Electronic Income Tax Return (E-ITR) filing has become the standard method for taxpayers to report their income and meet their tax obligations in India. As per PIB, direct tax collections reached Rs. 14.70 lakh crore as of January 2024 (a 19.41% year-on-year increase). Understanding the process of filing income tax returns has become more important. This blog covers everything from understanding what ITR is, the types of forms available, mandatory filing requirements, benefits, required documents, how to file ITR online in India, and special considerations for different types of incomes.

Understanding Income Tax Return (ITR)

What is ITR?

Income Tax Return (ITR) is a formal declaration form used by taxpayers to report their gross taxable income for a given fiscal year. Through this form, taxpayers declare their income, claim deductions and exemptions, and report taxes already paid. The form calculates the net income tax liability for the fiscal year.

According to the Income Tax Act of 1961, individuals under 60 years whose income is taxable must file returns. Additionally, if your taxable income exceeds Rs. 5 lakh in a financial year or if you’ve paid advance tax, filing an ITR is mandatory.

Legal Framework

Section 139 of the Income Tax Act, 1961, outlines the requirements for filing Income Tax Returns. This section is divided into various sub-sections (139(1), 139(3), 139(9), etc.) that cover different situations and conditions under which filing a tax return is necessary.

Read Also: Everything You Need to Know About Income Tax Slabs and Regimes in India

Why Filing ITR is Mandatory

Legal Requirements

Section 139(1) of the Income Tax Act mandates that any individual or entity whose total income exceeds the prescribed exemption limit must file their ITR within the specified due date. This is a legal obligation, and non-compliance can result in penalties and other consequences.

Exceptional Cases

Even if your income is below the taxable limit, filing ITR may still be mandatory in certain cases:

- If you’re seeking a tax refund

- If you want to carry forward losses under any head of income

Benefits of Filing Income Tax Return

Filing an ITR offers several important benefits:

- Claiming TDS Refunds: If you’ve had excess tax deducted at source, filing an ITR allows you to claim a refund.

- Facilitating Loan Applications: Having filed ITRs makes loan applications smoother as they serve as income proof for banks and financial institutions.

- Carrying Forward Losses: ITR filing allows you to carry forward certain losses to future assessment years, which can be set off against future income.

- Claiming Deductions and Exemptions: Filing returns allows you to claim applicable deductions and exemptions under the Income Tax Act, 1961.

- Nation Building: Income tax is a significant source of government revenue used for salaries, welfare schemes, government projects, and defense.

Which ITR Form Should I Use?

There are seven different types of ITR forms catering to various taxpayer categories. The appropriate form depends on your status (individual or organization), total income, and income sources.

1. ITR-1 (Sahaj)

This form is appropriate for individuals who:

- Earn salary and pension income

- Have a total income up to Rs. 50 lakh

- Have income from other sources (excluding lottery winnings or horse racing)

- Have agricultural income less than Rs. 5,000

- Receive payments from a single house property with certain exclusions

2. ITR-2

This form is suitable for individuals and Hindu Undivided Families (HUFs) who:

- Have income exceeding Rs. 50 lakh

- Receive income through salary, pensions, capital gains, and other sources (excluding business or professional income)

- Generate income from foreign assets

- Have agricultural income exceeding Rs. 5,000

3. ITR-3

This form is designed for individuals and HUFs who:

- Earn income from business or profession

- Receive income as a partner in a firm

- Have income from salary, pension, capital gains, and other sources

- Have investments in unlisted equity shares

- Are individual directors in a company

4. ITR-4 (Sugam)

This simplified form is for individuals, HUFs, and firms with specific income characteristics, though the search results don’t provide complete details about the eligibility criteria.

5. ITR-5,6,7

- ITR-5 is generally for partnership firms, LLPs, and other entities that aren’t companies.

- ITR-6 form is typically used by companies.

- ITR-7 form is generally for trusts, political parties, and charitable institutions.

Documents Required for Filing ITR

General Documents

The general documents required for filing income tax returns include:

- Permanent Account Number (PAN)

- Aadhaar number

- All bank account details of the assessee

- TDS certificates

Documents for Salaried Individuals

Salaried taxpayers need specific documents for filing their income tax returns:

- Form 16 (Salary Certificate): Provided by employers at the end of the financial year, containing details of salary paid, deductions, and tax deducted. Even if no tax was deducted, employees can request this form. Those with multiple jobs must consider all Form 16 certificates from all employers.

- Pension Certificate: For pensioners, pension is considered part of salary and is taxable.

- Arrears in Salary: If an employee received salary arrears, they must file Form 10E as their tax liability increases.

- Full & Final Settlement (F&F): Required for salary computation when changing jobs.

- Rent Agreements/Receipts: For claiming housing-related deductions.

