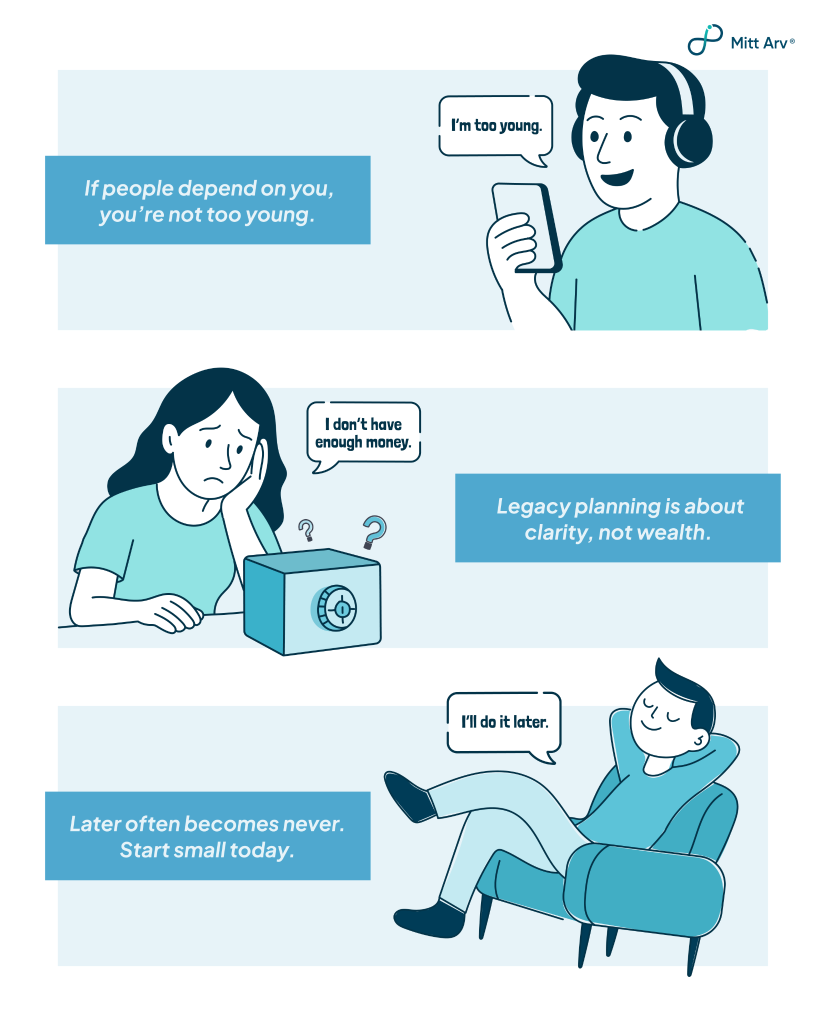

Legacy planning often sounds like something you do much later in life, “after retirement” or “once everything is settled.” But real life doesn’t wait for perfect timing.

Across India, only about 2–3 percent of people have even made a basic will, leaving billions of rupees in wealth tangled in uncertainty as generations change hands.

In India, not having a clear legacy plan can lead to long, expensive, and emotionally draining disputes even among close family members.

One recent high-profile example shows this clearly.

After the sudden death of industrialist Sunjay Kapur, his Rs 30,000 crore estate became the centre of a bitter legal fight in the Delhi High Court, with his children from a previous marriage challenging the authenticity of a will produced by his widow. The dispute has dragged on for months, filled with allegations, courtroom drama, and emotional strain on all sides.

If this can happen in a high-profile family with access to top legal advice, imagine how much harder it becomes for ordinary families.

According to older research, roughly 80 percent of Indians die without making a last will, which means what they think should happen to their assets often gets decided by default laws instead of their own wishes.

The result? Endless court hearings, fractured families, and assets locked up for years.

What Is a Legacy Plan?

A legacy plan is simply a way to decide what happens to your money, responsibilities, and your values when you’re gone. It is your way of ensuring that your assets, beliefs, and memories are passed on exactly as you intend. It includes legal, financial, and personal parts of your life. A good legacy plan reduces confusion, prevents conflict, and gives your loved ones peace of mind.

5 Things to Include in Your Legacy Plan

1. Will

The most important part of any legacy plan is a will.

