As a child, I always wanted money. Whether it was for snacks, collectible cricket cards, or something else, I was constantly asking my parents for a little extra pocket money. One thing was always certain though, I would spend all of the money as soon as I got it. Saving wasn’t even on my radar back then.

Now that I’ve grown up, I know better—or at least better than my 14-year-old self. In learning more on financial literacy – and specifically for the purpose of writing this blog – I’ve realized that money management isn’t just about spending or saving for the moment; it’s a lifelong journey.

From the first paycheck to the farewell to your 9-to-5, your life is a series of financial decisions that shape your future and define your freedom. At its core are two key components: financial planning and retirement planning. While these terms are often used interchangeably, they serve distinct purposes and are crucial at different stages of life. Understanding when to prioritize each can significantly improve your financial future.

Financial Planning: The Foundation of Your Financial Journey

Financial planning is the starting point. It’s about organizing your money to meet short-term and long-term goals, whether buying a home, paying off debt, or saving for your child’s education. This stage often dominates the early to mid-career years when you earn, spend, and build your financial base.

Here’s when to focus on financial planning:

- Starting Your Career: When income is limited, financial planning helps with budgeting and establishing habits like saving and investing.

- Life Milestones: Marriage, starting a family, or buying a home requires careful financial planning to balance priorities and expenses.

- Building an Emergency Fund: ensures you can handle unexpected costs without derailing your goals.

Michael Benoit, Founder and Insurance Expert, ContractorBond puts it eloquently:

”In my experience, retirement planning works best when it begins early, alongside financial planning, rather than being treated as a late-career concern. People who start sooner often have more flexibility, lower stress, and a stronger financial foundation when they finally step away from work.A 25-year-old setting aside $500 per month in a retirement account could build over $1 million by retirement, while a 50-year-old saving the same amount might end up with less than half of that. The earlier someone starts, the easier it is to build wealth without making drastic sacrifices.”

Components of Financial Planning

Key areas of focus under financial planning include budgeting, debt management, and investments. Budgeting helps you maintain control over your expenses and savings, ensuring that your financial foundation remains stable.

Debt management ensures that liabilities are kept in check, preventing unnecessary financial strain.

Meanwhile, investments with higher risk tolerance, such as equities or growth-oriented assets, can yield significant returns over time, harnessing the power of compounding.

| 💡Don’t forget to regularly reviews your financial goals and plans! They keep your financial plan aligned with your changing circumstances. |

Also See: Ultimate Retirement Planning Checklist.

Retirement Planning: Shifting the Focus to Your Golden Years

Retirement planning takes center stage as you progress in your career and financial stability. While it’s technically a part of financial planning, retirement planning ensures a comfortable lifestyle after you stop working.

As Austin Benton, Marketing Consultant, Gotham Artists, advices:

- 20s-30s: Focus on financial independence, not just retirement. Automate savings, invest early, and explore passive income so you have choices later.

- 40s-50s: Shift from just accumulating money to defining your retirement lifestyle. Where will you live? What will you do? Start testing it.

- 50s-60s: Optimize-reduce risk, adjust spending, and ensure you can sustain your desired life.

- Reviewing Healthcare Needs: Don’t forget about your health. Healthcare costs are rising at 14% annually. Plan for rising healthcare costs, one of the largest expenses post-retirement.

Retirement isn’t an age—it’s a financially-backed choice.The earlier you plan, the sooner you get to work because you want to, not because you have to.

This stage answers key questions: How much money will you need? How can you ensure it lasts? It involves shifting investments to safer options, estimating costs with inflation, and exploring income streams like pensions or retirement accounts.

| 💡Financial planning and retirement planning are deeply connected. The earlier you prioritize financial planning, the smoother your transition to retirement planning will be. For instance:Savings Today, Comfort Tomorrow: The money you set aside in your 20s and 30s forms the core of your retirement savings.Tax Benefits: Early financial planning can help you leverage tax advantaged retirement accounts. |

Also see: Who can help you with Retirement Planning.

The Bottom Line

Focus on financial planning early in your career to build a strong financial base. Gradually shift to retirement planning as you grow older, and your priorities shift toward long-term security. Starting early and staying consistent with both ensures a future that’s not just financially stable but also fulfilling.

Explore our detailed blog here to dive deeper into financial and retirement planning and learn how to secure your financial future. By managing these stages wisely, you’ll pave the way for true financial freedom, enjoying peace of mind today and a worry-free retirement tomorrow.

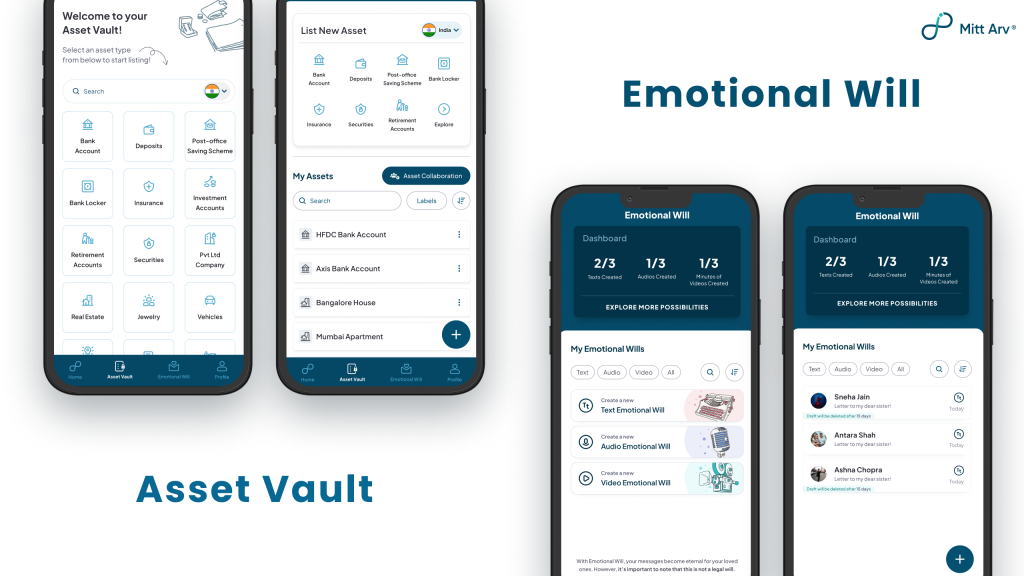

At Mitt Arv, we make retirement planning easier with our innovative tools. Our Asset Vault helps you organize and safeguard your financial assets, ensuring nothing is overlooked. Our Emotional Will empowers you to leave behind meaningful messages and memories for your loved ones to cherish. Together, these tools provide a complete foundation to kickstart your retirement planning journey. Visit Mitt Arv today and take the first step toward a secure and fulfilling future!