How to File ITR Online in India

Step 1: Log In

Visit the Income Tax e-Filing Portal and log in using your PAN, Aadhaar, or User ID, along with your password and captcha code.

Step 2: Start Filing Your Return

Navigate to the ‘e-File’ section in the top menu, then select ‘Income Tax Returns’ > ‘File Income Tax Return’.

Step 3: Choose the Correct Assessment Year

Pick the appropriate Assessment Year (AY). For example, if you’re filing for the financial year 2024–25, choose AY 2025–26.

Also, specify the type of return: Original or Revised.

Step 4: Select Filing Status

Choose your filing status. Most individuals should select ‘Individual’ and click ‘Continue’. Other options include HUF (Hindu Undivided Family) and Others.

Step 5: Select the Correct ITR Form

Determine which ITR form is applicable to you:

- ITR 1 to 4 are relevant for Individuals and HUFs.

- For instance, use ITR 2 if you have capital gains but no income from business or profession.

Step 6: Mention the Reason for Filing

State the reason you’re filing your ITR. Options include:

- Your taxable income exceeds the basic exemption limit.

- You meet certain criteria that require mandatory filing.

- Other applicable reasons.

Step 7: Fill, Validate, and Submit

Your personal details (PAN, Aadhaar, name, contact info, bank details) will be auto-filled. Review and validate them carefully.

Make sure to:

- Pre-validate your bank account.

- Accurately report all income, exemptions, and deductions.

- Cross-check pre-filled information from employers, banks, etc.

Once everything is reviewed, confirm your return summary and pay any balance tax due.

Step 8: E-Verify ITR Return

Verifying your return is mandatory and must be done within 30 days of filing.

You can e-verify through:

- Aadhaar OTP

- Net Banking

- EVC (Electronic Verification Code)

- Or by sending a signed physical copy (ITR-V) to CPC, Bengaluru.

You can calculate your taxes using the Tax Calculator

E-Verify ITR Online

Timeline for E-verification

- The time limit for e-verification or submission of ITR-V is 30 days from the date of filing the return of income.

- If the return is uploaded and ITR-V is submitted within 30 days, the date of uploading is considered the date of furnishing the return.

- However, if e-verification or ITR-V submission happens after the 30-day period, the date of e-verification/ITR-V submission is treated as the date of furnishing the return. This may result in consequences of late filing.

Important Deadlines for ITR Filing

The deadlines for filing income tax returns vary based on the taxpayer category:

- Individual Taxpayers (Not Requiring Audit): July 31st is the standard deadline for individuals not required to undergo an audit, including salaried individuals, self-employed professionals, freelancers, and consultants. Extensions to August 31st are common but not guaranteed.

- Taxpayers Requiring Audit: September 30th is the deadline for business entities, self-employed professionals requiring an audit, and partners or consultants in firms with audited accounts. This deadline may also be extended by the government.

Special Considerations for Different Types of Income

Salaried Income

Salary income is taxable, and employers deduct tax at source (TDS). Form 16 provided by employers contains details of salary paid and tax deducted. Pension is also considered part of salary and is taxable.

Professional/Business Income

Individuals earning income from business or profession must use ITR-3 or ITR-4 forms depending on their circumstances.

Consequences of Late Filing

If you miss the 30-day deadline for submitting your ITR-V (verification of your Income Tax Return), several important consequences follow:

- Return Treated as Not Filed: If you do not verify your ITR within 30 days, your return is considered invalid by the Income Tax Department-essentially, it is as if you never filed a return at all. This means your return will not be processed, and you will not receive any tax refund due to you.

- Late Filing Consequences: If you verify your ITR after the 30-day window, the date of verification becomes the official date of filing. As a result, all consequences of late filing under the Income Tax Act apply, including penalties, interest, and loss of certain benefits such as the ability to carry forward losses. For example, if you filed your ITR before the due date but verified it late, you may be liable for a penalty of up to Rs 5,000 under Section 234F. If your total income does not exceed Rs 5 lakh, the penalty is limited to Rs 1,000; if your income is below the taxable limit, no penalty is charged.

- Condonation Request Option: If you missed the 30-day deadline due to a genuine reason, you can submit a “condonation request” on the income tax e-filing portal. You must provide a valid reason for the delay. The Income Tax Department will review your request, and only if it is approved will your return be treated as valid and processed. The steps to file a condonation request include logging into the e-filing portal, navigating to ‘Services’ > ‘Condonation Request’, selecting ‘Delay in submission of ITR-V’, and submitting your reason for the delay.

Read Also: Understanding Goods and Services Tax

Conclusion

Filing income tax returns is not just a legal obligation but also provides numerous benefits to taxpayers. With the shift toward electronic filing, the process has become more streamlined but requires careful attention to deadlines, selection of appropriate forms, and proper verification.

