Saving for retirement and retirement planning is a task. This requires a roadmap that guides you through your financial decisions in retirement, ensuring that your savings last as long as you do. What if there was a tried-and-tested strategy to help you withdraw just the right amount to live comfortably without the fear of running out of money? Enter the 4% rule—a popular approach for retirement planning.

This rule suggests that by withdrawing 4% of your savings each year, you can maintain a steady income throughout retirement while preserving your nest egg for the long haul.

“The definition of the word ‘retire’ is actually ‘to remove yourself from a situation,’ but in reality, retiring is actually starting a new chapter of your life,” says Scott Meyer, a wealth manager and partner at Merit Financial Advisors. “It’s not about leaving the workforce; it’s about starting a new chapter, and it’s important to think about what that new chapter will look like and how you can put a monetary value behind it.”

See Also: Early vs Late Retirement Planning

What is the 4% Rule?

The 4% rule is a well-known retirement planning strategy designed to ensure that retirees don’t outlive their savings. The rule suggests that in the first year of retirement, you should withdraw 4% of your retirement savings. In subsequent years, you should adjust this initial withdrawal for inflation, continuing to withdraw the same inflation-adjusted amount each year. This method is intended to last for about 30 years, providing a steady income stream while leaving enough principal to generate future returns.

How does the retirement planning 4% Rule work?

The 4% rule is a simple guideline designed to help retirees plan their annual withdrawals to ensure they don’t run out of their savings. Here’s how it works step-by-step:

- Calculate Your Retirement Nest Egg: Start by estimating your annual retirement expenses based on your current lifestyle, expected inflation, and retirement goals. This will give you a rough idea of how much you’ll need each year to maintain your desired standard of living.

- Multiply by 25: Once you have determined your estimated annual retirement expenses, multiply this number by 25. The idea is that if you can withdraw 4% of your savings each year, you’ll need a retirement corpus equivalent to 25 times your annual expenses.

| 💡For example, if you expect to need Rs 10 lakh annually, you’ll need a retirement corpus of Rs 2.5 crore (10 lakh × 25). |

- Initial Withdrawal: In the first year of retirement, you would withdraw 4% of your total savings. For instance, if you’ve accumulated Rs 1 crore, your initial withdrawal would be Rs 4 lakh in the first year (4% of Rs 1 crore).

- Inflation Adjustment: Each year, you adjust your withdrawal to account for inflation. In India, where inflation averages around 6%, you would increase your withdrawal accordingly. So, if you withdrew Rs 4 lakh in the first year and inflation was 6%, you would withdraw Rs 4.24 lakh in the second year.

- Periodic Review: Regularly review your portfolio’s performance. If your investments are performing better than expected, you may continue with your current strategy or increase withdrawals slightly. If your portfolio underperforms, you might need to reduce your withdrawals to ensure that your savings last throughout your retirement.

Advantages and Disadvantages

The 4% rule offers both benefits and limitations when it comes to retirement planning. While it provides a straightforward approach to ensuring income throughout retirement, it may not work universally in every scenario.

Accounting for Inflation

In India, the 4% rule, a popular retirement strategy, needs to be adjusted for local inflation dynamics to remain effective. Unlike the U.S., where inflation is relatively stable and lower, India experiences higher and more variable inflation rates. This makes it crucial for Indian retirees to adapt their withdrawal strategy accordingly.

Here are key modifications to consider for applying the 4% rule in India:

- Flat Annual Increase:

In the U.S., retirees often apply a flat 2% annual increase to account for inflation, aligning with the Federal Reserve’s target. However, in India, where inflation typically ranges between 6-8%, this 2% adjustment would likely fall short. A more practical approach for Indian retirees would be to set a flat annual increase of around 6%, which better reflects the country’s inflationary environment. While this method offers predictability and ease of budgeting, it may not perfectly match the actual fluctuations in inflation, but it provides a more realistic adjustment than the U.S.-based model.

- Adjusting for Actual Inflation:

Given India’s more volatile inflation rates, adjusting withdrawals based on actual inflation each year might be a more accurate way to maintain purchasing power. This strategy ensures that retirees’ income aligns with the true cost of living. However, it introduces unpredictability—withdrawal amounts may vary significantly depending on whether inflation surges or slows down. While this method can better safeguard against inflation, retirees should prepare for varying annual withdrawals, which may complicate long-term financial planning.

- Portfolio Allocation:

The 4% rule traditionally recommends a 50-50 split between stocks and bonds. In India, however, this may not be the optimal approach due to the higher volatility of Indian equity markets. While stocks offer potential for higher returns, they come with increased risk, especially in a retirement portfolio.

Indian retirees should consider a diversified portfolio that includes:

- Inflation-linked bonds (such as government securities indexed to inflation), which offer protection against rising prices.

- Fixed deposits (FDs) and Public Provident Fund (PPF), which provide stable returns and relatively high interest rates compared to similar instruments in developed markets like the U.S.

- Real assets like gold or real estate, which are widely viewed in India as effective hedges against inflation.

| 💡As retirees approach or enter retirement, it may be wise to reduce exposure to equities and focus more on fixed-income assets and inflation-protected investments. This shift can help protect the retirement corpus from market volatility while ensuring a steady income stream. |

See Also: How Does Inflation Affect Your Retirement Savings?

