Before we begin, ask yourself one simple question:

If something happened to you tomorrow, would your loved ones know what you wanted?

If the answer makes you pause… this step-by-step Guide to creating a Will in India is for you.

Most of us happily track our wealth, investments, and achievements, but rarely do we track who gets them when we’re gone. A will is a core part of estate planning in India that gives your family clarity, comfort, and confidence when they need it the most.

A will ensures that your home, savings, digital assets, and personal belongings are passed on exactly as you intend. And the best part? Creating a Will in India is simpler than most people think.

This guide walks you through each step of creating a valid will in India, while keeping things simple, practical, and easy to follow.

Things to look out for while creating a Will in India

There is no strict legal format for a valid will in India, but it should include a few essential components. These include the following:

- Introduction/Declaration: This section declares the document as the testator’s (person making the will) “Last Will and Testament.” According to Jason B. Javaheri, Co-Founder & Co-CEO, J&Y Law

“Failing to declare the will as your ‘last and final testament’ in clear language can create problems, especially if there are older wills or conflicting documents.

Here, the testator also states they are of sound mind and voluntarily creating the will, while revoking any previous wills or codicils. - Personal Information: This section includes the testator’s full name, age, address, and date of drafting, confirming the identity and time of creating the will.

- Beneficiaries: This part lists individuals or entities, like charities, who will inherit specific assets, such as property or cash. Alternate beneficiaries can be included to ensure assets go to intended heirs even if a primary beneficiary passes away.

- Executor: The executor is the person tasked with carrying out the terms of the will. The testator may also name an alternate executor if the primary is unable or unwilling to serve. Executors ensure assets are distributed as outlined in the will.

- Witness Signatures: To validate a will, it must be signed by at least two witnesses who do not stand to benefit from it. Witnesses affirm the will’s authenticity and the testator’s voluntary signature.

- Communicate Your Motives Clearly: Ensuring your intentions are understood while you’re alive can prevent future conflicts. As Michael E. Farah, Founder, Realtor and Real Estate Attorney, The Farah Law Firm, P.C., advises:

“Most people assume the will does all the work, but if your family disagrees on your intentions, it can cause frustration later. Sharing your reasons with loved ones and possibly including a letter of instruction can reduce confusion and resentment.”

Legal Requirements for a Valid Will in India

Wills in India are governed by the Indian Succession Act, which applies to Hindus, Christians, Parsis, and Jews. Muslims follow personal laws that limit the distribution of assets through a will to one-third of their estate. The Act also provides guidelines for privileged wills (such as soldiers in danger), requiring fewer formalities.

To create a valid will, a person must be:

- 18 years or older

- Of sound mind

- Acting voluntarily

Conditions such as coercion, undue influence, or intoxication can invalidate a will.

According to Andrew Pickett, Founder and Lead Trial Attorney, Andrew Pickett Law:

“It is important to document the testator’s mental capacity at the time of drafting the will. This could involve obtaining a statement from a physician to confirm their sound mind, as this can counter claims of undue influence or incompetence.”

For a will to be enforceable in India, it must include:

- Testator’s Signature: The testator must sign the will to indicate they approve of its contents.

- Attestation by Two Witnesses: Two witnesses must attest the will, affirming the testator’s sound mind and voluntary action.

Although optional, registering a will provides security and reduces fraud risks. To register, the testator must visit the local sub-registrar to ensure the will’s authenticity and reduce the chances of disputes.

Your Step by Step Guide to Creating a Will in India

Having understood what a valid will should look like and include, we can now move on to creating them. Here’s a step-by-step guide to follow while creating a will:

- List Your Assets: Begin by listing all your assets, such as real estate, bank accounts, digital assets, investments, personal belongings, insurance policies, and retirement accounts.

- Choose Your Beneficiaries: After listing assets, designate primary and alternate beneficiaries for each one to ensure they go to intended heirs in any circumstance.

- Appoint an Executor: Select a trustworthy executor while creating a will to manage your estate, pay debts, and distribute assets according to your will. It’s wise to discuss this responsibility with the chosen person beforehand.

- Draft the Will: After organizing your assets, beneficiaries, and executor, draft the will. Ensure it’s clear and includes all necessary sections, such as an introduction, personal information, asset distribution, guardianship for minors, and executor designation.

- Sign and Witness the Will: To ensure its validity, the will must be signed in the presence of two witnesses, who must also sign. To avoid conflicts of interest, witnesses should be disinterested parties.

- Store and Register the Will (Optional): After completion, store the created will safely, such as in a bank locker, with a trusted family member, or in a digital vault. Inform your executor of its location.