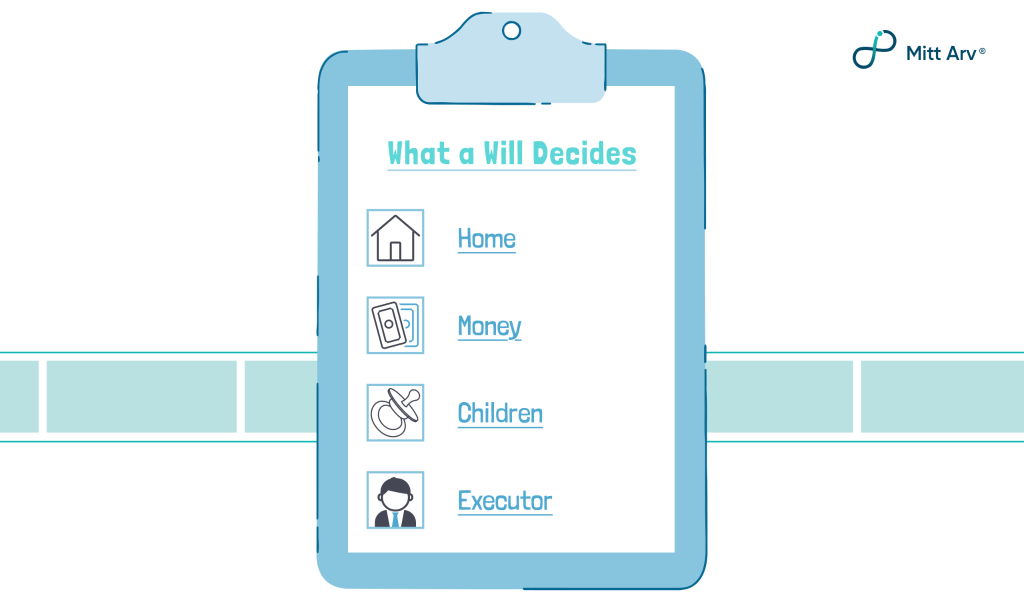

A will is a legal document that clearly states who gets your property, money, and belongings after you die. Without a will, the law decides for you.

In India, if someone dies without a will (this is called dying “intestate”), their assets, such as houses, bank accounts, and insurance money, are divided according to personal succession laws. This often leads to confusion, delays, and family disputes.

By writing a will, you stay in control. You choose:

- Who receives your assets

- Who manages your estate (called an executor)

- Who should care for your children

It’s also important to update your will whenever your life changes, such as marriage, divorce, having children, or buying property. Many disputes happen simply because people forget to update old wills.

Even if you don’t think you own much, a will still matters. It is the only way to clearly identify your heirs and legally appoint a guardian for your children. Without it, these decisions are left to the courts.

2. Financial Assets & Beneficiaries

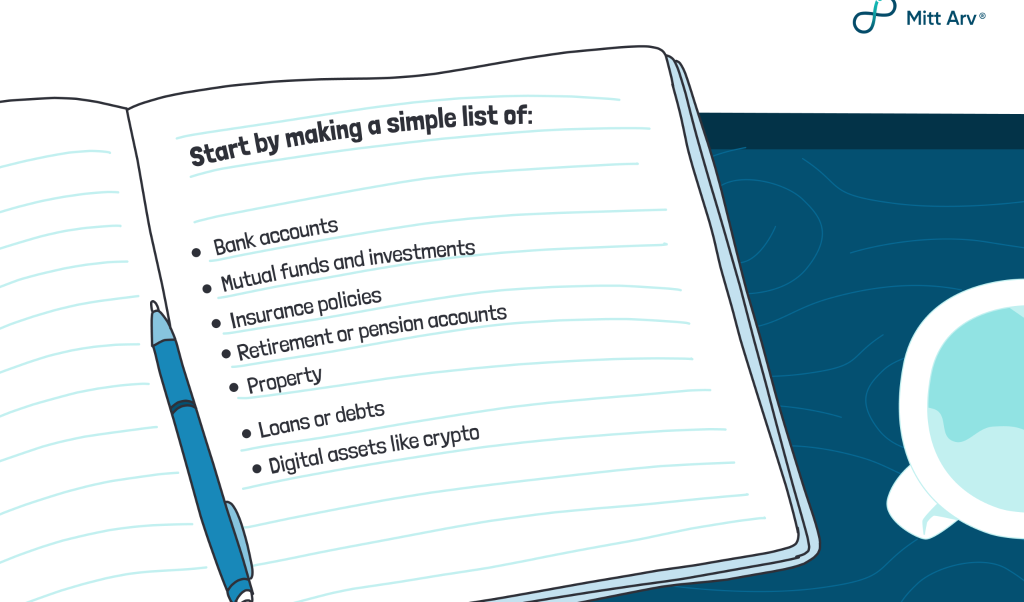

A good legacy plan also includes clear financial instructions.

This list is incredibly helpful for your family. Without it, they may spend months just trying to figure out what accounts you had.

Next, make sure you nominate beneficiaries or nominees wherever possible.

In India, banks and insurance companies allow you to name a nominee, but this is where many people get confused. A nominee is not always the legal owner. In most cases, a nominee only holds the money temporarily until the legal heirs are identified.

That’s why your will is still essential, even if you’ve named nominees. Your will should clearly state who the money truly belongs to.

Also consider:

- Life insurance policies

- Pension or provident fund accounts

- A power of attorney (POA), so someone can manage your finances if you’re unable to

You don’t need advanced tax planning to begin with. For now, focus on clarity, clear lists, clear names, and clear instructions.

