Prices are rising everywhere. Groceries, fuel, electricity, and what not. Our parents once bought a full bag of groceries for Rs. 500, and today, the same items cost Rs. 2000 or more. Food inflation has become a major concern for policymakers in India, as food items make up 45.9% of the Consumer Price Index (CPI). Recent price hikes in key vegetables like tomatoes, onions, and potatoes have highlighted this growing problem. If this is what inflation looks like in one generation, just imagine its effect on your savings when you retire!!! This is why retirement savings are important.

What Is Inflation, and Why Should You Care?

Well, we are all aware of what inflation is. Simply put, it refers to the steady rise in the prices of goods and services over time, which reduces the purchasing power of your money. Yes, your own money!!

If ten years ago, your monthly household expenses were ₹25,000. Today, due to a 6% annual inflation rate, the same lifestyle can cost you over ₹44,000 a month!

This is how inflation creeps into your finances. It doesn’t feel like much in the short term but compounds significantly over decades. For someone planning for retirement in India, inflation can be devastating.

See Also: Early Vs Late Retirement: Which is right for you?

Impacts of Inflation on Retirement Savings

Inflation has three key impacts on retirement savings:

- Erosion of Purchasing Power – Today, retiring with an amount of Rs. 1 crore, may seem like a large amount. However, at 6% inflation, in 12 years, the purchasing power of this Rs. 1 Crore, will be halved to Rs. 53 Lakhs.

- Rising Healthcare Costs – While general inflation averages around 6%, healthcare inflation in India is much higher, at 14%. This means the cost of medical care and services is rising at more than double the general rate, creating a substantial burden on future financial planning.

This means that your rising medical expenses can cause you to dip into your savings and exhaust your retirement fund quicker.

- Increased life expectancy – Retirees often plan their savings based on their life expectancy. However, advancements in healthcare and changes in personal circumstances can sometimes result in a longer lifespan than planned for. This, combined with inflation and rising costs, can quickly drain retirement savings.

Where can you possibly go wrong?

You should not rely primarily on traditional investments like fixed deposits, provident funds, and pensions. While these instruments provide safety, their returns can barely offset inflation.

Interest rates on fixed deposits rarely cross 7.5%. This means that adjusted for inflation at 6%, the effective return on a fixed deposit is only 1.5%. Similarly, while slightly better than fixed deposits, the rate of interest on employee provident funds is 8.25%, making the effective annual returns only 2.25% (8.25 – 6 = 2.25) of the corpus.

This happens because while your investments grow in amount, the prices of goods and services around you also grow. Therefore, you are required to pay more for the same. Ideally, an investment should be such that it outpaces the rate of inflation. This would allow you to grow your wealth while accounting for raised prices of the future.

How to Beat Inflation?

- Investing Early with SIPs – SIPs allow you to invest small amounts over regular intervals. If you start investing Rs. 5,000 every month at the age of 20, by the time you retire at 60, at 12% annual rate of return, you can have Rs. 24 lakhs invested already. Your estimated returns can approximately be Rs. 5.7 Cr. You can retire with more than 10X the amount you invested initially!!

You can calculate the estimated value of your SIPs using SIP calculators such as: https://groww.in/calculators/sip-calculator.

- Alternate Investments – Instruments like provident funds and fixed deposits are reliable and carry minimal risk. However, they offer smaller returns as opposed to other investments, barely outpacing inflation. Alternatively, Investing in the Indian stock market offers average annual returns of 12 to 15%. It is nearly twice of what fixed deposits and provident funds offer. This means that even after adjusting for inflation, the annual rate of return still remains between 6% and 9% as opposed to merely 1.5% to 2.5% from FDs and PFs.

This is explained better by Wes Lewins, Chief Financial Officer, Networth, “For example, you might consider a conservative split, like 60% of your investments in bonds and 40% in both domestic and international stocks. This balance can help protect your principal with the bonds providing a steady income stream, while the stocks work to grow your savings more significantly.“

| 💡Tip of the Day: Investing in equity is riskier than investing in FDs and PFs.However, this risk can be mitigated by investing for the long term and employing instruments such as Systematic Investment Plans (SIP’s) and Mutual Funds. |

- Inflation Protected Instruments – For those not wanting to deal with the increased risk of investing in equities and stocks, alternatives also exist in the form of inflation protected instruments. Investing in Inflation Protected Instruments links the returns to the rate of inflation. The greater the rate of inflation, the greater are one’s returns. Such instruments have certain characteristics that make them ideal for offsetting inflation.

