Introduction

Did you know that over $1 billion worth of jewellery is stolen every year at a global level?

It’s because we rarely store bills or mention who should get what. That’s how family gold gets forgotten or worse, stolen. When no one knows it exists, it’s easy for it to disappear without a trace.

Debabrata Mukherjee, a 52 year old from Kolkata, learned this the hard way. He spent years saving cash and gold, and on his deathbed, he told his brother where he had kept them. But after his death, the items were missing.

There were no bills. No documents. No proof of jewellery ownership. His brother tried to file an FIR, but the police couldn’t help. Without proof, they had no case.

Do you realise how easily a lifetime of savings can vanish?

You work hard, save with care, but if it isn’t documented or shared properly, it could all disappear after you’re gone.

Gold and ornaments aren’t just expensive items, they carry generations of blessings and memories . These items are too precious to be forgotten and too valuable to be left behind.

That’s why it’s important to keep everything safe and organised, or else, hard-earned savings and treasured possessions can be lost overnight.

This isn’t just a sad story: It is a life lesson.

Mr.Debabrata’s story is a wake-up call. Without proper documentation, even your most valuable belongings can vanish without a trace. If this could happen to Mr.Debabrata, it could happen to anyone. Don’t take that chance.

Learn just how important it is to keep your jewellery and documents safe, organised, and accessible, especially during emergencies when every second matters.

One way to solve this issue is to mention jewellery and precious metals in your will.

Why it matters :

- It helps prevent gold inheritance issues.

- It ensures that years of sacrifice are passed on as a meaningful legacy.

- It brings fairness and clarity to inheritance.

- Most importantly, it allows your family to remember you with love and not with questions, stress, or legal trouble.

| DID YOU KNOW ? In 2021, India’s Public Sector Banks reportedly held over ₹35,000 crore worth of unclaimed deposits, including gold, that had no rightful claimant due to lack of documentation or nominee. |

But here’s the mistake most people make:

They think a bank locker is enough.

Why Bank Lockers Are Not Enough To Protect Your Family Gold

Bank lockers might keep your jewellery and precious metals physically safe, but that’s only part of the story. What happens when your family needs documents, bills, purchase receipts, valuation certificates, or proof of ownership?

These are often sitting somewhere else… in a forgotten file, a drawer, or sometimes, nowhere.

In emergencies, this can lead to chaos.

Lost keys. No nominee. No paperwork. And suddenly, your family is locked out, legally and emotionally.

Here’s what bank lockers don’t do for you:

- Don’t store digital copies of essential documents.

- Don’t allow secure, real-time sharing with your family.

- Don’t notify anyone if something happens to you.

- Don’t prevent confusion or inheritance issues.

Don’t Forget About Gold Scams!

What went wrong?

Most victims had no proper documentation, no valid receipts, no certificates, no proof of ownership.

Without documents:

- You can’t prove what’s yours.

- You lose legal protection.

- You reduce your chance of recovery or justice.

What you should do:

- Store all jewellery receipts and valuation certificates.

- Keep ownership proof safe and easy to access.

- Make sure trusted family members know where to find them.

Don’t rely only on lockers, organise your records too. Because without your papers, your gold would be of no value.

Your Gold Will Lose Its Value Without Documents!

Gold holds value, but without proof of ownership, jewellery can become hard to claim or sell in times of emergencies. During weddings or family events, knowing your family’s jewellery details matters a lot. They carry symbols of love and tradition. But without organised details, they may lose their legal value or worse, they might get forgotten somewhere.

Without clear instructions and organised planning, missing family gold can bring unnecessary chaos and stress. That’s why gold and jewellery safety goes beyond just lockers. Keeping records organised and securely is just as important.

Your will should also include clear instructions about your jewellery. But if no one knows what exists or where to find it, even a detailed will can fall short. Hence, it is essential to safeguard your jewellery and support your loved ones, so plan ahead.

Plan by organising your records, noting the details, and deciding who should receive what. When everything is clearly documented, your family can access it with ease, without confusion or delays.

This is where Mitt Arv’s Asset Vault truly makes a difference.

Protect and Simplify Your Legacy with Mitt Arv.

