“A budget is telling your money where to go instead of wondering where it went.”

– John C. Maxwell

Budgeting is often thought of as a tiring task, something that’s reserved for those with advanced finance degrees or people who really enjoy crunching numbers. But here’s the truth: managing your money doesn’t have to be complicated or overwhelming. In fact, there’s a simple method called the 50/30/20 rule that anyone can use to take control of their finances.

The best part? It’s straightforward, easy to follow, and doesn’t require a deep dive into the world of personal finance. Whether you’re just getting started with budgeting or looking to improve your current financial situation, the 50/30/20 rule can be the perfect solution.

What is the 50/30/20 Rule?

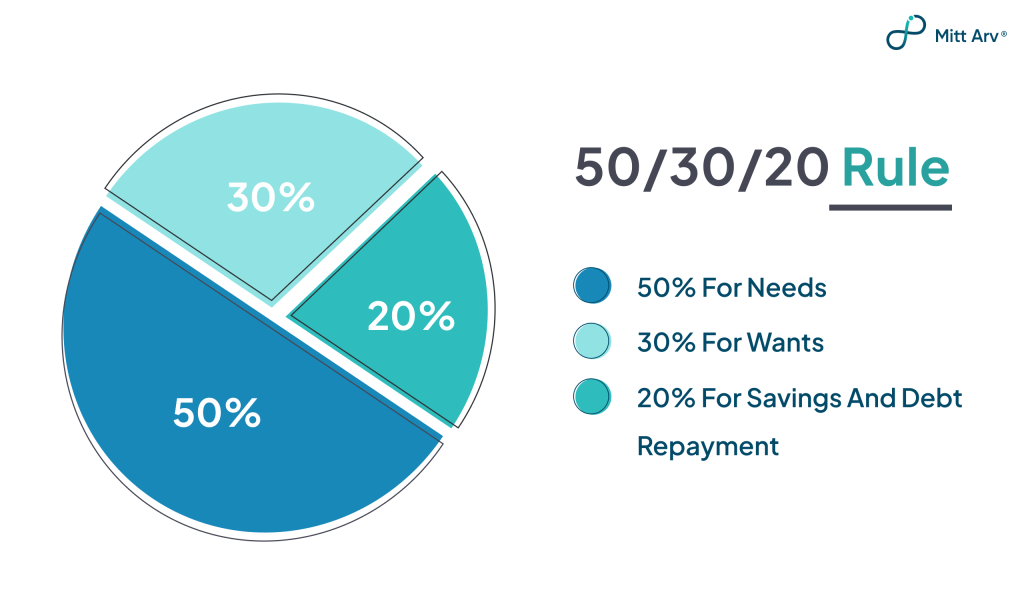

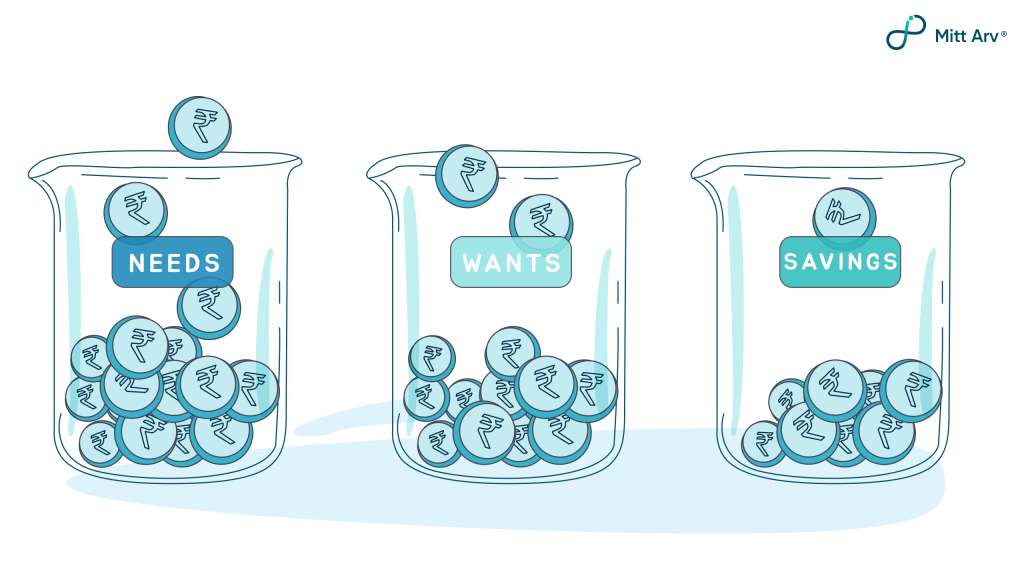

At its core, the 50/30/20 rule is a budgeting strategy that divides your income into three main categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debt Repayment

Now, let’s break this down further:

- 50% for Needs: These are your essentials. Things like rent, utilities, groceries, transportation, and health insurance. These are expenses you absolutely need to cover in order to live and function.

