Every Indian family knows a story like this.

A parent passes away. The children rush between banks, lockers, relatives, and lawyers, not to claim wealth, but to find answers.

“Where are the papers?”

“Did they have insurance?”

“Who were the nominees?”

No one knows. Everyone guesses. And grief quietly turns into stress and conflict.

If this feels familiar, you’re not alone. Most families go through this because over 90% of Indians don’t have a written will or a clear plan in place.

But it doesn’t have to be this way.

End-of-Life Planning isn’t about imagining the worst. It’s about making life easier for the people you love.

In this blog, we’ll break down what end-of-life planning is, the key steps involved, and how Mitt Arv makes end-of-life planning easier than ever.

What Is End-of-Life Planning?

End-of-Life Planning simply means preparing for the decisions and arrangements that must be made when someone passes away or becomes unable to communicate.

It’s a way to stay in control of your choices and ensure your loved ones aren’t left confused or burdened.

This planning often includes:

- How you want to be cared for medically

- Who should make decisions when you can’t

- How your assets should be managed or shared

- What kind of farewell you’d want

- Messages and memories you want to leave behind

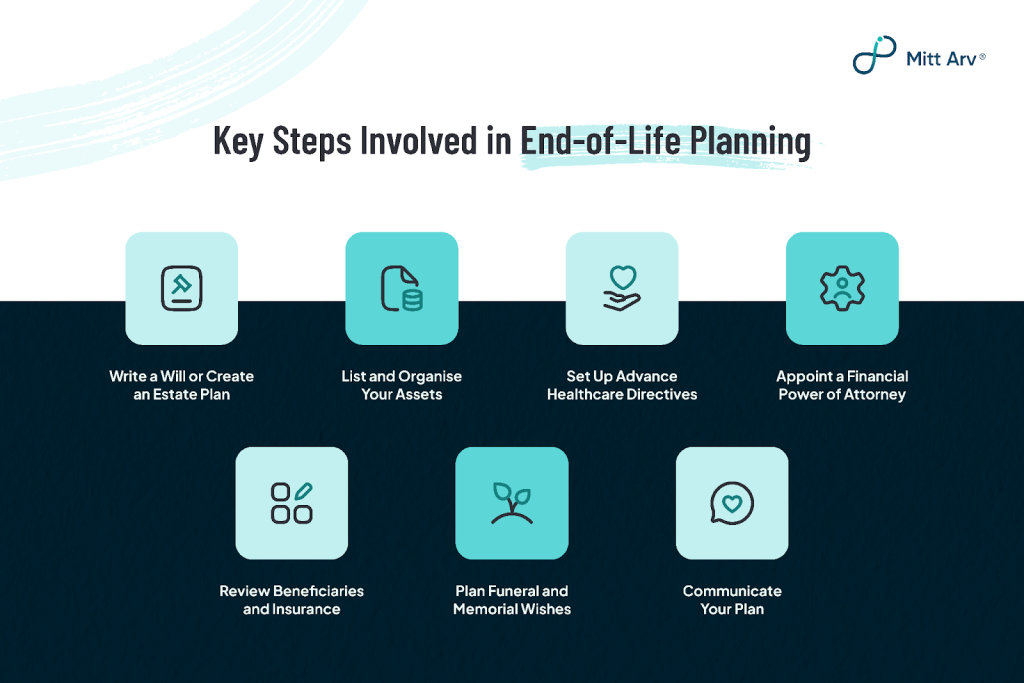

Key Steps Involved in End-of-Life Planning

End-of-life planning can be broken down into several key steps. Even if you’re starting from scratch, taking these steps one by one will cover the most important bases:

- Write a Will or Create an Estate Plan:A basic will avoids disputes, confusion, and delays. If your estate is more complex, setting up trusts or other legal arrangements may help but for most people, a simple will is a powerful first step.

- List and Organise Your Assets: Document everything clearly, from Bank accounts to Investments to Insurance and Real estate. Also include all your Digital accounts. This ensures nothing gets lost and your family knows exactly where things are.