Is the 4% Rule still relevant?

In today’s Indian context, the 4% rule may not be as relevant or effective as it once was. The 4% rule, developed by William Bengen for U.S. retirees, suggests withdrawing 4% of retirement savings annually, adjusted for inflation, to ensure income for 30 years. However, India faces higher inflation rates, often between 6-8%, which can rapidly erode purchasing power, making a fixed 4% withdrawal rate inadequate for sustaining long-term retirement income. Moreover, while Indian equity markets offer potential for higher returns, they come with significant volatility, which could risk a retiree’s financial stability during market downturns.

Adapting the 4% Rule to Indian Conditions

According to Inge Von Aulock, Investor & Chief Wealth Builder, Invested Mom, ” Indian retirees need to approach the 4% rule with a bit more flexibility these days, especially given the current inflation and market volatility. One strategy could be to adjust withdrawals dynamically rather than sticking rigidly to a fixed percentage. It might also be helpful to maintain a more diversified portfolio, balancing equity with more stable assets like bonds or even some gold, which can help cushion against market swings. Some retirees might consider using a slightly lower initial withdrawal rate as a buffer during volatile periods, allowing their portfolio more time to recover in tough years.“

- Conservative Approach:

- Lower Initial Withdrawal Rate: Instead of starting with a 4% withdrawal, Indian retirees may opt for a more conservative rate, such as 3-3.5%, to account for both inflation and market volatility. This approach creates a buffer for unexpected downturns in the market or higher-than-expected inflation.

- Gradual Increase: The withdrawal rate can be adjusted over time based on inflation trends and the performance of the portfolio.

- Dynamic Withdrawal Strategy:

- Flexible Withdrawals: Instead of a fixed percentage, retirees should consider adjusting withdrawals annually based on the growth of their investments and inflation, ensuring their portfolio lasts longer while meeting immediate needs.

- Bucket Strategy: Dividing the retirement corpus into buckets—short-term (cash, FDs), medium-term (debt funds), and long-term (equity funds)—can help in managing withdrawals from the least volatile assets first.

Conclusion

While the 4% rule provides a helpful framework for retirement planning, it needs adjustment for India’s higher inflation and market volatility. A flexible and dynamic withdrawal strategy that accounts for changing inflation rates and market conditions is crucial. By maintaining a diversified portfolio, considering inflation-protected investments, and seeking professional guidance, Indian retirees can ensure a more secure and sustainable retirement income.

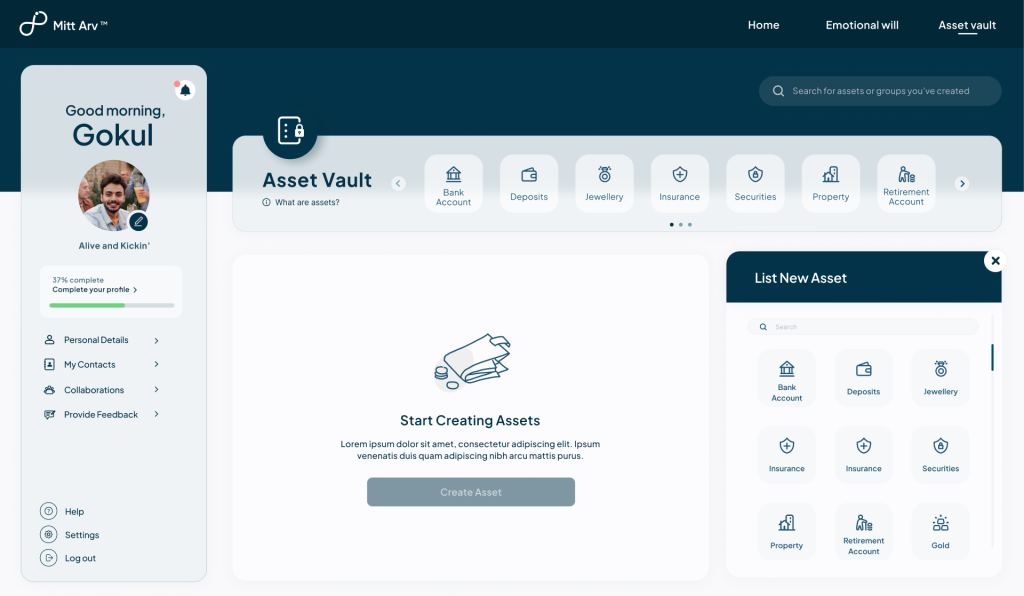

At Mitt Arv, we help you plan your future with confidence. Our easy-to-use Asset Vault organizes all your assets in one place and simplifies the process of retirement planning for you. With its secure asset vault, you can store all your asset details such as real estate, investments, insurance policies, and valuables in one organized place. No more wasting time searching for important documents; your entire financial portfolio is just a few clicks away. Mitt Arv also provides a clear overview of your wealth, helping you make informed decisions for a worry-free retirement. Plus, it ensures your loved ones can easily access essential information when needed, bringing peace of mind and eliminating any confusion during stressful times.

With Mitt Arv, you can protect your and your loved ones’ future and enjoy peace of mind knowing everything is in place. Isn’t this the best way to retire?