See Also: Mistakes to avoid while creating a will for your inheritance

Another key thing to remember is to include digital assets in your Will. It’s important to handle it carefully. Jeffrey A. Preszler, Partner, Preszler Law Alberta, advises providing clear instructions for managing digital assets while avoiding sensitive details like passwords directly in the Will, as it may become public during probate. Instead, reference a separate, secure document containing access information. This approach ensures your wishes are legally binding while keeping your information private, reducing confusion and potential disputes over your digital property ni ni.

In the End

In recent times, we’ve seen India shaken by tragedies, the Himachal and Uttarakhand flash floods, the heartbreaking Medina bus accidents, the alarming Red Fort explosion, the rising war-like atmosphere, and countless cases of sudden cardiac deaths among young people.

Each of these moments has shown us how unpredictable life can be, and how unprepared families can be left in just a single moment.

Every day you delay your will is a day your family remains unprotected.

Our Founder and CEO, Vishal Mehta, learned this truth early. After losing a close friend during the covid wave and witnessing the emotional and financial chaos the friend’s family was left to figure out, he created his own will at just 33 years old. He refused to leave his loved ones vulnerable to the same uncertainty.

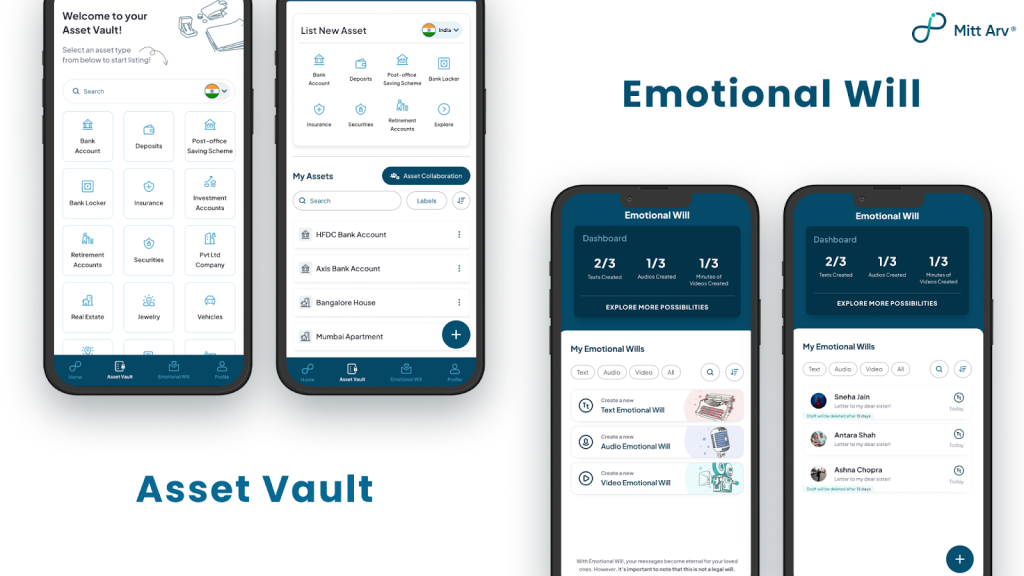

Don’t wait for a wake-up call. Start by listing your assets on Mitt Arv and follow this guide to secure your legacy for the future!

Available on Android, iOS & Web.

FAQs

1. Why should I create a will?

Creating a will ensures that your assets are distributed according to your wishes after your passing. It helps to avoid potential family disputes, ensures clarity, and provides peace of mind, knowing your loved ones will be taken care of as per your intentions.

2. What are the legal requirements for a will to be valid in India?

For a will to be valid in India, it must be made by a person of sound mind, aged 18 or older. The will must include the testator’s signature and the signatures of at least two witnesses who do not benefit from the will. Registering the will is optional, but can add an extra layer of authenticity and security.

3. Who can be named as beneficiaries in a will?

Beneficiaries can include family members, friends, charities, or other entities whom you want to inherit your assets. While creating a will, you may also name alternate beneficiaries to cover situations where a primary beneficiary may have predeceased you.

4. What is the role of an executor, and how should I choose one?

An executor is responsible for managing your estate, paying any debts, and distributing assets according to the will. While creating a will, choose a trustworthy person, preferably someone who understands your wishes, is organized, and willing to take on the responsibility. Discuss this role with the person beforehand to ensure they’re prepared.

5. Is it necessary to register my will?

Registration after creating a will is not legally required, but it can offer additional protection against fraud or disputes. Registration is done at the local sub-registrar’s office and adds a layer of security, ensuring your will’s authenticity and that it’s less likely to be challenged in court.