Introduction

Did you know that 61% of college students struggle with financial management? Money management for college students is essential for staying stress-free and financially stable. Student budgeting tips can be as simple as tracking every expense, no matter how small. Understanding financial literacy early on can lead to long-term financial success and make college life much more manageable.

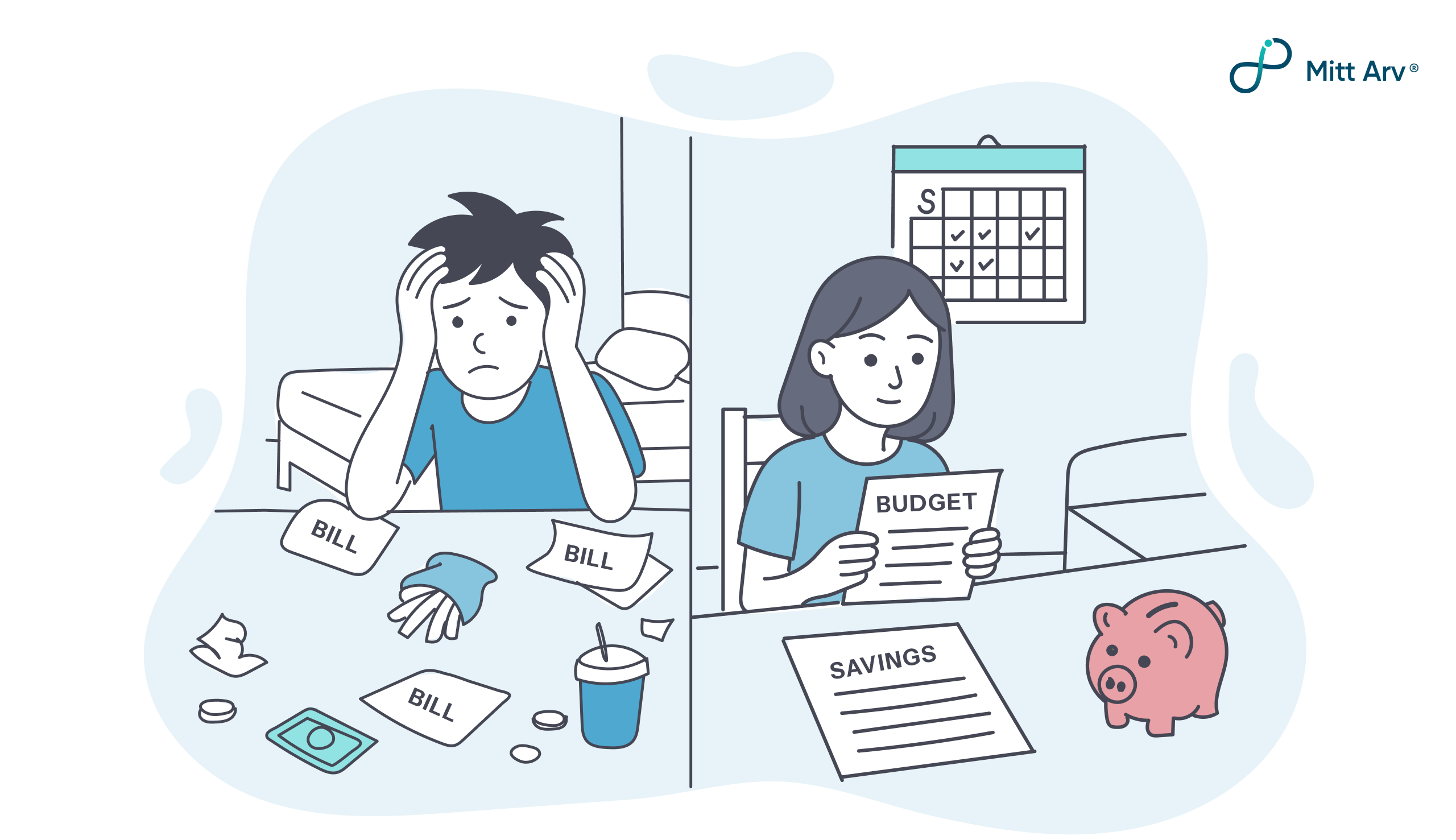

Let’s look at a student who recently turned 18, joined a college, and started getting a ₹20,000 monthly allowance. Most would think that’s a fairly good deal, right? The problem that came with it was that this student didn’t know how to manage allowance in college!

He would spend every day shopping because something seemed “cool,” ordering food online, buying things he didn’t need, and trying his luck at online gambling (an awful mistake). His bank account would be empty by the fifteenth of each month which led to him asking his friends for financial help. Only if he had some financial literacy for students!

