What is a credit score?

A credit score is a three-digit number (usually between 300 and 900) that tells banks and lenders how responsible you are with money and your finances. It is like a report card for your financial habits. The higher the number, the better your score, which shows lenders that you can be trusted to repay borrowed money. In simple terms, it reflects how responsibly you’ve managed loans and credit cards in the past.

Why Does Your Credit Score Matter?

Your credit score matters because banks check it before giving loans, such as a home loan, a student loan, a personal loan, etc., or a credit card. Lenders check this score as a first filter. If your score is high, you have better chances of approval, faster processing, and even lower interest rates on loans. On the other hand, a low score might lead the bank to reject your application or offer credit on less favorable terms.

Statistics show that about 79% of loans are sanctioned to individuals with a credit score above 750. This doesn’t mean you can’t get a loan with a lower score, but it does mean a high score greatly improves your odds. In short, your credit score in India is often the deciding factor between a lender’s “yes” or “no”. It’s your financial reputation distilled down to a number.

Read Also: Money 101: Beginner’s Guide To Financial Literacy

How Are Credit Scores Calculated?

In India, credit scores are generated by licensed credit bureaus. The RBI authorizes four main credit information companies:

- TransUnion CIBIL

- Experian

- Equifax

- CRIF Highmark.

Among these, the CIBIL score (from TransUnion CIBIL) is the most widely used and famous. Each bureau collects data on your loans and credit cards from banks and lenders, and uses a proprietary algorithm to calculate your score. While the exact formulas are secret, all bureaus look at similar key factors in your credit history to derive the score.

| Note: If you’re completely new to credit (no credit cards or loans ever), you won’t have a score yet – it may show as “NA/NH” or zero, indicating no history rather than a bad score. The good news is that building a score from scratch or improving a low score is possible with the right steps. |

Factors That Influence Your Credit Score

Lenders and credit bureaus examine several aspects of your credit profile. According to TransUnion CIBIL and financial experts, the following are the major factors impacting your credit score:

- Payment History: This is the most important factor. It tracks whether you pay your EMIs (loan installments) and credit card bills on time. Consistently paying all your dues by the due date boosts your score, while late payments or loan defaults hurt it significantly. Even a single missed payment can have a sharp negative impact (a 30-day delay could drop your score by around 100 points). Every late or missed payment is recorded on your credit report and remains visible for years. So, paying on time, every time, is key to a healthy credit score.

- Credit Utilization (Amount Owed): Credit utilization is how much of your available credit you are using. It is usually expressed as a percentage of your credit card limits (and sometimes other revolving credit). Using too much of your credit limit can drag down your score. For example, if your credit card limit is ₹1,00,000 and you consistently carry a balance of ₹80,000, your utilization is 80%, which is considered high. A high utilization suggests you might be over-relying on credit, which is a red flag to lenders. Aim to use less than 30% of your credit limit – this is generally seen as a healthy usage ratio. Keeping your balances low (or paying your card in full each month) shows that you’re not likely to overextend yourself financially.

- Length of Credit History: This factor looks at how long you’ve been using credit. A longer credit history, with several years of maintained accounts, is beneficial because it gives lenders more evidence of your long-term repayment behavior. For instance, an old credit card that you’ve managed responsibly for, say, 5-10 years, reflects positively. This is why financial advisors often suggest not closing your oldest credit card accounts, even if you don’t use them much – their age is adding to your credit history length. Young adults starting out will, by nature, have a shorter credit history, but you can gradually build it. In India, it typically takes 18-36 months of credit usage to generate a decent score if you’re new to credit. Patience and consistent good behavior over time will be rewarded here.

- Credit Mix (Types of Credit): Credit mix refers to the variety of credit accounts you hold, such as credit cards, personal loans, home or auto loans, etc. Having a healthy mix of both secured loans (like a home loan or car loan) and unsecured credit (like credit cards or personal loans) can positively impact your score. This is because it demonstrates you can handle different types of credit responsibly. If all your credit is of one type (say, only multiple credit cards), it’s not necessarily bad, but a balanced profile is preferable. For example, someone with a credit card and an education loan, both paid on time, might be seen as lower risk than someone with five credit cards maxed out. That said, do not take a loan just for the sake of mixing, only borrow when needed. The idea is that if you need different credit products in life, handling them well boosts your credibility.

- New Credit and Inquiries: Each time you apply for a loan or credit card, the lender performs a “hard inquiry” on your credit report. Too many such inquiries in a short span can hurt your score. This is because multiple applications make you look credit-hungry or suggest you might be taking on more debt than you can handle. Also, opening several new accounts simultaneously can shorten your average account age, which ties back into the length of history factor. The score calculation considers recent “new credit” activity, if you’ve opened many new credit lines recently, it might decrease your score a bit in the short term.

| Tip: Spread out credit applications and only apply when truly necessary. (Note that checking your own score is a soft inquiry and does NOT affect your score at all, so you can monitor your credit report regularly without worry.) |

Each of these factors combines to form your credit score. Among them, payment history and credit utilization carry the most weight in most scoring models, so prioritize paying on time and keeping balances low.