- Set Up Advance Healthcare Directives: A Living Will states the medical treatments you want or don’t want if you can’t voice your wishes. A Healthcare Power of Attorney appoints someone to make decisions for you. This way, doctors and loved ones know your preferences regarding critical care.

- Appoint a Financial Power of Attorney: Choose a person who can manage your accounts, bills, and property if you’re unable to. Choose someone dependable and trustworthy.

- Review Beneficiaries and Insurance: Review your beneficiary details on insurance and investment accounts. These pay out directly to the nominee and override your will, so keep them updated.

- Plan Funeral and Memorial Wishes: Decide how you’d like your final farewell to be, burial or cremation, simple or traditional, or any rituals you want. Writing it down helps your family honour your wishes.

- Communicate Your Plan: The most overlooked step is simply talking to your loved ones. Let someone you trust know you have a plan and where to find key documents. These conversations may feel hard, but they’re acts of love that prevent confusion later.

4 Ways Mitt Arv Simplifies End-of-Life Planning

Mitt Arv (meaning “My Legacy” in Swedish) is an end-of-life planning app that brings together all the essential pieces of your legacy plan in one secure place. It was created with a mission to remove the stigma around discussing death and encourage proactive planning. How does Mitt Arv actually make things easier? Here’s how:

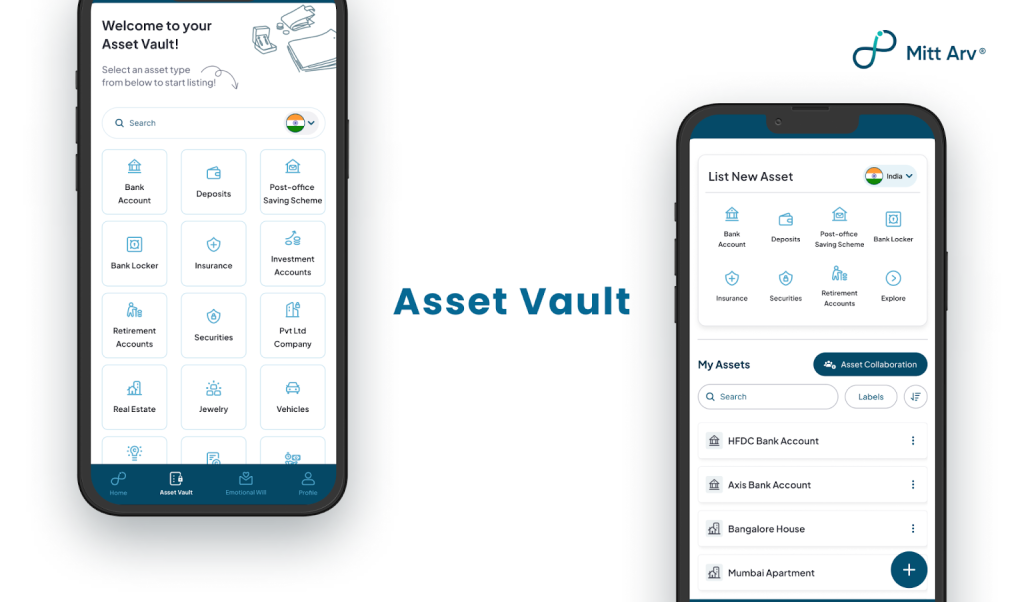

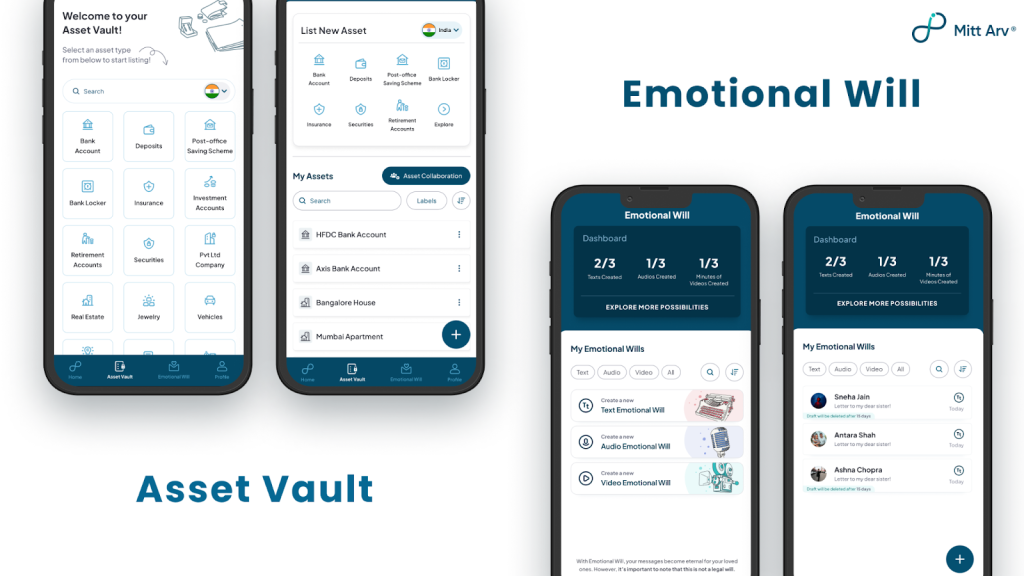

1. Centralizing All Your Assets in a Secure Digital Vault

One of the hardest parts of planning is simply keeping track of everything you own. Most of us have bank accounts, insurance policies, investments, property papers, and digital assets scattered everywhere, and if something happens, our families may not even know where to begin. Mitt Arv solves this by providing a secure digital vault – Asset Vault, where you can list and organise detailed information about all your assets in one place. You can also upload important documents (like PDF copies of your insurance or property deeds) into the vault for safekeeping.

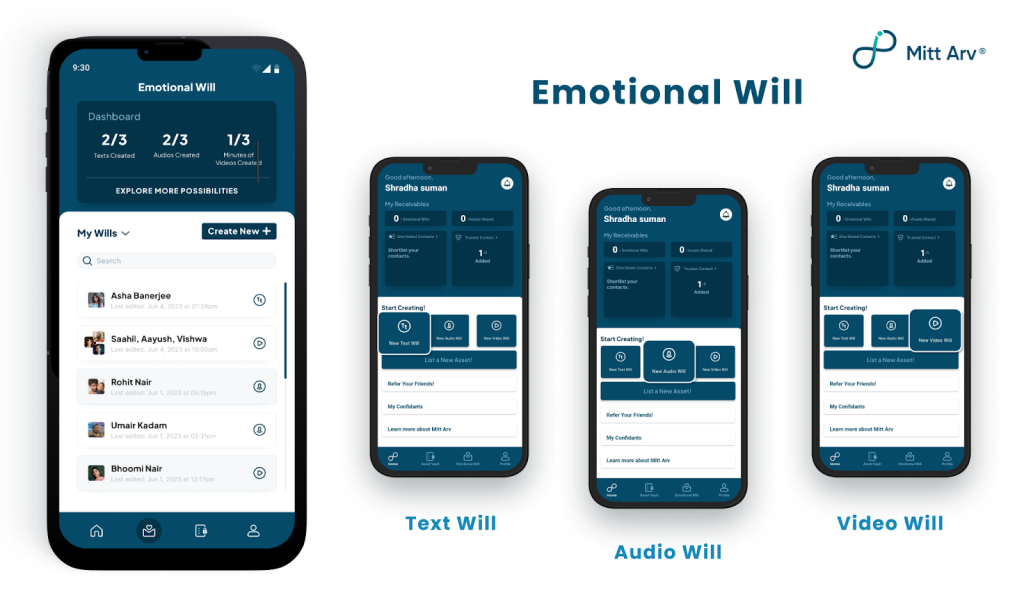

2. Preserving Messages and Memories with an “Emotional Will”

End-of-life planning is also about the words, memories, and feelings you leave behind. Mitt Arv introduces a beautiful concept called the Emotional Will, which lets you record heartfelt messages in text, audio, or video, almost like writing letters for your loved ones to receive when they need them most.

