According to the Reserve Bank of India‘s Annual Report, as of March 2024, over ₹78,000 crore lies unclaimed in bank accounts. Most of it is now sitting in a government fund because no one came forward to claim it, or even knew it existed!

Why is this happening?

Because most people never told their families about every SIP, Demat account, or trading app they opened, or thought to include investment accounts in estate plan paperwork. Many skipped adding a nominee, or forgot to update one.

It’s not just statistics. It’s personal.

There are many stories out there. Let’s take a look at one, Rattan Dhillon, a rally driver from Chandigarh.

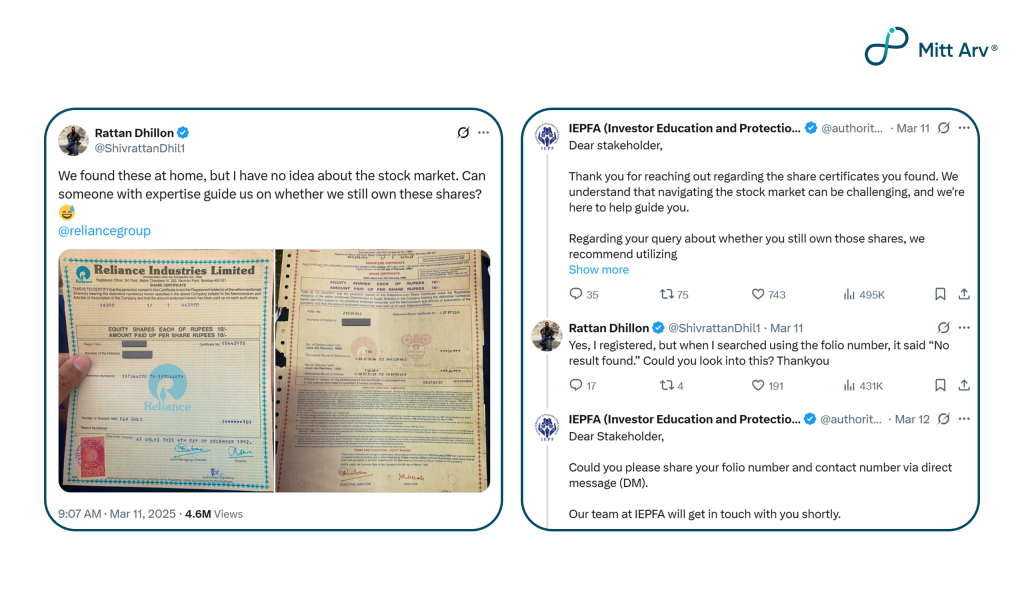

It was just a regular day in Chandigarh when Rattan Dhillon, decided to do some spring cleaning. Amid old files and forgotten drawers, he stumbled across something unexpected: physical share certificates of Reliance Industries, dating back to 1987 and 1988, purchased at just ₹10 each.

Curious and unfamiliar with the stock market, Rattan posted a photo of the certificates on X (formerly Twitter), asking:

“We found these at home, but I have no idea about the stock market. Can someone guide us on whether we still own these shares?”

What happened next was extraordinary. The internet stepped in. Financial experts pointed out that thanks to stock splits and bonus issues, his original 30 shares had multiplied to nearly 960, now valued at over ₹11 lakh.

Soon, the Investor Education and Protection Fund Authority (IEPFA) reached out. Zerodha offered help, and KFin Technologies, the share registrar, provided guidance. With support pouring in, Rattan discovered he was holding onto a small fortune, completely by accident.

But what if Rattan had never opened that drawer?

What if:

- An investment made 20 years ago sits quietly in a folio.

- No nominee, no will, no mention of it anywhere.

- Your family, dealing with your loss, has no idea it even exists.

That money becomes unclaimed wealth, eventually taken by regulatory funds like the IEPF (nobody wants that).

And the harshest truth?

This doesn’t just happen with ancient paper shares. It happens every day with mutual funds on apps, stocks in demat accounts, digital gold, and SIPs. Just because something is online doesn’t mean your family can access it without the right documentation and instructions.

The Missing Piece in Most Estate Plans

We remember to secure our homes, insure our cars, and write a will. But investment accounts, especially digital ones, are often overlooked. Sometimes it’s because of the assumption that “I’ll sort it out later,” or sometimes cultural habits of not discussing money openly play a role.