Now, let’s look at another scenario on how to save money as a student. Another student’s monthly allowance was barely ₹10,000, which was half of the first student. This is where things become interesting. He managed his finances well. He saved up for things he actually needed, made small budgets, and even started a tiny emergency fund as a student! While the other student was borrowing money from his friends by the end of the month, the student with financial literacy was calmly sipping his homemade cold coffee while being stress-free.

So what’s his secret? Is he some kind of budgeting genius? Did he take a crash course in money magic? Not really. He just followed some simple steps that even the other student could have followed.

In this blog, we will explore what students can do to avoid going broke and some personal finance tips for students. We’ll break it down in simple, no-jargon steps, that even someone who still mixes up debit and credit can follow. If you’re a student, this might just save your wallet (and your social life). So, whether you’re in college trying to change or someone looking to stay on track—this one’s for you. Start your financial journey today—learn financial literacy for students in 5 easy steps!

See Also: Money 101: Beginner’s Guide To Financial Literacy

Stop Impulse Buying and Start Budgeting

The term “impulse buying” describes the habit of making impulsive, unplanned purchases that are frequently motivated by emotions or an unexpected need. Impulse buying can wreck your budget fast. Track your spending, make a monthly list, and allow small treats without going overboard. Mindful money management helps students stay in control, avoid regrets, and build smart habits for long-term financial stability.

According to reports, as much as 84% of consumers online have engaged in Impulse buying. This is often related to the idea of instant fulfillment, which means that people want pleasure as fast as possible without thinking about the future.

Making a budget list and sticking to it is one of the best things a student can do. Budgeting for beginners is simple, consider what you need essentially each month: meals, basic consumables, travel, recharging your phone, and perhaps a movie or treat. Put those in writing and make a basic budget. In this manner, you take charge of your finances rather than the other way around.

The student who went broke never made a list. “If it looks cool, buy it” was the guiding principle. Thus, flashy discounts, “limited-time offers,” and deals on food delivery would entice him while he browsed online shopping apps. Even without realising, half of his money had been spent on items he couldn’t even remember purchasing.

Compared to that, the wise student created a simple list of items each month. He was aware that a single expensive and unnecessary online purchase may completely disrupt his spending plan. He understood that doing a spending analysis at the end of each month is one of the best things one can do! Even after a few musings, he will be financially stable as long as he follows his budget plan.

Additionally, going completely minimalist can backfire because it’s unrealistic to deny yourself everything. Occasionally, purchasing some small things is fine. However, avoid making your wishes a habit and avoid impulse buying. Be mindful, maintain your discipline, and use your list as a financial road to stability.

Limit expenses on Food Delivery Apps

Spending without limits adds up fast—especially with daily food orders and outings. Set a monthly budget, pick affordable options, and plan ahead. Enjoy college life smartly, without breaking the bank. Small choices today lead to big savings tomorrow!

Students in India might be spending as much as 30,000 INR per month. This high amount makes sense because it’s super easy to lose track of your money when you’re going out with friends or constantly ordering food. Let’s take an example of a student who never controlled his expenses. There was no budget for outings, so whenever his friends planned something, he’d join without thinking twice and pick something expensive from the menu. Add food delivery apps to the mix, and it became a daily habit. “It’s buy one get one free” he would say to himself. But that purchase every day adds up really fast.

This is something everyone might struggle with, who would not want to go out with friends and spend money at every opportunity? The student who understood savings, despite his desires, made the smartest choice. He gave himself a fixed budget for outings and stuck to it. He picked affordable cafes, sometimes just chilled in the dorm with friends, and even cooked meals to save money. If they did go to a fancy place, He made sure not to order the priciest thing on the menu. Smart move, right?

Food delivery apps can be super tempting with flashy discounts and “order again” buttons. But don’t fall for it. What feels like a small treat can become a money trap. Instead, plan your outings, choose budget-friendly options, or bring the fun to your room. The goal is to enjoy college life without facing financial difficulties.

Build an Emergency Fund

An emergency fund helps students handle urgent, unexpected costs like medical bills or repairs. Start small, plan ahead, and save consistently—because being prepared is smarter than panicking when something suddenly goes wrong.

It should go without saying that having an emergency fund for students throughout college has several advantages. Building one is a little more difficult, particularly if you’re only at college and not exactly making a ton of money. But don’t worry, you can still complete it by taking responsibility.

Calculate the amount you’ll require in your fund: If you’re currently enrolled in college, you could be well aware of potential costs. You’ll need to estimate them if you haven’t already. Will you have a vehicle at college, for instance? If yes, what is the condition of your vehicle? How about your phone or computer? Are they in a decent condition? Evaluate the genuine reason for the emergency fund.