3. Digital Legacy

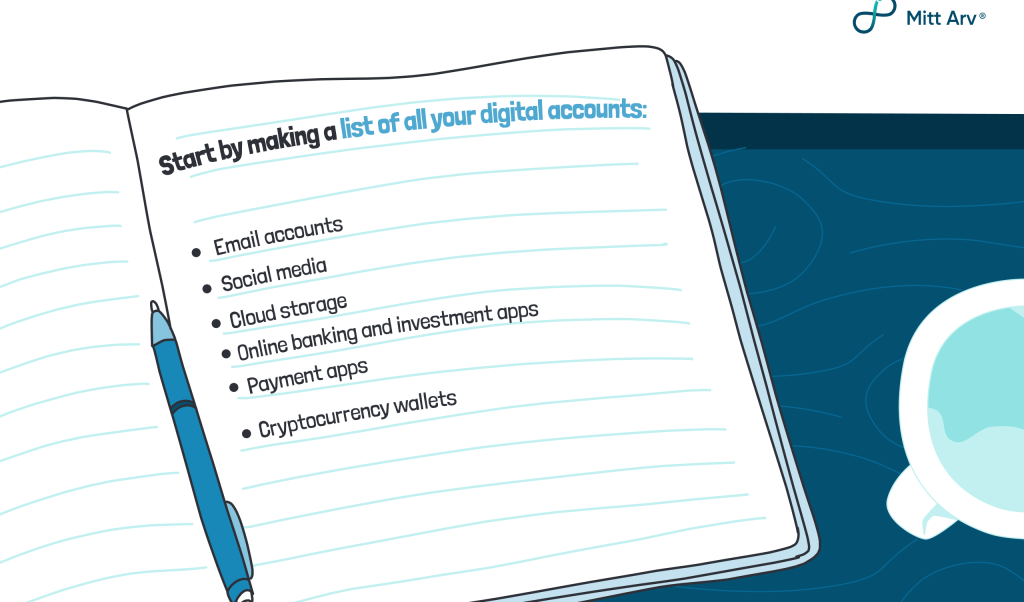

Today, a big part of our lives exists online.

Your emails, social media accounts, cloud photos, online banking, and even crypto wallets make up your digital legacy. Many families permanently lose photos, documents, and even money simply because no one knew the passwords.

With proper planning, your family will be able to:

- Access important documents

- Retrieve photos and memories

- Close or manage online accounts

- Recover digital money

Store login details securely and tell one trusted person how to access them.

You can also:

- Choose a legacy contact on platforms like Facebook

- Use Google’s Inactive Account Manager

- Appoint a digital executor to manage or close accounts

Simple steps like these save your loved ones from stress and permanent data loss.

4. Instructions for Healthcare and Emergencies

Legacy planning isn’t only about what happens after death. It’s also about what happens if you are alive but unable to speak for yourself.

Imagine a medical emergency where you’re unconscious or seriously ill. Someone will need to make decisions quickly. Without instructions, families are often left confused, scared, and unsure of what they want.

That’s why it’s important to include healthcare and emergency instructions in your legacy plan.

This can include:

- Who should make medical decisions for you

- Whether you want life-support in extreme situations

- Your preferences for hospitals or treatments

- Important medical conditions or allergies

- Emergency contacts

You can document this through:

- A medical power of attorney (authorising someone to decide for you)

- An advance healthcare directive or living will

- A simple written note kept with your important documents

Even a basic document stating “In an emergency, please contact X” or “I trust Y to make medical decisions for me” can make a huge difference.

This part of planning is not about giving up control, it’s about keeping control, even in difficult situations.

5. A Personal Legacy Letter or Message

Beyond legal documents and finances, there’s something deeply human you can leave behind, your words.

You can leave behind a personal legacy letter or an emotional will where you speak directly to the people you love. This isn’t a legal document. There are no rules. It’s simply a message from you in your voice.

In this letter or message, you might share:

- Life lessons you learned the hard way

- Values you hope your family carries forward

- Apologies, gratitude, or encouragement

- Family stories that shouldn’t be forgotten

- Hopes for your children, partner, or parents

This can be:

- A handwritten letter

- A typed note stored safely

- A recorded video or voice note

For many families, this becomes the most emotionally valuable part of a legacy plan. Money can be spent, but words last. When someone you love is gone, hearing their thoughts, advice, or reassurance can be incredibly comforting.

You don’t need to write something perfect. Even a few honest paragraphs are enough. What matters is that it sounds like you.

BONUS TIP

6. Guardianship for Minor Children

If you have children under 18, this step is non-negotiable.

A guardian is the person who will raise your children if both parents are no longer alive. If you don’t name one, the court will decide, and that decision may not match what you would have wanted.

In India, parents can name a testamentary guardian through a will. This ensures that your children are cared for by someone you trust.

When choosing a guardian:

- Talk to them first and make sure they’re willing

- Consider their values, lifestyle, and stability

- Think about where your child will grow up

You can also include instructions about how any money you leave behind should be used for your child’s education and care.

This one decision can shape your child’s entire future.

See Also: 5 Ways Mitt Arv Simplifies Legacy Planning

Final Thoughts

Legacy planning isn’t about being old or wealthy. It’s about being responsible and thoughtful. Starting early doesn’t mean expecting the worst; it means preparing with care.

Start where you are. Write things down. Review them over time. The peace of mind you create today may be one of the most meaningful gifts you ever give.

Note: This article is for educational purposes and does not replace personalised legal advice.