- 30% for Wants: These are your non-essentials that make life more enjoyable but are not absolutely necessary. This includes things like dining out, entertainment, hobbies, vacations, or any other luxury spending that enhances your lifestyle.

- 20% for Savings and Debt Repayment: This is money you put aside for your future. It includes contributions to savings accounts, investments, retirement funds, or paying off credit card debt and loans. This category ensures you’re preparing for unexpected events, building wealth, and securing your financial future.

Read Also: Money 101: Beginner’s Guide To Financial Literacy

Why Should You Use the 50/30/20 Rule?

The 50/30/20 rule works because it gives you a simple, clear framework to manage your money. Here’s why it’s so effective:

1. It’s Easy to Understand

One of the main reasons the 50/30/20 rule is so popular is because of its simplicity. You don’t need a degree in finance to understand it. You just divide your income into three broad categories and stick to the percentages.

2. It Provides Balance

Unlike other budgeting methods that may make you feel guilty for spending money on things you enjoy, the 50/30/20 rule strikes a balance. It ensures you’re taking care of your necessary expenses while also giving you room to enjoy life and save for the future. This balance is key to maintaining long-term financial success without feeling deprived.

3. It Helps You Prioritize

This rule forces you to think about your priorities. By allocating a portion of your income to savings and debt repayment, you’re ensuring that you’re setting yourself up for financial success in the future, not just living in the moment. The structure also helps you avoid overspending in the short term and encourages you to be more intentional with your money.

Fact Check:

Net Financial Savings as Percentage of GDP: The net financial savings stood at 5.1% of GDP in FY23, marking the lowest level in decades, compared to 7.2% in FY22.This means people are saving less money than before, a reminder of just how crucial it is to manage money wisely. Budgeting strategies like the 50/30/20 rule can offer much-needed structure during uncertain economic times.

How to Apply the 50/30/20 Rule in Your Life

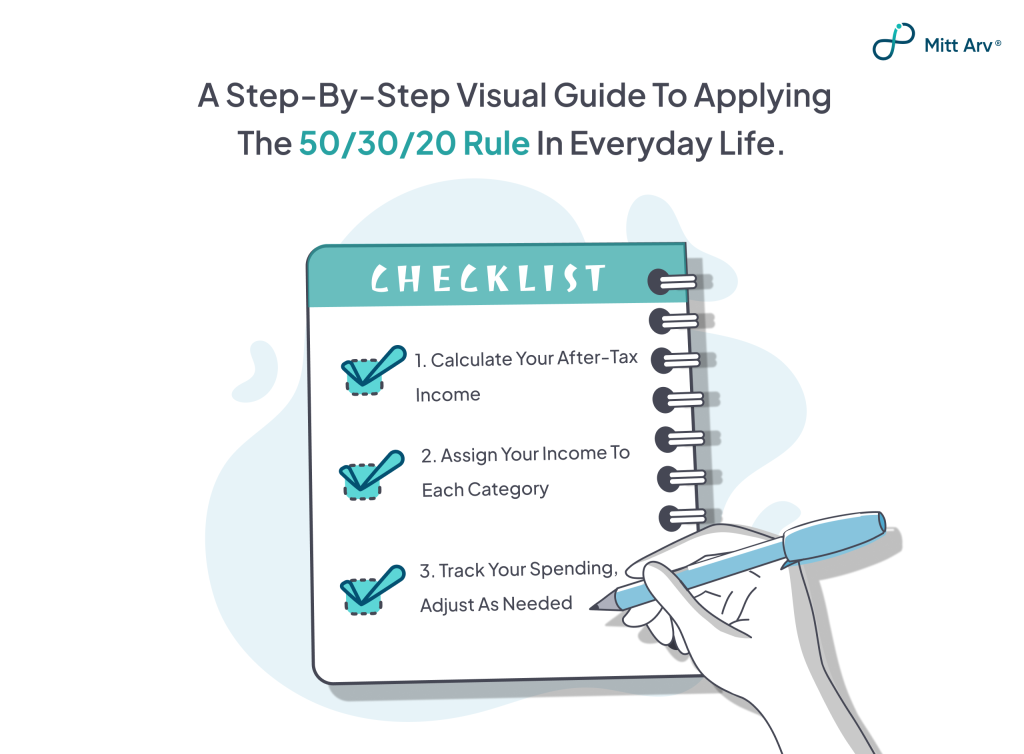

So, how can you start using the 50/30/20 rule in your daily life? Here’s a step-by-step guide to help you implement it effectively:

1. Calculate Your After-Tax Income

The first thing you’ll need to do is figure out how much money you actually have to work with. This means calculating your after-tax income — that is, the amount you bring home after taxes and other deductions are taken out. If you’re salaried, this number is easy to find, but if you have a fluctuating income (like from freelancing or side gigs), you’ll need to track your earnings over a few months to get an average.