Let’s understand what an emergency is: There’s a reason an emergency fund is called that. It’s for unexpected, important, and urgent expenses like car repairs, phone repairs, medical bills, or emergency travel expenses back home. It should not be used for things you want, but rather for things you definitely need. Concert tickets purchased at the last minute, for instance, shouldn’t be regarded as an emergency.

Learn to Invest Early

Starting early with saving and investing builds financial discipline and long-term growth. Even small monthly investments in stocks or SIPs can make a big difference. Learn, take risks wisely, and let time work in your favor—your future self will thank you!

Roger Lowenstein, an American financial journalist, stated that ” College students are the ideal age to begin investing because it is never too early to do so. ” Students can take and overcome greater risks, such as losing money. Their greatest asset is time, which enables them to recover from whatever losses they may sustain. They can also gain more experience and improve their risk and financial management as a result. You have a possibility of being financially independent sooner if you start early.

Frequent investing also improves saving habits and budgeting abilities. Students need to learn how to save money, but they also need to invest in small amounts. This is your chance to improve your financial literacy and learn from your failures.

Everybody is aware of the basic bank savings accounts, and many likely had their parents open one for them. Selecting a high-yield savings account might be a great way for students to begin their investing experience. These accounts provide interest rates that are far higher than the national banks’ typical 3% return. Like a standard savings account, these accounts also provide flexibility and high liquidity in an emergency.

Given that stocks are extremely volatile financial assets, it may seem odd to bring them up while talking about investing strategies for students. Nonetheless, if you’re a young adult, now is the ideal moment to try your hand at the stock market and gain useful experience. Investing a small amount each month in stocks is a great approach to making a side income online if you’ve been looking for ideas.

SIPs (systematic investment plans) are one of the best investment options for students. They are considered safe as they are managed by experts which reduces risks when the market goes up or down. SIP can be a good step toward building discipline and staying steady for the future.

Let’s take a look at the two students :

- One believed that saving was merely holding onto whatever money remained in his bank account until it was empty. But the other student adopted a more clever method. After starting with a basic savings account his parents opened, he switched to a high-yield savings account that gave better interest – more than the usual 3% most banks offer. It was just as easy to access and helpful during emergencies. He also started to learn about investing.

- While one spent his free time on shopping apps, the other spent hours learning about the stock market. He didn’t invest large amounts, of course, just small sums each month to build the habit. Stocks can be risky but he knew that starting young gave him time to learn and recover from mistakes.

By the end of the semester, he had some savings and some investments growing. On the other hand, one was still spending money. The lesson? Start early, stay smart, and build your future step by step.

Financial Literacy for Students

Saving tips for college students do not need to be intimidating or boring. The difference between the two students can be linked to basic habits. While one student planned, saved, and even began investing, the other one spent mindlessly. Taking charge of your finances doesn’t need you to be a finance expert. Simply begin by reducing eating out, avoiding impulsive purchases, setting up an emergency fund, and learning how to make modest investments. Over time, little changes can have a significant impact. College is the ideal time to develop sound financial practices that will benefit you throughout your life. When you’re not always worried about running out of money, you’ll be delighted at how much freedom and peace of mind you may have.

FAQs – Frequently Asked Questions

- How can students create a budget that works for them?

Students can create a budget by tracking all income (allowance, part-time job, etc.) and expenses (tuition, food, entertainment). Use budgeting apps or a simple spreadsheet to categorise spending and set limits for each category. Stick to this budget for better control over finances. - What are some effective ways to track expenses as a student?

Use apps like Mint, YNAB (You Need a Budget), or simply an Excel sheet to track expenses. Track every purchase, from coffee to textbooks, to understand where your money is going. Regularly review and adjust to stay on top. - Is it better to use cash or UPI for managing daily expenses?

UPI apps are convenient, but they can encourage overspending. Cash can help limit your spending by making you more mindful of how much you’re using. Consider using both: UPI for larger expenses and cash for small, day-to-day purchases. - How can students avoid falling into debt while in college?

Set a budget, avoid impulse buying, and spend wisely. Pay off any debt in full each month to avoid interest. Stick to needs rather than wants and avoid taking out loans unless absolutely necessary. - How can students find part-time jobs to supplement their income?

Look for on-campus jobs, such as in libraries, cafeterias, or student centers. Off-campus, explore roles in retail, tutoring, or freelancing. Networking with professors or fellow students can also open up opportunities. - What are some common money mistakes students make and how to avoid them?

Common mistakes include overspending on non-essential items, failing to budget, and not saving for emergencies. Avoid them by tracking all expenses, prioritising needs over wants, and starting an emergency fund.