Read Also: Financial Literacy for Students

How to Check Your Credit Score in India (for Free)

Tracking your credit score is important, and fortunately it’s quite easy to do these days. In India, you have the right to check your credit report for free. As per RBI guidelines, every individual can get one free full credit report (with score) per year from each of the four credit bureaus. This means you could obtain your report from CIBIL, Experian, Equifax, or CRIF Highmark annually at no cost. Here are some simple ways to check your score:

- Through Official Credit Bureaus: You can request your free annual credit report directly from the bureau’s website. For example, TransUnion CIBIL’s website has a “Free CIBIL Score and Report” option. You just need to fill in your details to get your report. Each bureau typically allows one free report per calendar year. The report will show your score and a detailed history of your loans/credit cards.

| Pro Tip: Space out your requests from different bureaus throughout the year and not all at once, to monitor your credit at different times, since data should be similar. |

- Via Your Bank or Credit Card Provider: Many banks now offer their customers the facility to check credit scores for free, either through net banking or mobile apps. For instance, some banks have tie-ups with credit bureaus to show you a monthly updated score in your banking app. ICICI Bank, for example, allows its customers to check their credit score online easily. HDFC Bank and others send out credit score information to credit card holders periodically. It’s worth exploring if your bank provides this service, it’s usually free for customers.

- Using Online Portals and Fintech Apps: A number of reputable financial websites and apps offer free credit score checks to users. Websites like Paisabazaar, BankBazaar, and CreditMantri, or apps like CRED, OneScore, etc., provide your credit score (sometimes drawing from one of the bureaus) for free. You sign up with some basic information (and PAN number, since credit records are linked to PAN), and they fetch your score and report. These services often provide free monthly updates to your score, which can be handy for tracking changes. Just be aware you might receive promotional offers, since in exchange for the free score they may recommend loans or cards to you. Stick to using well-known and trusted platforms to protect your data.

Checking your own credit score does not hurt your score in any way, so you can and should do it at least once a year if not more frequently. Regularly monitoring your score and report can alert you to any issues. For example, an unexpected drop in score or an error in the report, so you can address them promptly.

| Fun Fact:Many people are surprised by what’s in their credit report; in one survey by HDFC Life, over 90% of participants were unaware of their own credit score. Don’t be part of that statistic, take advantage of the free resources to know where you stand. |

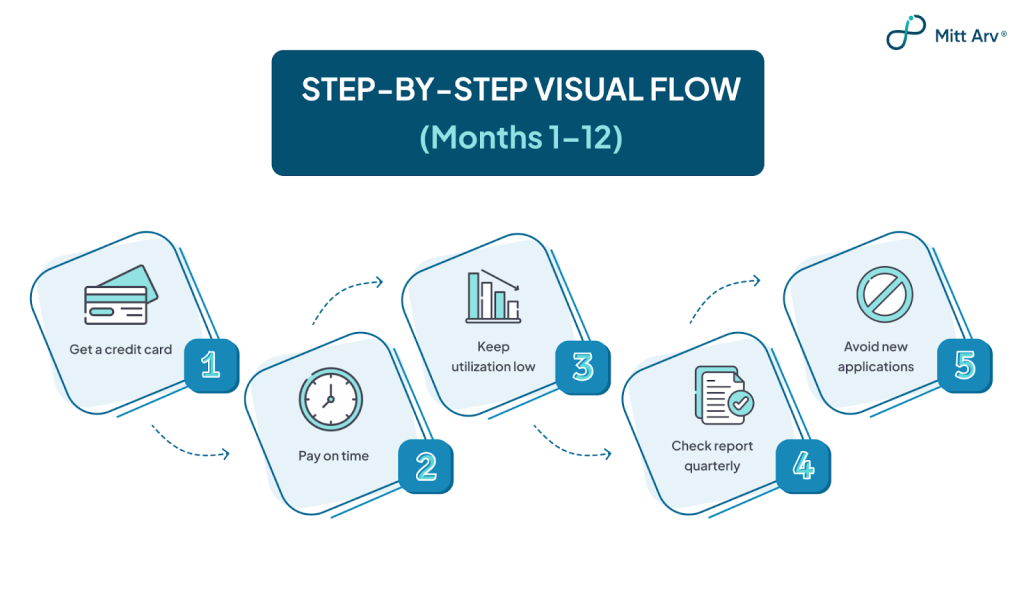

Simple Steps to Improve Your Credit Score in India

If your credit score isn’t where you want it to be, don’t worry. Just like staying healthy, improving your score takes small, steady steps. Here’s how you can build a better score:

- Pay Your Bills on Time

Late payments hurt your score. Set reminders or automate payments to avoid missing EMI or credit card due dates. Consistent, on-time payments show you’re reliable. - Use Less Credit (Credit Utilization)

Avoid using too much of your credit limit. Keep usage below 30%, if your limit is ₹50,000, aim to spend less than ₹15,000. You can also ask your bank for a higher limit or pay before the bill is generated. - Don’t Apply for Too Many Loans/Cards

Each credit application triggers a “hard inquiry” and too many can hurt your score. Apply only when necessary and avoid applying to multiple lenders at once. - Maintain a Mix of Credit

A mix of secured (like home/car loans) and unsecured credit (like credit cards) is better than only one type. Don’t borrow just to improve your mix – only take loans you genuinely need. - Check Your Credit Report Regularly

Sometimes errors happen, wrong loan entries or missed payments you didn’t miss. Check your report and raise a dispute if you find a mistake. Fixing these can quickly boost your score. - Start Early, Build Slowly

If you’re new to credit, start with a secured credit card or a small loan. Use it responsibly and repay on time. Over time, this helps build a strong credit history. - Be Consistent and Patient

Credit scores don’t change overnight. Stick to good habits and your score will improve gradually. Avoid mistakes and keep making positive moves.

In the End

Your credit score might just be a three-digit number, but it has a big influence on your financial life, especially when you need a loan or a credit card.

The good news is that you are in control of that number.

Disciplined repayments, keeping your credit usage in check, and reviewing your report regularly can steadily build and maintain a healthy score. Remember, building a good credit score is a bit like building trust, it takes time, but it opens doors. So start cultivating smart credit habits today!