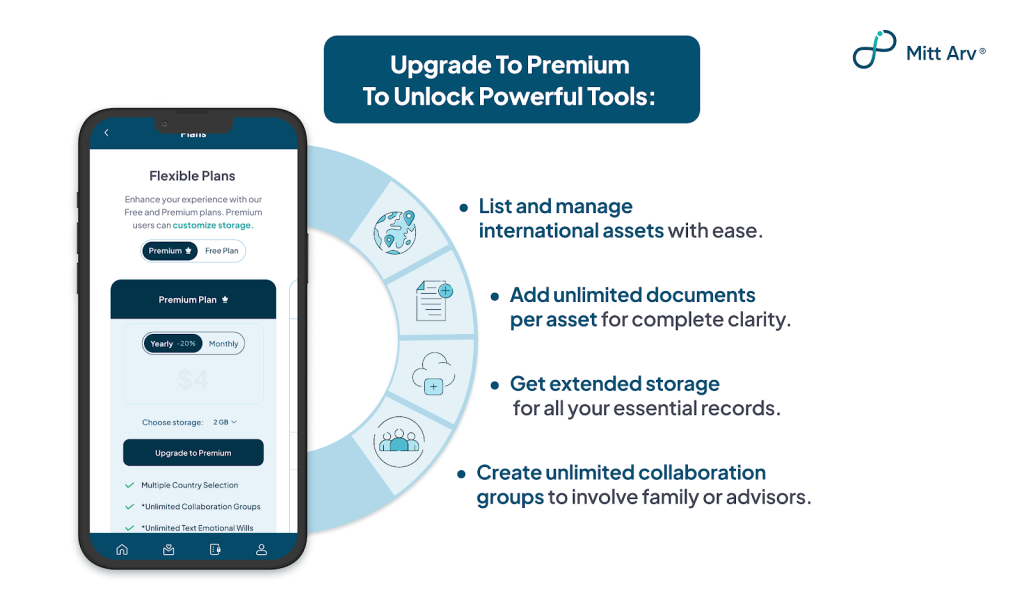

With Mitt Arv, you can store all these details securely in one place, so your loved ones always know what you had and how to access it when the time comes. You can securely store every detail of your jewellery bills, certificates, and ownership proofs in one place. And not just jewellery, you can also add information about property, investments, and other assets that matter to you.

You can peacefully leave heartfelt messages in Emotional Will as texts, audios, or videos for your loved ones to remember you by.

Everything is safe, encrypted, and only shared with the people you trust. You can decide when they get access, either now or after you’re no longer around. The Free plan gives you a secure start. The Premium plan gives you more storage and the freedom to plan your legacy your way.

With Mitt Arv’s Asset Vault, your family won’t have to guess what you owned or where to find it. No confusion. No fights. Just clarity, when it’s needed the most.

Because love shouldn’t fade because of lost jewellery records. It should be remembered with peace and pride.

Start using Mitt Arv today. Ensure your legacy is secure and easy to share with the right people, at the right time.

Frequently Asked Questions – FAQs

Q1. Why is it important to keep documents for my jewellery?

Jewellery bills and certificates prove ownership, help with resale, insurance claims, and inheritance. Without them, your assets may lose value or become difficult to transfer.

Q2. What kinds of documents should I keep with my jewellery?

Keep purchase bills, authenticity certificates (especially for diamonds or precious stones), insurance papers, and any custom receipts or valuation certificates.

Q3. What happens if jewellery documents are lost?

You may not be able to prove ownership or value, which can lead to rejection of insurance claims or trouble during inheritance distribution.

Q4. Is storing jewellery in a locker enough?

Lockers provide physical safety, but don’t protect against the loss of paperwork or ensure your family knows what you own.

Q5. Should jewellery be included in my Will?

Yes. Include gold in your will to avoid family disputes and ensure a smooth transfer to the intended heirs.

Q6. Can I insure my jewellery?

Yes. You can buy jewellery insurance that covers theft, loss, or damage. Make sure to update your policy with new purchases.

Q7. How often should I update my jewellery records?

Ideally, once a year, or every time you make a new significant purchase or gift.

Q8. What’s the best way to organise my jewellery records?

Use a simple system.Folders with receipts, labelled pouches, or digital scans stored in a secure place. Also, inform a trusted family member.

Q9. What are hallmarking and certification in jewellery?

Hallmarking is the official certification of purity (especially in gold). Always check for the BIS hallmark in India to ensure quality and authenticity.

Q10. Can jewellery be passed on without paperwork?

Yes, but it may create confusion or legal challenges during inheritance, especially among multiple heirs.