Precious metals like gold and silver have long been used as a hedge against inflation. Peter Reagan, Financial Market Strategist at Birch Gold Group, emphasizes, “Over the last 15 years, I have seen that opening a precious metals IRA account is one of the most effective strategies to safeguard retirement funds. Clients with long-term investments in these accounts hold high purchasing power when the U.S. dollar declines.“

The Reserve Bank of India (RBI) offers Inflation Indexed Bonds that protect investors from inflation.

- Diversification – Don’t choose to keep most of your investments limited to fixed deposits and provident funds. No doubt that your money can be safe, but it won’t generate returns that are sufficient enough to support your retirement. If you diversify some of your investments into alternate instruments such as mutual funds, equities, or inflation protected instruments, you can achieve higher returns while still managing risk.

Real estate investments can provide stable returns and serve as a shield against inflation. As Sebastian Wade, a real estate consultant at Eden Emerald Buyers Agent, shares, “I have worked with clients who used part of their savings to invest in residential properties in growing markets, ensuring their money worked harder for them. One client purchased a property in a high-demand rental area, and the income has helped offset living costs while the property’s value appreciates.“

Securing Your Retirement Against Inflation

Inflation can quietly eat away at your retirement savings if you’re not prepared. Retirement isn’t just about saving money, it’s about enjoying life without worry. Without proper planning, the rising cost of living can create unexpected financial strain, impacting not just your finances but also your overall well-being.

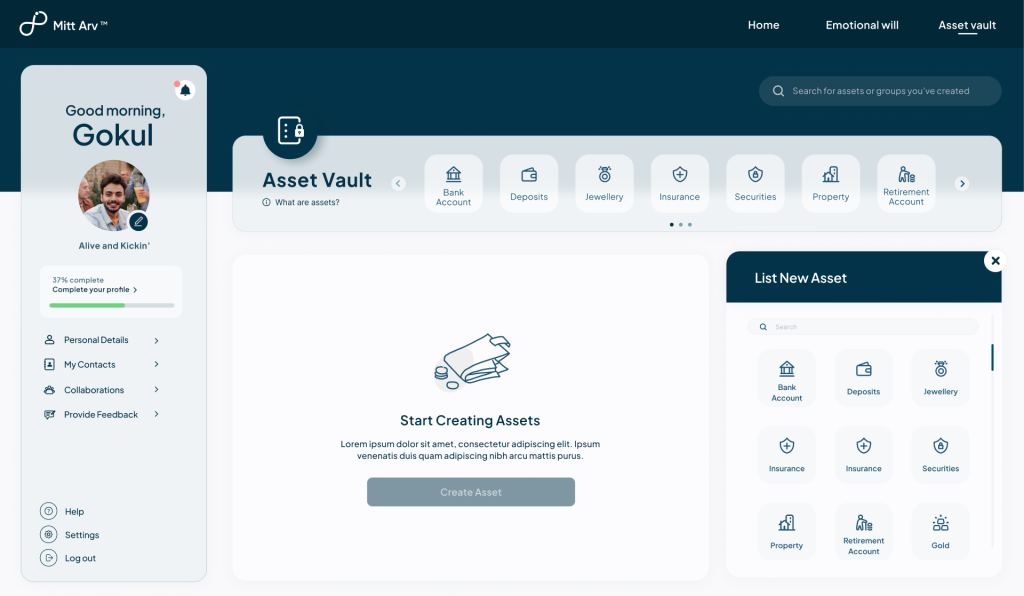

This is where innovative tools like Mitt Arv’s Emotional Will or Asset Vault come in. They offer solutions to help you plan your future thoughtfully and ensure your financial assets are organized for future generations. At Mitt Arv, we make planning for retirement simple and stress-free. With our easy-to-use Asset Vault, you can keep all your assets organized in one place, making the process of retirement planning effortless. By choosing Mitt Arv, you’re not just securing your financial future but also ensuring peace of mind for you and your loved ones.

Here’s how Mitt Arv makes managing your assets effortless:

- Organized Storage: Safely store all your asset details, be it real estate, investments, insurance, and valuables, in one secure digital vault.

- Time-Saving: Say goodbye to searching for documents. Access your entire financial portfolio instantly with just a few clicks.

- Clear Overview: Gain a complete understanding of your wealth to make informed decisions for a worry-free retirement.

- Peace of Mind for Your Family: Ensure your loved ones can easily access essential information when needed, eliminating confusion and stress.

After all, isn’t this the best way to enjoy a worry-free retirement?

Retirement isn’t just about surviving—it’s about living life to the fullest. Start planning today to ensure a secure and fulfilling tomorrow. The retirement you’ve always dreamed of is within reach, and every step you take now brings you closer to making it a reality.