Introduction

Did you know that out of the 18.5 million Bitcoins in existence, nearly 20 percent, worth around $140 billion, are lost in digital wallets?

Many people lose digital assets due to forgotten passwords, misplaced private keys, accidentally deleting files, or computer errors. Lack of organised management often turns digital assets into unclaimed funds, leaving millions effectively lost forever.

All of this can be avoided by simply organising your assets and making them accessible to your close ones. By keeping them safe and easy to reach for your family, you ensure that your digital wealth is protected from financial losses.

Countless cases show digital assets vanishing simply because no one knew where they existed. Crypto offers control and freedom, but what’s the point if it can’t be passed on?

Because, sure, you might own digital assets today, but will your heirs even know where to find them, or will they scramble between various digital wallets?

If no one inherits them, digital assets remain just files sitting in a digital wallet. So ask yourself:

- Is your crypto part of your will?

- Have you made a plan for digital assets inheritance?

Disorganised Digital Assets? Your Wealth & Legacy Are In Serious Danger.

Turning digital wealth into legacy requires more than just a digital wallet. It requires planning and structure.

Many people assume that digital wallets or cloud storage are enough, but without a clear plan, access can be lost forever. Simply failing to tell anyone where your assets are stored can turn your wealth into a puzzle.

Several individuals have lost access to millions in digital assets due to forgotten passwords, misplaced devices, or because they left no clear succession plan for their families.

Do not believe us? Consider the real stories of real people.

James Howells, who accidentally threw away his crypto details, now worth over $800 million. Or Stefan Thomas, who has just two password attempts left before losing access to $250 million worth of Bitcoin forever.

These are not rare cases; they are warnings.

These mistakes highlight one key point: if your digital asset details aren’t easily accessible, your digital wealth can disappear.

Simply storing crypto details on digital wallets isn’t safe, they must be easy to access and designed for digital inheritance planning.

Even if a tragedy were to happen, your family can still find and inherit digital wealth. That is why it is important to not just rely on digital wallets but on a shareable platform for your heirs. Because digital assets inheritance is crucial for their future.

Digital Wallets: Great for You, Not for Your Digital Inheritance Plan.

Wallets hold your crypto and digital assets, but if something happens to you, loved ones can’t access them, and real financial value can vanish in an instant.

Digital wallets may be perfect for personal use, but they’re not built for passing cryptocurrency to heirs. They lock away access details instead of making them shareable when it matters most.

In emergencies, families often find themselves locked out, struggling to locate wallets or accounts. This increases digital inheritance risk as unorganised assets can disappear easily.

What you really need is a platform that goes beyond storage, one that organises all your digital assets in one place and makes them securely shareable with the people who matter.

Legacy isn’t just about what you earn, but what you leave behind.

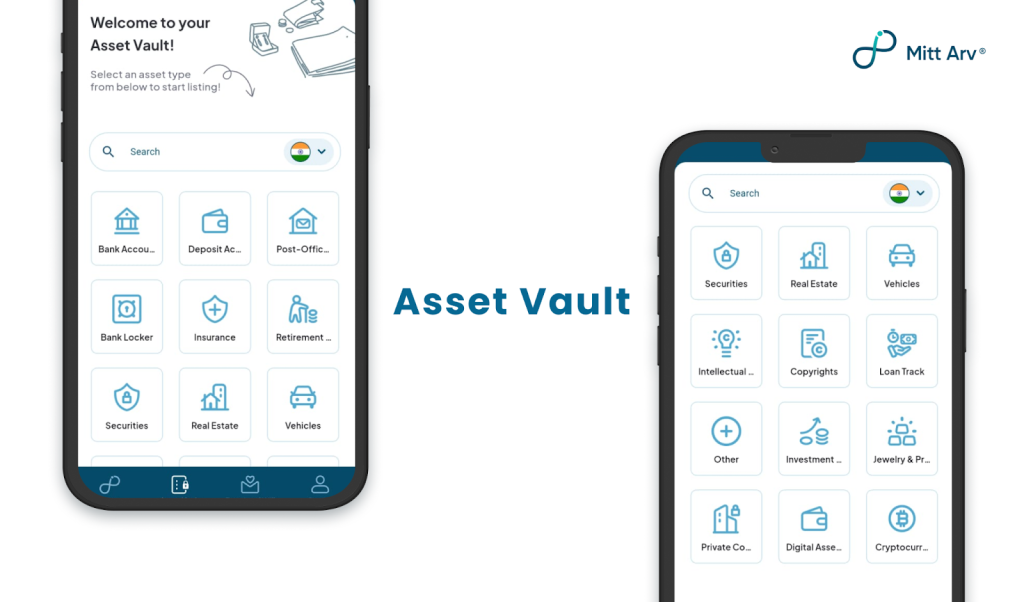

That’s why Mitt Arv is more than just storage. Its Asset Vault is designed for family access and organisation, ensuring your loved ones can actually find and use your assets. Powered by its VeriLife Algorithm, Mitt Arv securely passes on your asset details to trusted contacts during emergencies.

Now that you know digital wallets aren’t enough, Mitt Arv is here for anyone who owns digital or physical assets and wants them organised, protected, and easily accessible for crypto inheritance planning.

Digital Asset Inheritance doesn’t have to be complicated. With Mitt Arv , it’s simple, secure, and built for your legacy.

Mitt Arv offers more than just listing your assets. It also provides:

- Multiple Nation Access – Manage and track assets across different countries.

- Collaboration Groups – Create groups with role-based access for family, advisors, or executors.

- Emotional Will – Share personal notes, audios, or videos with your family, leaving behind love and memories, not just wealth.

Mitt Arv isn’t just for the present, it’s your digital legacy, made secure and future-ready.

Don’t wait another day. Secure your digital assets with Mitt Arv today.

Frequently Asked Questions (FAQs)

1.What is a digital executor in estate planning?

A digital executor is a person appointed to manage online assets such as crypto, NFTs, or social accounts after death.

2. Why is digital wallet inheritance planning important?

Because digital assets can hold both financial and sentimental value. Without planning, heirs may lose access permanently.

3. Can I include Bitcoin in a regular will?

Yes, but you must provide instructions for accessing private keys or consider using a trust for added security.

4. Is a crypto inheritance plan legally binding?

Yes, if included in your will or trust and executed under your country’s estate laws.

5. What happens if I don’t plan for digital assets?

Your heirs may face legal disputes or lose access forever, since crypto companies don’t provide recovery like banks.

6. How do I secure my digital wallet for inheritance?

Use encrypted hardware wallets, password managers, or legal custodians.

7. Can a digital executor sell my crypto?

Yes, if your will or trust grants that authority.

8. What’s the safest way to share private keys with heirs?

Through sealed legal documents, hardware wallets, or split-key solutions to prevent unauthorized access.

9. Does NFT estate planning differ from crypto planning?

Slightly, NFTs may involve intellectual property rights, requiring additional legal clarity.

10. Should I update my crypto inheritance plan regularly?

Yes, especially when buying new assets, switching wallets, or when regulations change.