This feature is especially powerful because it goes beyond the traditional scope of a will. A legal will might say who gets the house or the savings, but an emotional will says, “I love you, I’m proud of you, and here’s my advice for the future…”.

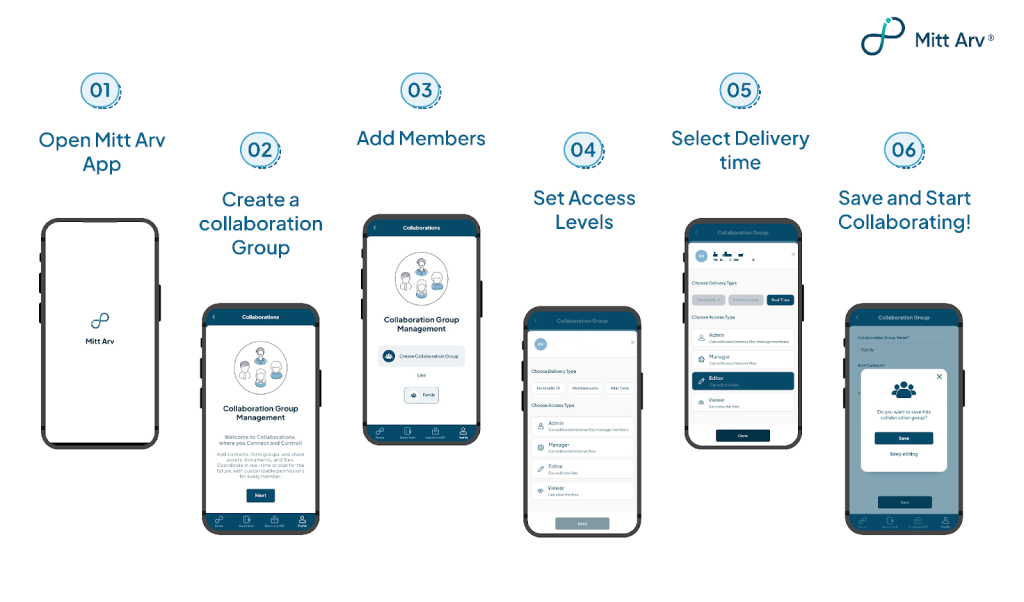

3. Secure Sharing and Collaboration with Family

Planning shouldn’t happen alone. Often, you’ll want your spouse, children, or trusted advisors to know what you’ve planned. Mitt Arv’s Collaboration feature makes this simple and secure.

You can share your Asset Vault, or just certain parts of it, with selected people and choose exactly what they can see or edit. Maybe your spouse gets full access, your children get view-only access, and your financial advisor can see just the accounts they handle.

4. Automated Safekeeping and Timely Delivery of Information

You may wonder how Mitt Arv makes sure your documents and messages reach your loved ones at the right time. The platform uses a thoughtful, automated system to handle this with care:

- Regular Check-Ins: If you’re inactive for a while, Mitt Arv gently checks in to confirm you’re okay. As long as you respond occasionally, everything stays safely on hold.

- Trusted Contact Verification: If you don’t respond for an extended period, the app reaches out to the trusted contacts you’ve chosen to verify your well-being.

- Controlled Release of Data: Only after they confirm that you’ve passed away or can’t respond anymore does Mitt Arv release your documents and emotional messages to the people you selected.

Conclusion

Thinking about end-of-life planning might feel uncomfortable at first, but it is truly one of the greatest gifts you can give your loved ones. Organising your affairs and recording your wishes now, you spare your family from uncertainty and difficulty later. Tools like Mitt Arv make the legacy planning process simpler, more organised, and far less overwhelming.

Don’t wait for a crisis to start planning. See this as an act of love, a way to bring your family clarity, comfort, and peace. With Mitt Arv by your side, end-of-life planning becomes less about fear and more about responsibility and care.

Start building your legacy today, and let Mitt Arv help you every step of the way.