2. Assign Your Income to Each Category

Once you know how much money you’re working with, it’s time to allocate it to the three categories:

- 50% for Needs: Start by listing your essential monthly expenses, such as rent, utilities, groceries, and transportation. Make sure the total is no more than 50% of your after-tax income.

- 30% for Wants: Next, think about the non-essentials that you like to spend money on. This includes things like entertainment, dining out, vacations, shopping, or any other luxury items. Limit these expenses to 30% of your income.

- 20% for Savings and Debt Repayment: Lastly, set aside 20% of your income for savings and paying down debt. This could include contributions to your emergency fund, retirement accounts, or paying off high-interest debt like credit cards.

3. Track Your Spending

Once you’ve assigned percentages to each category, it’s time to track your actual spending. This is where you’ll see how closely your habits align with your goals. Use a budgeting app, spreadsheet, or even a simple notebook to track where your money goes each month. Tracking is key to making sure you stay on track and adjust when necessary.

4. Adjust as Needed

Life is unpredictable. You may find that your spending fluctuates month to month, or you may need to adjust your budget based on unexpected expenses. The key is to be flexible and make changes as needed. For example, if you find that you’re consistently overspending on “wants,” you may need to scale back a bit. On the other hand, if you’re not putting enough toward savings, you can adjust your “wants” category to boost your savings efforts.

Read Also: Financial Literacy for Students

Common Pitfalls to Watch Out For

While the 50/30/20 rule is a great guideline, it’s important to avoid a few common pitfalls that can make budgeting harder than it needs to be:

1. Ignoring Irregular Expenses

It’s easy to focus on monthly bills, but don’t forget about irregular or annual expenses like holiday shopping, car maintenance, or insurance premiums. These can throw off your budget if you don’t plan for them in advance. A good strategy is to divide these costs by 12 and add that amount to your monthly budget.

2. Overlooking the Importance of Savings

Many people struggle to prioritize saving for the future, especially when there are so many immediate wants and needs. However, it’s critical to make savings a top priority. If you’re not saving enough each month, it can be hard to build a financial safety net or save for big goals like retirement or buying a home.

Fact Check:

Net Financial Savings at a Five-Year Low: In FY23, Indian households’ net financial savings dropped to ₹14.16 lakh crore, the lowest in five years, from ₹17.12 lakh crore in the previous year. This decline is attributed to a significant increase in financial liabilities, which shows that people are saving less and taking on more debt. It’s a wake-up call to start building better money habits. Start today and take control of your money before it controls you.

3. Getting Stuck in Rigid Rules

While the 50/30/20 rule is a great guide, don’t feel like it’s set in stone. Life happens, and sometimes you may need to adjust your budget. If you have a month where you need to spend more on needs (e.g., medical bills or car repairs), it’s okay to temporarily adjust your percentages to make it work. The goal is to find a balance that works for your current situation.

Benefits of Following the 50/30/20 Rule

So, what can you expect when you stick with the 50/30/20 rule?

- Financial Clarity and Control

By following the 50/30/20 rule, you’ll have a clear picture of where your money is going each month. This transparency will give you more control over your finances, reducing stress and uncertainty about your spending.

- Better Long-Term Financial Health

Allocating 20% of your income to savings and debt repayment will help you build a more secure financial future. Whether you’re saving for an emergency fund, a home, or retirement, you’ll be making steady progress toward your financial goals.

- Less Guilt Around Spending

One of the most appealing aspects of the 50/30/20 rule is that it allows room for enjoying life without guilt. By setting aside money for both needs and wants, you can live in the present while still preparing for the future.

Read Also: Credit Score 101: What It Is, Why It Matters, and How to Boost It?

Conclusion

The 50/30/20 rule is one of the simplest yet most powerful ways to take control of your finances. It’s all about balance, making sure you’re meeting your essential needs, enjoying life’s little luxuries, and saving for a secure future. By following this easy-to-implement strategy, you’ll be on your way to financial stability and peace of mind in no time.

Remember, budgeting doesn’t have to be complicated. Start with the 50/30/20 rule, and let your money work for you, not the other way around.