Now, let us take a look at the most common accounts that go untracked and unclaimed simply because families don’t know they exist:

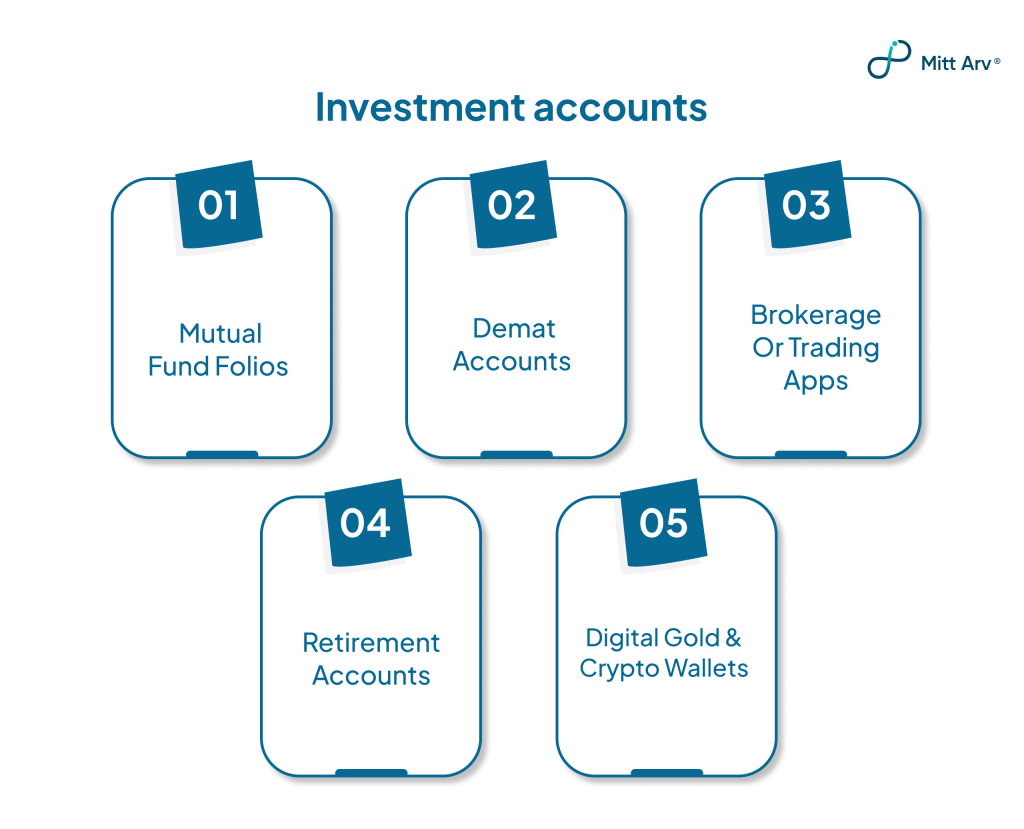

Types of Investment Accounts

- Mutual Fund Folios – A mutual fund folio is an account that holds all your mutual fund investments, whether in equity, debt, or hybrid schemes.

- Demat Accounts – A demat (Dematerialized) Account is where stocks, bonds, and ETFs are held electronically instead of on paper.

- Brokerage or Trading Apps – Brokerage or trading apps are used for buying and selling stocks, doing intraday trading, or trading in futures and options. These platforms operate mostly through mobile or web dashboards.

- Retirement Accounts – These are long-term savings schemes such as NPS, PPF, EPF that build wealth over time, often run on autopilot, and passbooks are checked only once a year (if at all). Balances can be forgotten completely.

- Digital Gold & Crypto Wallets – These are digital assets you buy on fintech or crypto platforms.

- Digital gold is gold stored virtually but backed by real reserves.

- Crypto wallets hold cryptocurrencies like Bitcoin or Ethereum.

The main reason this happens? Most investment accounts are app-based, paperless, and password-protected. That makes them easy to go unnoticed… and easy to lose.

Don’t worry though. In the next part, we’ll take a look at why it’s so important to keep track of all your investment accounts and how listing your assets can make life a whole lot easier for you and your family.

4 Reasons Why You Must Include Investment Accounts in Your Estate Plan

- Your Family May Never Find the Money

If you don’t document your investment accounts, your family might not even know they exist. Unlike property or jewellery, there’s no visible sign of that mutual fund you bought through an app or the demat account you opened years ago.

Did you know?

As of 2025, nearly ₹2 lakh crore lies unclaimed across India in bank accounts, insurance, mutual funds, and stocks. In mutual funds alone, over ₹2,600 crore is unclaimed, often because families are simply unaware of them.

- Legal Hassles and Delays

Even if your family finds some record of your investments, claiming them without a nomination or mention in your will can be very difficult. They may need to gather documents, complete KYC again, or go to court for a succession certificate or probate. - Financial Strain and Unclaimed Investments

Without access to these funds, your loved ones may struggle to pay bills, EMIs, or emergency expenses. If the investments are left untouched for too long, they may be transferred to government funds like the Investor Education and Protection Fund (IEPF), which makes recovery even more difficult. - Fraud or Misuse Risk

Inactive accounts are also at risk of fraud. If someone else finds out about your investment and pretends to be your heir, they might attempt to misuse it. While protections exist, it’s safer to make sure your trusted people know about your accounts in the first place.

