We all want financial stability.

Almost every finance guru or influencer talks about attaining financial independence. But the path to it can be unclear. Whether starting your career, planning for a family, or preparing for retirement, one thing is certain – the key lies in managing your money.

Two important parts of this journey are financial planning and retirement planning. Though they may sound alike, they have different roles and are crucial for long-term financial security.

In this blog, we’ll go through the two sides of managing your finances – financial planning vs retirement planning. We’ll focus on their meanings, how they work, and how they differ from one another.

What Is Financial Planning?

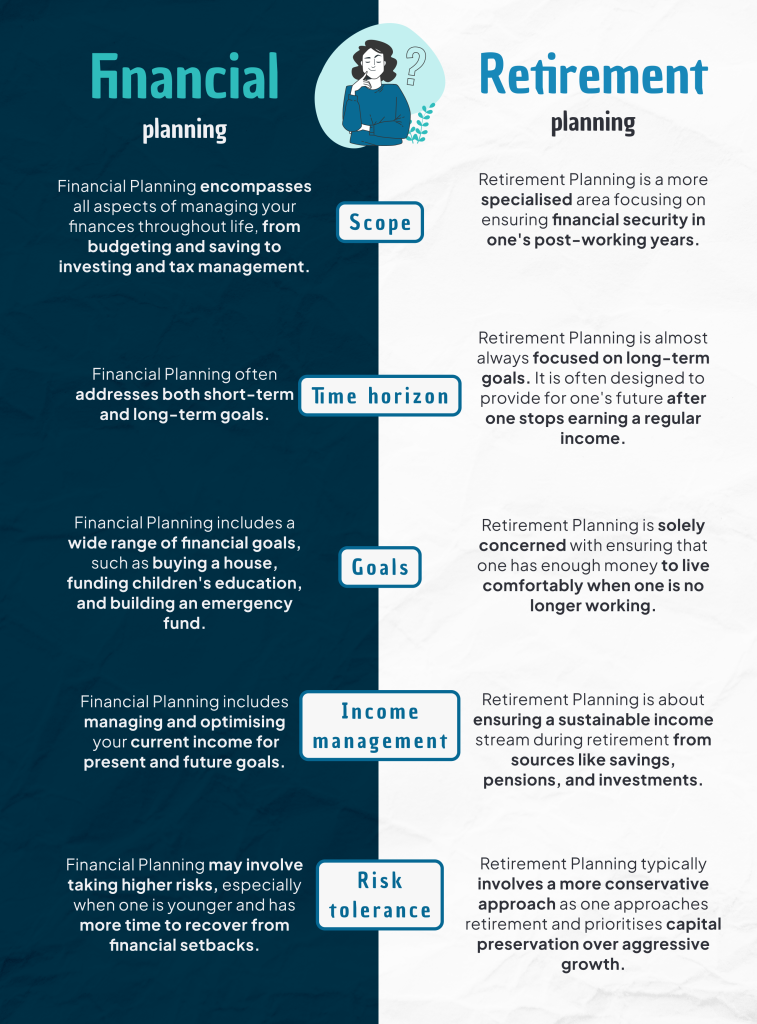

Financial planning is like designing a plan for your financial future. It’s a process that helps you manage your money efficiently to achieve your short-term and long-term goals. Financial planning sets the foundation, whether buying a home, funding your child’s education, building an emergency fund, or saving for retirement.

Importance of Financial Planning:

Financial planning is important because it gives you control over your money rather than letting your money control you. With a well-thought-out financial plan, you can:

- Avoid overspending and manage your cash flow effectively.

- Be prepared for financial emergencies (like medical bills or job loss).

- Save consistently for important life goals, whether personal or professional.

- Reduce your financial stress and live with more confidence.

| 💡Financial planning is NOT a one-time plan. It evolves as your circumstances change, so regularly revisiting and updating your plan is crucial to keeping it relevant and effective. |

What Is Retirement Planning?

Retirement planning is a more specific part of financial planning. It focuses on ensuring you have enough savings, investments, and income to support your lifestyle once you stop working. Think of it as preparing a financial safety net for you once you retire.

According to Robert Whelan, Managing Director, Rockwell Financial Management Limited:

“The difference between financial planning and retirement planning is really about the time frame. Financial planning is the big picture, it covers everything from budgeting and debt management to saving for a house, education, or unexpected expenses. Retirement planning, on the other hand, is a specific part of that, it’s all about ensuring you have enough money to live comfortably when you stop working. The two should work together seamlessly… “

In essence, retirement planning answers the following questions:

- How much money will I need to retire comfortably?