Understanding the various ITR forms, eligibility criteria, document requirements, and deadlines is essential for compliance with tax regulations and avoiding penalties. By following the guidelines outlined in this comprehensive guide, taxpayers can fulfill their obligations efficiently and take advantage of all applicable benefits and deductions.

As direct tax collections continue to grow and contribute significantly to nation-building, timely and accurate filing of income tax returns remains a crucial civic responsibility for every eligible Indian taxpayer.

FAQs

1. Which ITR form should I file for salary income?

If your income is primarily from salary, along with income from one house property, other sources (like interest), and your total income is up to ₹50 lakh, you should file ITR-1 (Sahaj).

However, if your income exceeds ₹50 lakh, or you have capital gains or foreign assets, you may need to file ITR-2 or another applicable form.

2. Can I file ITR without Form 16?

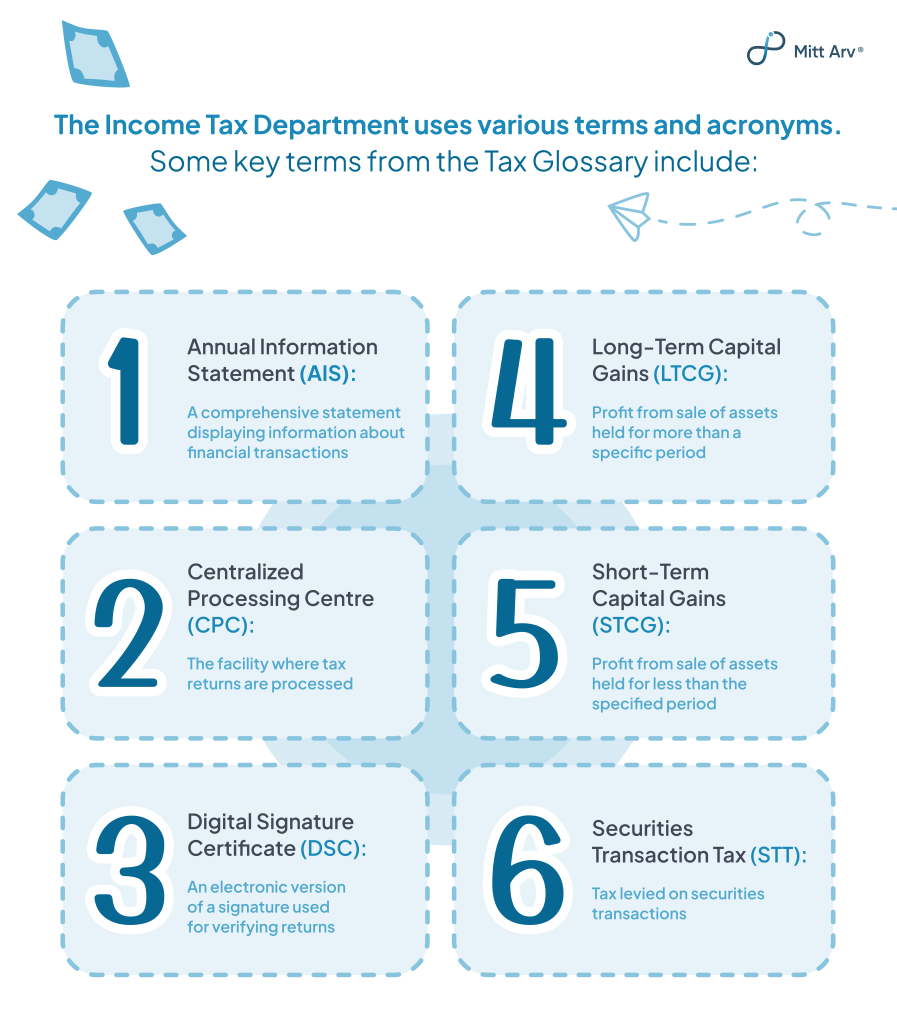

Yes, you can file ITR without Form 16. You’ll need to collect salary details from your payslips and use Form 26AS, AIS (Annual Information Statement), and bank statements to report income and TDS correctly.

3. Is it mandatory to e-verify ITR?

Yes, e-verification is mandatory. If you do not verify your return within 30 days of filing, it will be considered invalid, as if it was never filed.

4. What is the last date to file ITR for FY 2024–25?

The due date for most individuals (not requiring audit) to file their ITR for FY 2024–25 (AY 2025–26) is 31st July to 15th September 2025.

5. What is the penalty for late filing of ITR?

If you file after the due date but before 31st December 2025:

- You may have to pay a late fee of ₹5,000.

- If your total income is below ₹5 lakh, the penalty is limited to ₹1,000.

Additionally, you may lose out on certain deductions or interest refunds.