Don’t Rely on Luck. Rely on a Plan.

Rattan was lucky. You might not be. But you don’t need luck when you have a plan.

Include investment accounts in estate plan. Record it, whether it’s a trading account, a SIP, or even a small digital gold stash. Nominate someone. Make sure your loved ones know what you own and where to find it.

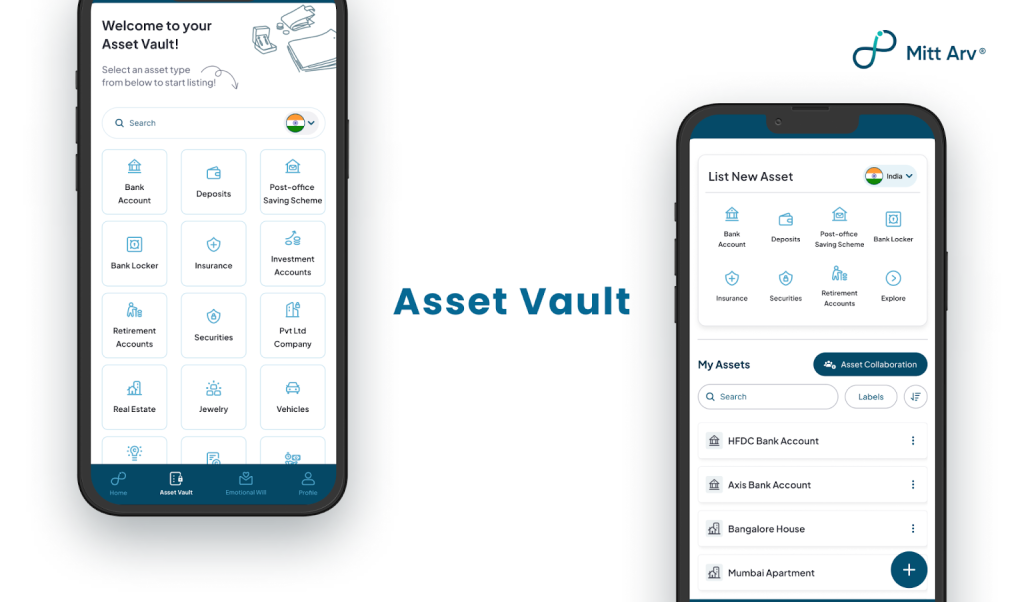

Platforms like Mitt Arv make this incredibly simple.

- Unified Investment Dashboard: List all your investments, mutual funds, stocks, bonds, digital gold, and more, in one place. It’s easier to update one master list than recall scattered accounts years later.

- Secure Sharing with Trusted Contacts: Share details with trusted people (spouse, kids, advisor) in a controlled way. You don’t have to give full access now, but if something happens to you, they’ll know what exists and where to find it.

- Life Status Checks: Timely reminders to log in when our algorithm senses inactivity. When you don’t respond after repeated reminders, your primary trusted contact is asked about your life status.

- Timely Delivery When needed: If you stop responding, the platform securely shares your stored details with your trusted contacts after verification, so your family gets timely access, not confusion.

No unclaimed funds. No lost accounts. Just clarity when it matters most.

Wrapping Up

Got a mutual fund? A demat account? Maybe some digital gold?

Pick one investment and log it in Mitt Arv. Just a few key details. That’s it.

Those five minutes now could save your family months of stress later. No confusion, no hunting for documents, no “where did dad invest?”

Mitt Arv keeps everything safe and organized, and only shares your information with the people you trust when it’s truly needed.

Don’t wait for “someday.”

Start with one entry. Include investment accounts in estate plan documents today.

Without clear instructions, your wealth could get lost in the unclaimed assets pool or set off family disputes. That’s why investment accounts must feature in every estate plan.

FAQs

- What counts as an “investment account” for estate planning?

Any place where you hold money or securities digitally or on paper, like mutual fund folios, Demat accounts, brokerage apps, NPS/PPF/EPF, digital gold, crypto wallets, corporate bonds, and even employee stock options.

- Why should one include investment accounts in estate plan if they already have nominees?

A nominee can receive the assets but may not be the legal heir; a will (or other estate document) makes your intention legally clear and prevents disputes.

- How do unclaimed investments end up with the IEPF or other funds?

If an account stays inactive for a set period (typically 7 years for shares / dividends, 10 years for bank deposits) and no claimant appears, the balance is transferred to the Investor Education and Protection Fund or a similar statutory pool.

- Is listing assets in Mitt Arv legally binding like a will?

No. Mitt Arv acts as a secure record and delivery tool. You still need a registered will or other legal document; Mitt Arv just makes sure the details reach your heirs quickly.

- What if my nominee and will conflict, who gets the money?

Courts usually give weight to the will for ownership, while the nominee is seen as a trustee. Align both to avoid confusion.