tata’s estate plan offers several key lessons that we can apply to our own lives, no matter the size of our bank accounts. Some practical takeaways from his approach are:

- Prioritize Your Values: Tata directed most of his wealth to charity, showing that his philanthropic values were paramount. Identify what matters most to you, it could be your family’s security, a charity, or a cause, and make sure your estate plan reflects those priorities. Your will is a reflection of your life’s values.

- Be Comprehensive, Think of Everyone Who Depends on You: Tata’s will covered family, friends, staff, and pets, leaving no one behind. Make a list of people (and even pets) who rely on you or whom you’d like to thank. Estate planning is not just for immediate heirs; you can include friends, employees, or anyone who made a difference in your life.

- Fairness and Clarity in Distribution: Tata split certain assets equally among key people (like his half-sisters and close friends) for fairness and allocated specific properties to those who would value them (like gifting a house to a friend who cherished it). Clearly decide “who gets what” in a way you feel is just. If you want to give one child the house and another child an equivalent in cash, spell it out. This avoids confusion and resentment later. Details are important, the more clearly you express your intentions, the smoother the process for your heirs.

- Reward Loyalty and Kindness: The generous provisions Tata made for his longtime staff and the forgiveness of their debts showed his appreciation for their loyalty. Consider acknowledging those who have stood by you , maybe a faithful friend, a caregiver, or anyone who supported you. A will can be a way to say “thank you” in a profound manner.

- Plan for Your Charitable Legacy: Tata ensured that institutions and causes he cared about would continue to receive support through his trusts. If you have a charity or cause you’re passionate about, think about leaving a part of your estate to them. Even a small percentage can make a difference, and it ties your legacy to something meaningful. This can be achieved through a donation in your will or by setting up a small trust or endowment, if appropriate.

- Use Tools to Prevent Conflict: Tata’s inclusion of a no-contest clause was aimed at preventing family disputes. While you may or may not include such a clause, the broader idea is to anticipate potential disagreements and address them effectively. Talk to your family about your decisions if you can, or write a letter to be read with your will explaining the reasoning for your choices. Transparency can go a long way in avoiding hurt feelings or fights.

- Appoint Trustworthy Executors: Tata appointed trustworthy executors, including his sisters and a trusted lawyer friend, to carry out his will, even providing a token compensation for their service. Choose someone responsible and trusted to be the executor of your will; this person will have the duty to ensure your instructions are followed. Make sure they’re willing to take on the job. You can even name multiple executors or backup executors. And, like Tata, you might consider leaving them a small gift as a gesture of thanks, since executing a will is a significant responsibility.

- Update Your Plans as Needed: Tata signed his last will in 2022. We don’t know how many revisions he made over the years, but it’s common to update your will with significant life changes, such as marriages, births, or changes in wealth. Legacy planning is not a one-time task. Revisit your plan periodically, say, every few years or whenever a significant event happens , to make sure it still reflects your wishes and current circumstances. Laws change too, so an update can ensure your will is compliant with the latest regulations.

See Also: Estate Planning blunders to Avoid While Creating a Will for Your Inheritance

Simplifying Estate Planning for Everyone with Mitt Arv

Reading about Ratan Tata’s estate plan might inspire you to plan your own legacy. But let’s be honest, the process of creating a will or organising assets feels overwhelming. Traditionally, estate planning involved hiring lawyers, drafting complex documents, and managing endless paperwork; no wonder it often gets postponed.

The good news? Times have changed.

Technology is making estate planning easier, faster, and way less intimidating, and that’s where Mitt Arv comes in.

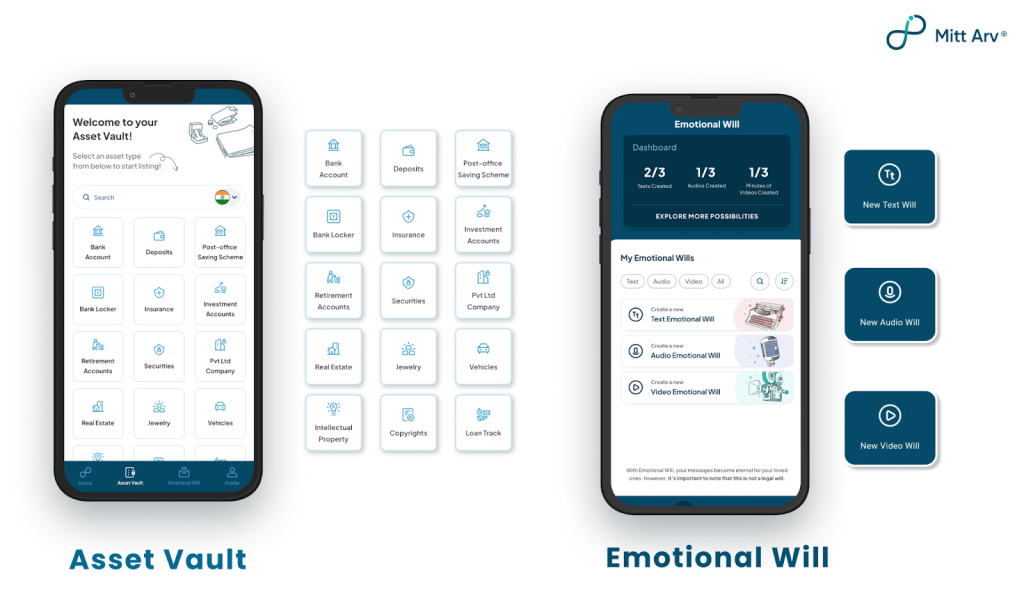

Mitt Arv helps you organize your entire estate digitally and securely. Its Asset Vault lets you store everything important, from bank accounts and property details to insurance, investments, and even your digital assets, in one safe place. So that when the time comes, your loved ones won’t have to go on a stressful treasure hunt; they’ll know exactly what you owned and how to find it.

But legacy is beyond material assets, it’s also about the things you leave behind, the memories, the love and the stories too.

That’s why Mitt Arv also offers an Emotional Will feature, letting you leave behind personal letters, audio, or video messages for your family and friends. These precious messages are securely stored and delivered after you are no more or when you are terminally ill, offering comfort, connection, and a little piece of you to hold onto for your loved ones.

Ratan Tata’s estate plan reflects love, values, deep care, responsibility, and a vision for the future. His story reminds us that true legacy is about more than just money; it’s about making sure your life’s work, love, and values continue to shine long after you’re gone.

And you don’t need to be wealthy to start planning, and you just need the right tools and a little intention.

Mitt Arv makes it easy to take that first step.