- How do I ensure I keep my savings?

See Also: Retirement Planning with 4% Rule in India

Steps to Effective Retirement Planning:

- Assess Your Retirement Goals: What kind of lifestyle do you want when you retire? Do you want to travel, downsize your home, or move to a different city? Understanding your retirement dreams will help you estimate how much you need to save.

As Thomas Franklin, CEO, Swapped, advices:

“In my experience, the biggest mistake people make is treating retirement planning as something to start “later” instead of integrating it into their financial habits now.” - Calculate Retirement Costs: Estimate how much money you’ll need annually once after your retirement. This will include your living expenses, healthcare costs, travel, and leisure activities. Remember to factor in Inflation, prices always rise over the years.

- Determine Your Income Sources: Retirement income comes from several sources—your savings, investments, pensions, Social Security, or other benefits. Understand how much you can expect from each and fill in any gaps.

- Diversify Investments: As you approach retirement, adjusting your investments to reflect your changing risk tolerance is important. Younger people typically can take more investment risks like equities, while retirees should focus on safer investments like debt or hybrid (debt + equity).

- Plan for Healthcare Costs: Healthcare can be one of the biggest expenses post retirement. Consider long-term care insurance or Medicare to help cover these costs.

- Review Your Estate Plan: Including estate planning in retirement preparation is wise. Ensure your will, trust, and beneficiary designations are updated so your assets are distributed according to your wishes.

Check out our blog on the ultimate retirement planning checklist for more insights.

Conclusion

Financial planning and retirement planning are two sides of the same coin, working together to secure your financial future. While financial planning lays the foundation by helping you manage your money effectively across all stages of life, retirement planning ensures you can enjoy your golden years without financial stress.

Understanding the differences and interplay between these two strategies, can help make informed decisions that align with your life goals. Whether building wealth or preserving it, proactive planning is the key to financial independence and peace of mind. Start today, because the best time to plan for your future is now!

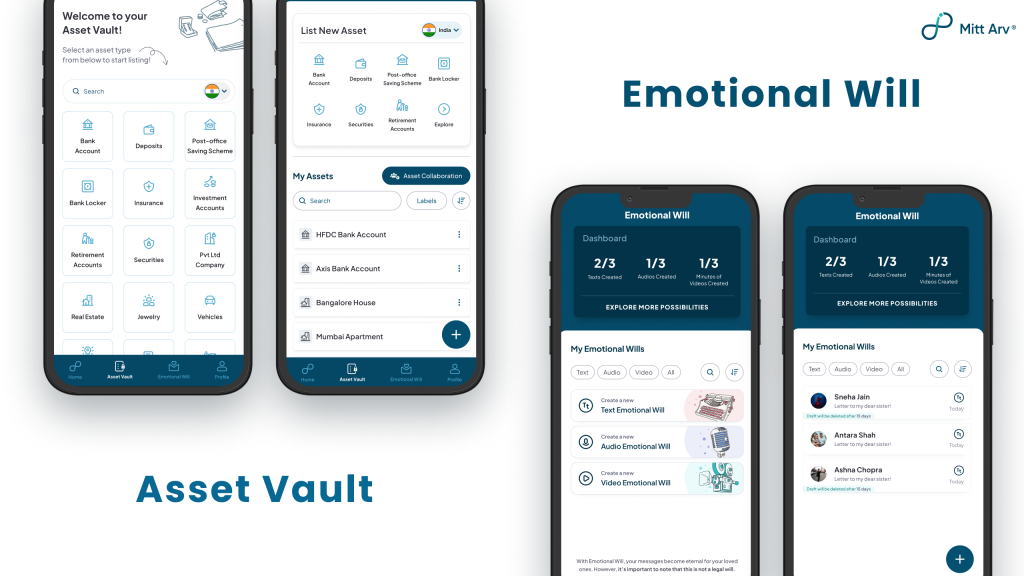

At MittArv, we make retirement planning easier with our innovative tools. Our Asset Vault helps you organize and safeguard your financial assets, ensuring nothing is overlooked. Our Emotional Will empowers you to leave behind meaningful messages and memories for your loved ones to cherish. Together, these tools provide a complete foundation to kickstart your retirement planning journey. Visit MittArv today and take the first step toward a secure and fulfilling future!